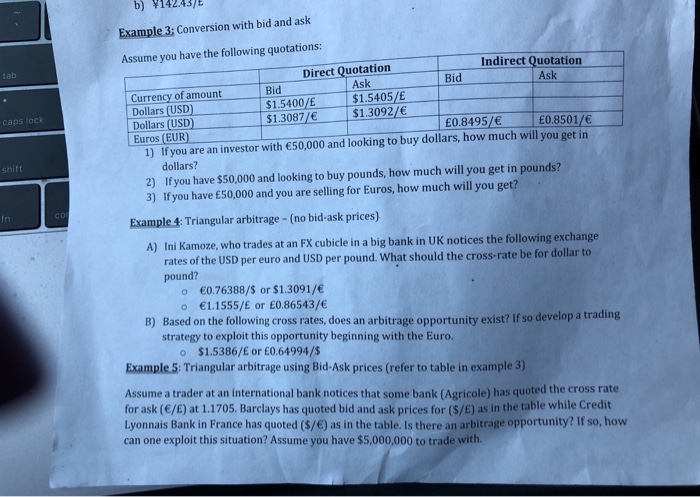

Question: answer #5 pls b) 142.43/E Example 3: Conversion with bid and ask tab caps lock Assume you have the following quotations: Direct Quotation Indirect Quotation

b) 142.43/E Example 3: Conversion with bid and ask tab caps lock Assume you have the following quotations: Direct Quotation Indirect Quotation Bid Bid Ask Currency of amount Ask Dollars (USD) $1.5400/E $1.5405/E Dollars (USD) $1.3087/ $1.3092/ Euros (EUR) 0.8495/ 0.8501/ 1) If you are an investor with 50,000 and looking to buy dollars, how much will you get in dollars? 2) If you have $50,000 and looking to buy pounds, how much will you get in pounds? 3) If you have 50,000 and you are selling for Euros, how much will you get? shift in Example 4: Triangular arbitrage - (no bid-ask prices) A) Ini Kamoze, who trades at an FX cubicle in a big bank in UK notices the following exchange rates of the USD per euro and USD per pound. What should the cross-rate be for dollar to pound? 0.76388/$ or $1.3091/ 1.1555/E or 0.86543/ B) Based on the following cross rates, does an arbitrage opportunity exist? If so develop a trading strategy to exploit this opportunity beginning with the Euro. o $1.5386/ or 0.64994/$ Example 5: Triangular arbitrage using Bid-Ask prices (refer to table in examples Assume a trader at an international bank notices that some bank (Agricole) has quoted the cross rate for ask (C/E) at 1.1705, Barclays has quoted bid and ask prices for (S/E) as in the table while cream Lyonnais Bank in France has quoted ($/) as in the table. Is there an arbitrage opportunity? If so, how can one exploit this situation? Assume you have $5,000,000 to trade with

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts