Question: answer 5-7 please 5-. O'Brien Inc. has the following data: TRF = 5.00%; RPM - 6.00%; and b - 1.50. What is the firm's cost

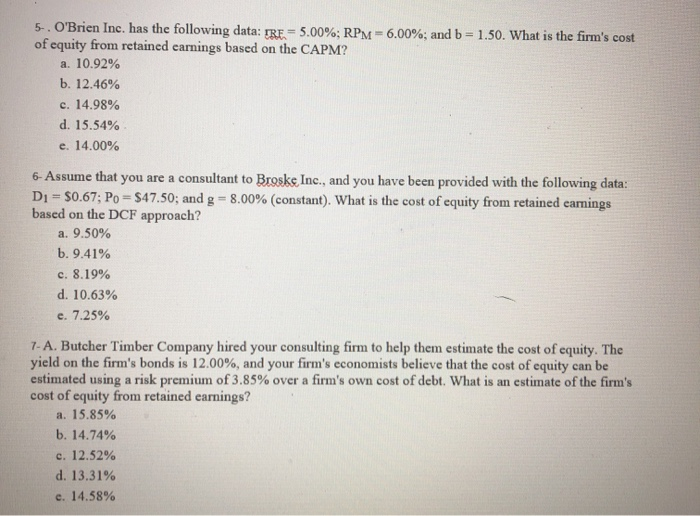

5-. O'Brien Inc. has the following data: TRF = 5.00%; RPM - 6.00%; and b - 1.50. What is the firm's cost of equity from retained earnings based on the CAPM? a. 10.92% b. 12.46% c. 14.98% d. 15.54% e. 14.00% 6- Assume that you are a consultant to Brosks Inc., and you have been provided with the following data: Di = $0.67; Po = $47.50; and g -8.00% (constant). What is the cost of equity from retained earnings based on the DCF approach? a. 9.50% b. 9.41% c. 8.19% d. 10.63% c. 7.25% 7- A. Butcher Timber Company hired your consulting firm to help them estimate the cost of equity. The yield on the firm's bonds is 12.00%, and your firm's economists believe that the cost of equity can be estimated using a risk premium of 3.85% over a firm's own cost of debt. What is an estimate of the firm's cost of equity from retained earnings? a. 15.85% b. 14.74% c. 12.52% d. 13.31% c. 14.58%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts