Question: answer 7, 9 only QUESTION 7 According to the mean-variance criterion, which one of the following investments dominates all others? a. E(r) = 0.9; Variance

answer 7, 9 only

answer 7, 9 only

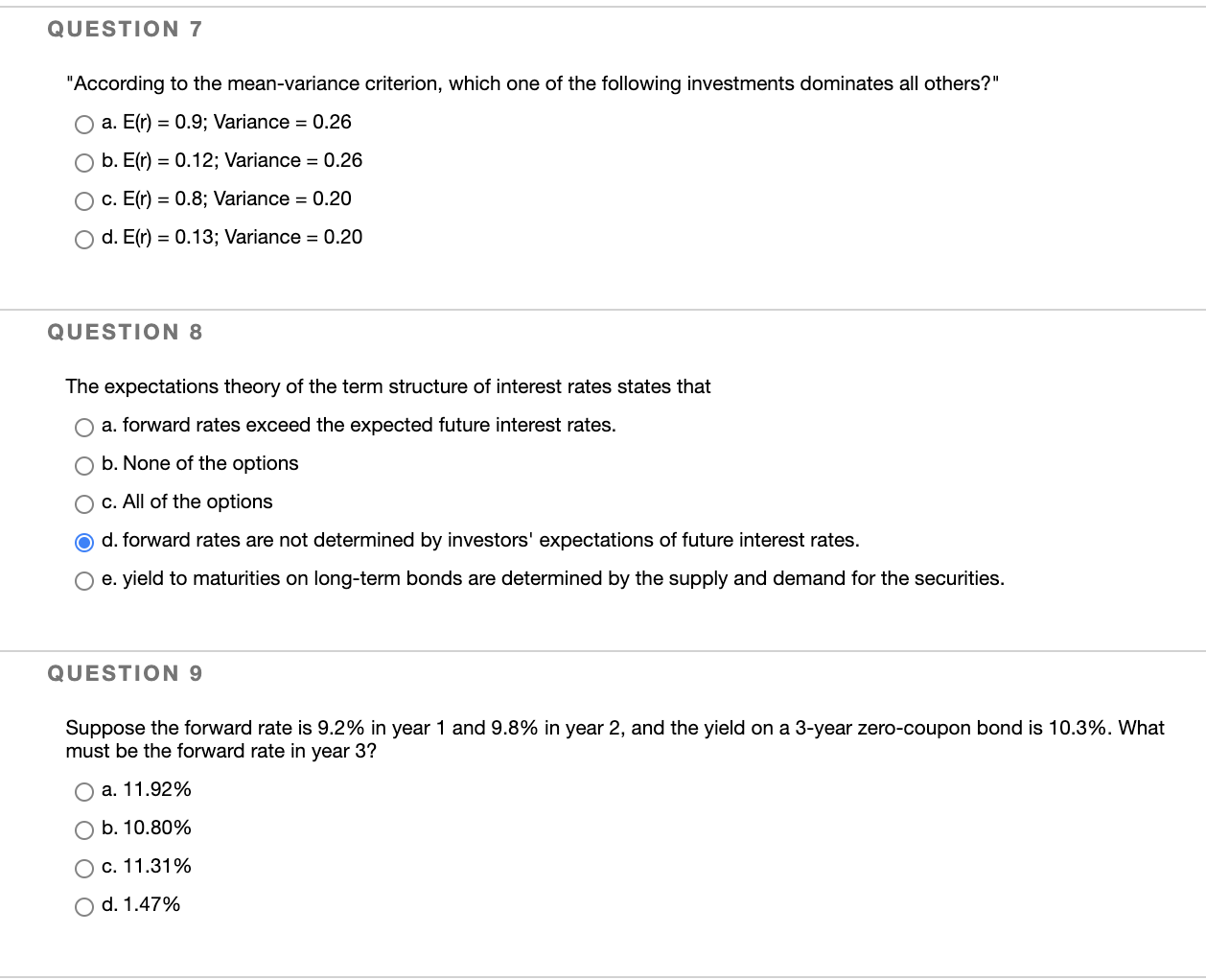

QUESTION 7 "According to the mean-variance criterion, which one of the following investments dominates all others?" a. E(r) = 0.9; Variance = 0.26 O b. E(r) = 0.12; Variance = 0.26 O c. E(r) = 0.8; Variance = 0.20 O d. E(r) = 0.13; Variance = 0.20 QUESTION 8 The expectations theory of the term structure of interest rates states that O a. forward rates exceed the expected future interest rates. O b. None of the options O c. All of the options d. forward rates are not determined by investors' expectations of future interest rates. e. yield to maturities on long-term bonds are determined by the supply and demand for the securities. QUESTION 9 Suppose the forward rate is 9.2% in year 1 and 9.8% in year 2, and the yield on a 3-year zero-coupon bond is 10.3%. What must be the forward rate in year 3? O a. 11.92% b. 10.80% O c. 11.31% O d. 1.47%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts