Question: Answer A) and B) A remotely situated fuel cell has an installed cost of $1,900 and will reduce existing surveillance expenses by $350 per year

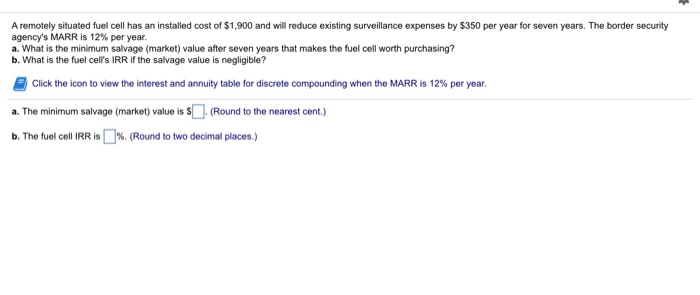

A remotely situated fuel cell has an installed cost of $1,900 and will reduce existing surveillance expenses by $350 per year for seven years. The border security agency's MARR is 12% per year. a. What is the minimum salvage (market) value after seven years that makes the fuel cell worth purchasing? b. What is the fuel cell's IRR if the salvage value is negligible? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. a. The minimum salvage (market) value is s (Round to the nearest cent.) b. The fuel cell IRR is 1 1%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts