Question: Answer A and B with the calculations P9-51. Reformulating RNOA for Acquisition Gross Profit Effects ADJUSTMENTS 9.2 LO3 Windstream Corporation, a communications and technology solutions

Answer A and B with the calculations

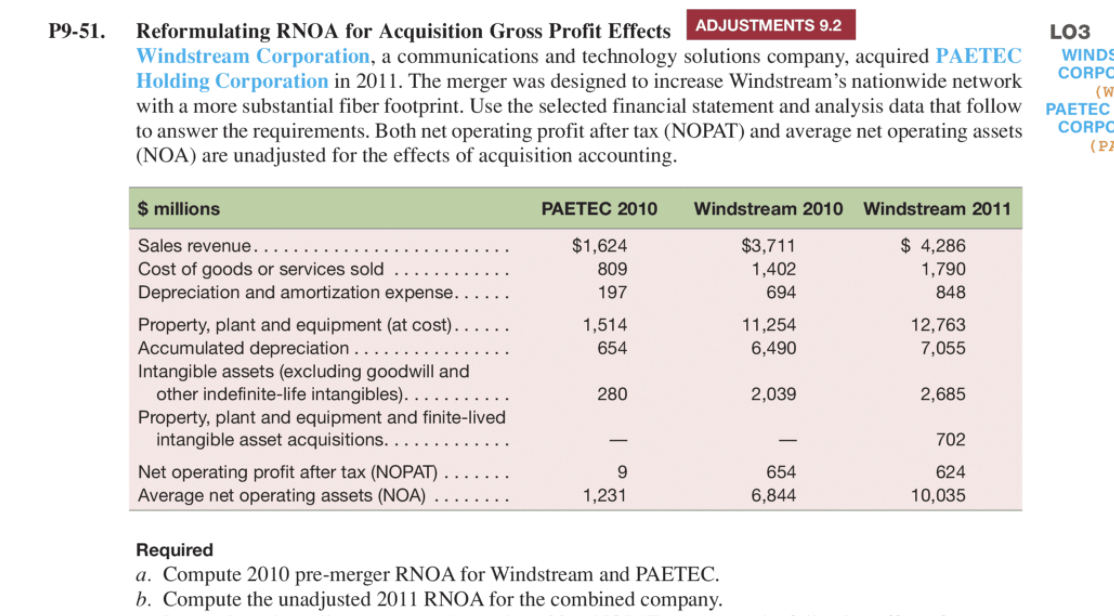

P9-51. Reformulating RNOA for Acquisition Gross Profit Effects ADJUSTMENTS 9.2 LO3 Windstream Corporation, a communications and technology solutions company, acquired PAETEC WINDS Holding Corporation in 2011. The merger was designed to increase Windstream's nationwide network CORPO with a more substantial fiber footprint. Use the selected financial statement and analysis data that follow PAETEC (W to answer the requirements. Both net operating profit after tax (NOPAT) and average net operating assets CORPO (NOA) are unadjusted for the effects of acquisition accounting. (P $ millions PAETEC 2010 Windstream 2010 Windstream 2011 Sales revenue . . . . . . . $1,624 $3,711 $ 4,286 Cost of goods or services sold . 809 1,402 1,790 Depreciation and amortization expense. . . .. 197 694 848 Property, plant and equipment (at cost). . .. . . 1,514 11,254 12,763 Accumulated depreciation . . . . . . . . 654 6,490 7,055 Intangible assets (excluding goodwill and other indefinite-life intangibles). . . . . . ... 280 2,039 2,685 Property, plant and equipment and finite-lived intangible asset acquisitions. . . . . . . . . . ... - 702 Net operating profit after tax (NOPAT) . .. . . . 9 654 624 Average net operating assets (NOA) . . . . . 1,231 6,844 10,035 Required a. Compute 2010 pre-merger RNOA for Windstream and PAETEC. b. Compute the unadjusted 2011 RNOA for the combined company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts