Question: Answer: (a) Approve proposal (NPV: $177K). (b) Not sensitive; 41.6% safety margin. Question 4 (25 marks The Vice President of Marketing at Envisions Canada is

Answer:

(a) Approve proposal (NPV: $177K). (b) Not sensitive; 41.6% safety margin.

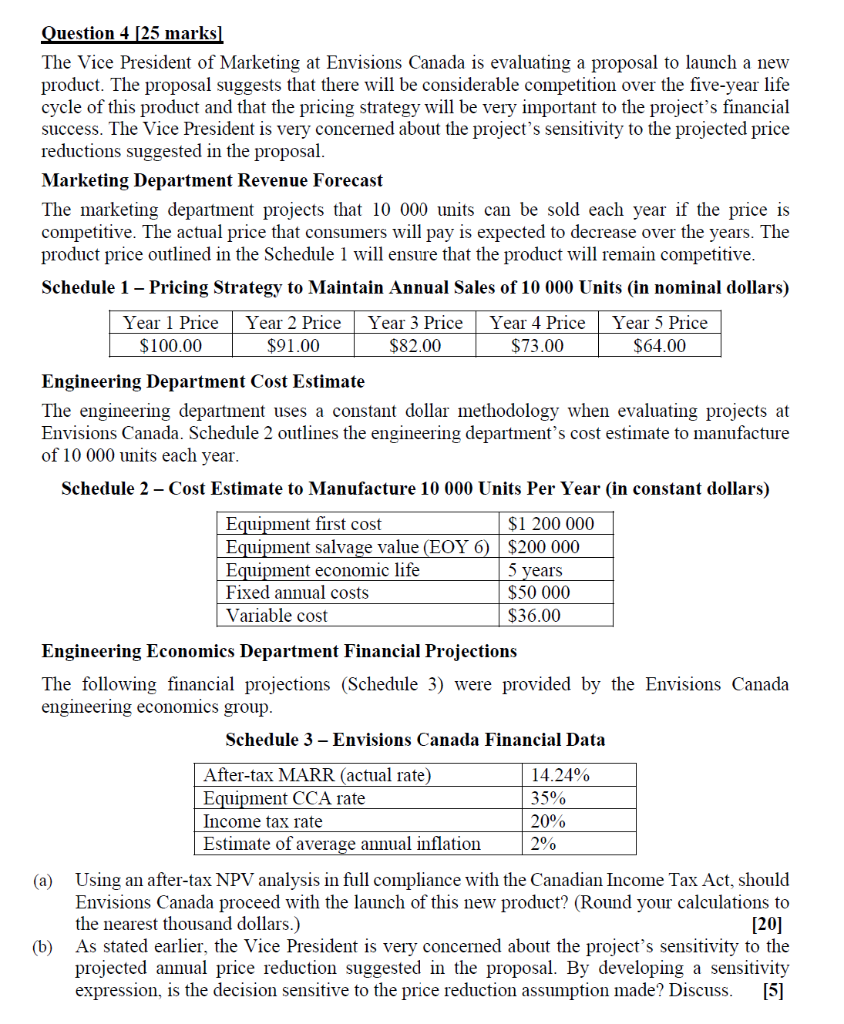

Question 4 (25 marks The Vice President of Marketing at Envisions Canada is evaluating a proposal to launch a new product. The proposal suggests that there will be considerable competition over the five-year life cycle of this product and that the pricing strategy will be very important to the project's financial success. The Vice President is very concerned about the project's sensitivity to the projected price reductions suggested in the proposal. Marketing Department Revenue Forecast The marketing department projects that 10 000 units can be sold each year if the price is competitive. The actual price that consumers will pay is expected to decrease over the years. The product price outlined in the Schedule 1 will ensure that the product will remain competitive. Schedule 1 - Pricing Strategy to Maintain Annual Sales of 10 000 Units (in nominal dollars) Year 1 Price Year 2 Price Year 3 Price Year 4 Price Year 5 Price $100.00 $91.00 $82.00 $73.00 $64.00 Engineering Department Cost Estimate The engineering department uses a constant dollar methodology when evaluating projects at Envisions Canada. Schedule 2 outlines the engineering department's cost estimate to manufacture of 10 000 units each year. Schedule 2 - Cost Estimate to Manufacture 10 000 Units Per Year (in constant dollars) Equipment first cost $1 200 000 Equipment salvage value (EOY 6) $200 000 Equipment economic life 5 years Fixed annual costs $50 000 Variable cost $36.00 Engineering Economics Department Financial Projections The following financial projections (Schedule 3) were provided by the Envisions Canada engineering economics group. Schedule 3 - Envisions Canada Financial Data After-tax MARR (actual rate) 14.24% Equipment CCA rate 35% Income tax rate 20% Estimate of average annual inflation 2% (a) Using an after-tax NPV analysis in full compliance with the Canadian Income Tax Act, should Envisions Canada proceed with the launch of this new product? (Round your calculations to the nearest thousand dollars.) [20] (b) As stated earlier, the Vice President is very concerned about the project's sensitivity to the projected annual price reduction suggested in the proposal. By developing a sensitivity expression, is the decision sensitive to the price reduction assumption made? Discuss. [5] Question 4 (25 marks The Vice President of Marketing at Envisions Canada is evaluating a proposal to launch a new product. The proposal suggests that there will be considerable competition over the five-year life cycle of this product and that the pricing strategy will be very important to the project's financial success. The Vice President is very concerned about the project's sensitivity to the projected price reductions suggested in the proposal. Marketing Department Revenue Forecast The marketing department projects that 10 000 units can be sold each year if the price is competitive. The actual price that consumers will pay is expected to decrease over the years. The product price outlined in the Schedule 1 will ensure that the product will remain competitive. Schedule 1 - Pricing Strategy to Maintain Annual Sales of 10 000 Units (in nominal dollars) Year 1 Price Year 2 Price Year 3 Price Year 4 Price Year 5 Price $100.00 $91.00 $82.00 $73.00 $64.00 Engineering Department Cost Estimate The engineering department uses a constant dollar methodology when evaluating projects at Envisions Canada. Schedule 2 outlines the engineering department's cost estimate to manufacture of 10 000 units each year. Schedule 2 - Cost Estimate to Manufacture 10 000 Units Per Year (in constant dollars) Equipment first cost $1 200 000 Equipment salvage value (EOY 6) $200 000 Equipment economic life 5 years Fixed annual costs $50 000 Variable cost $36.00 Engineering Economics Department Financial Projections The following financial projections (Schedule 3) were provided by the Envisions Canada engineering economics group. Schedule 3 - Envisions Canada Financial Data After-tax MARR (actual rate) 14.24% Equipment CCA rate 35% Income tax rate 20% Estimate of average annual inflation 2% (a) Using an after-tax NPV analysis in full compliance with the Canadian Income Tax Act, should Envisions Canada proceed with the launch of this new product? (Round your calculations to the nearest thousand dollars.) [20] (b) As stated earlier, the Vice President is very concerned about the project's sensitivity to the projected annual price reduction suggested in the proposal. By developing a sensitivity expression, is the decision sensitive to the price reduction assumption made? Discuss. [5]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts