Question: Answer A, B and C. Im not sure if I answered correctly. Current Attempt in Progress Johnson & Williams Industries makes artificial Christmas trees. The

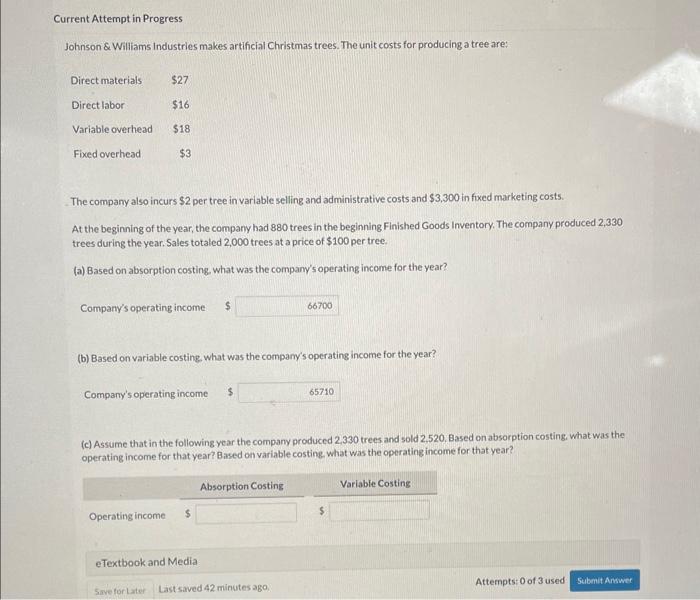

Current Attempt in Progress Johnson \& Williams Industries makes artificial Christmas trees. The unit costs for producing a tree are: The company also incurs $2 per tree in variable selling and administrative costs and $3,300 in fuxed marketing costs. At the beginning of the year, the company had 880 trees in the beginning Finished Goods Inventory. The company produced 2,330 trees during the year. Sales totaled 2,000 trees at a price of $100 per tree. (a) Based on absorption costing. what was the company's operating income for the year? Company's operating income (b) Based on variable costing what was the compary's operating income for the year? Company's operating income (c) Assume that in the following year the company produced 2,330 trees and sold 2.520. Based on absorption costing, what was the operating income for that year? Based on variable costing. What was the operating income for that year? efextbook and Media Attempts: 0 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts