Question: answer a, b and c please 5. Ali Company uses a job order cost system in each of its three manufacturing departments. Manufacturing overhead is

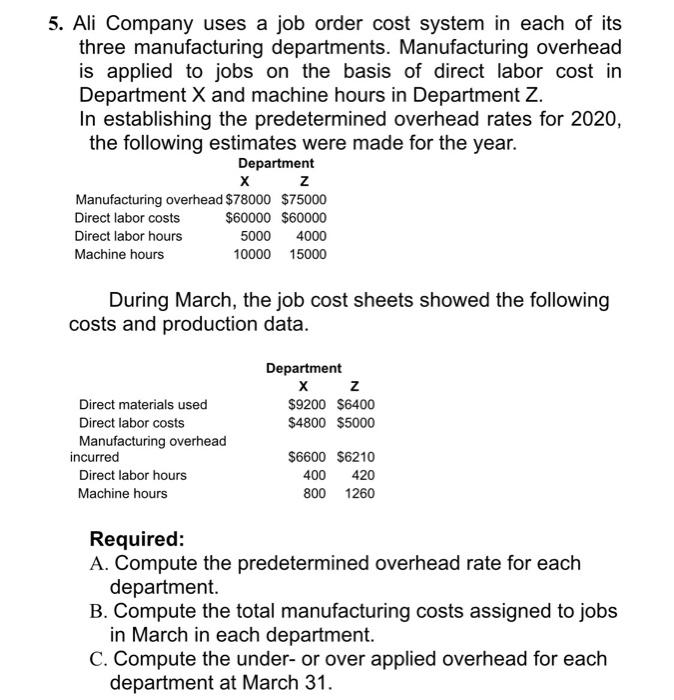

5. Ali Company uses a job order cost system in each of its three manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labor cost in Department X and machine hours in Department Z. In establishing the predetermined overhead rates for 2020, the following estimates were made for the year. Department X z Manufacturing overhead $78000 $75000 Direct labor costs $60000 $60000 Direct labor hours 5000 4000 Machine hours 10000 15000 During March, the job cost sheets showed the following costs and production data. Department Z $9200 $6400 $4800 $5000 Direct materials used Direct labor costs Manufacturing overhead incurred Direct labor hours Machine hours $6600 $6210 400 420 800 1260 Required: A. Compute the predetermined overhead rate for each department B. Compute the total manufacturing costs assigned to jobs in March in each department. C. Compute the under- or over applied overhead for each department at March 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts