Question: answer: a. Calculating the monthly interest rate: r = 0.061/12 = 0.005083333 = 0.5083% Using the PVA equation to find the monthly payments: PVA =

answer:

a. Calculating the monthly interest rate:

r = 0.061/12 = 0.005083333 = 0.5083%

Using the PVA equation to find the monthly payments:

PVA = $65,200 - $4,700 - $2,000 = C[{1 [1 / (1 + r)]48}/ r]

PVA = $58,500 = C[{1 [1 / (1 + 0.005083)48]}/ 0.005083]

Solving for the monthly payment:

C = $1,376.56

Now calculate the PV of this option with an annual discount rate of 8%:

The monthly interest rate = 0.08/ 12 = 0.00667= 0.667%

PV = $4,700 + $1,376.56[{1 [1 / (1 + 0.00667)48]}/ 0.00667]

PV = $4,700 + $56,382.19 = $61,082.19

b. Calculating the monthly interest rate:

r = 0.012/12 = 0.001 = 0.1%

Using the PVA equation to find the monthly payments:

PVA = $65,200 - $4,700 = C[{1 [1 / (1 + r)48]}/ r]

PVA = $60,500 = C[{1 [1 / (1 + 0.001)48]}/ 0.001]

Solving for the monthly payment:

C = $1,291.54

Now calculate the PV of this option with an annual discount rate of 8%:

The monthly interest rate = 0.08 / 12 = 0.00667 = 0.667%

PV = $4,700 + $1,291.54[{1 [1 / (1 + 0.00667)48]}/ 0.00667]

PV = $4,700 + $52,899.88 = $57,599.88

Option b is the better deal.

My question is about the answer I posted above:

Why after calculating the monthly payment with the present value annuity formula, do we need to use the discount rate 8% to calculate the present value of the sum of $4700 and the monthly payment?

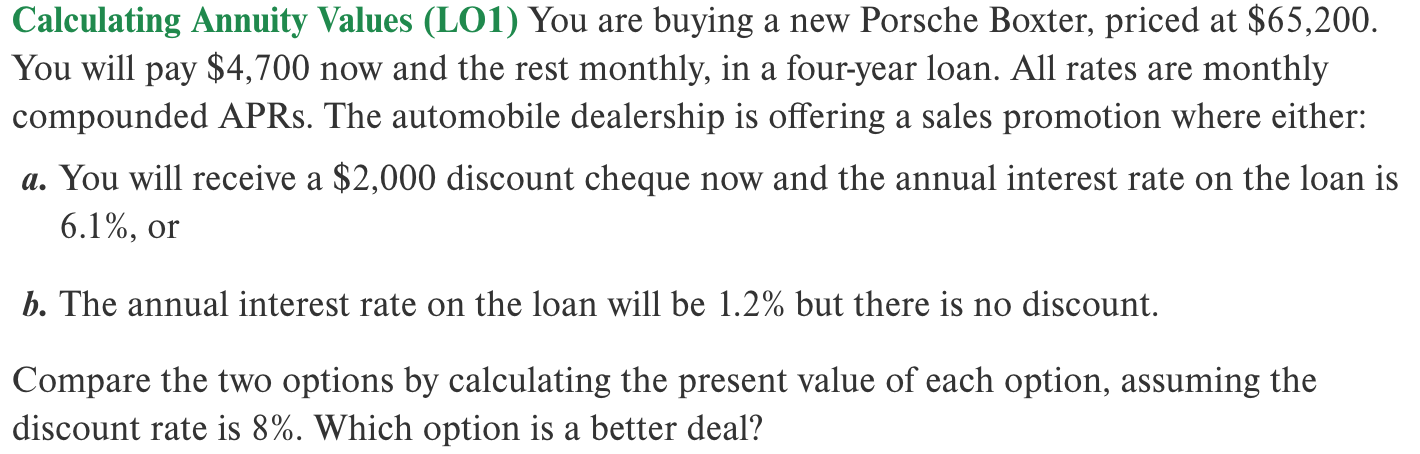

Calculating Annuity Values (L01) You are buying a new Porsche Boxter, priced at $65,200. You will pay $4,700 now and the rest monthly, in a four-year loan. All rates are monthly compounded APRs. The automobile dealership is offering a sales promotion where either: a. You will receive a $2,000 discount cheque now and the annual interest rate on the loan is 6.1%, or b. The annual interest rate on the loan will be 1.2% but there is no discount. Compare the two options by calculating the present value of each option, assuming the discount rate is 8%. Which option is a better deal? a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts