Question: Answer: (a) Consider the following two yield curves (representing perhaps annual yields on two different classes of zero coupon bonds), based on the notation of

Answer:

Answer:

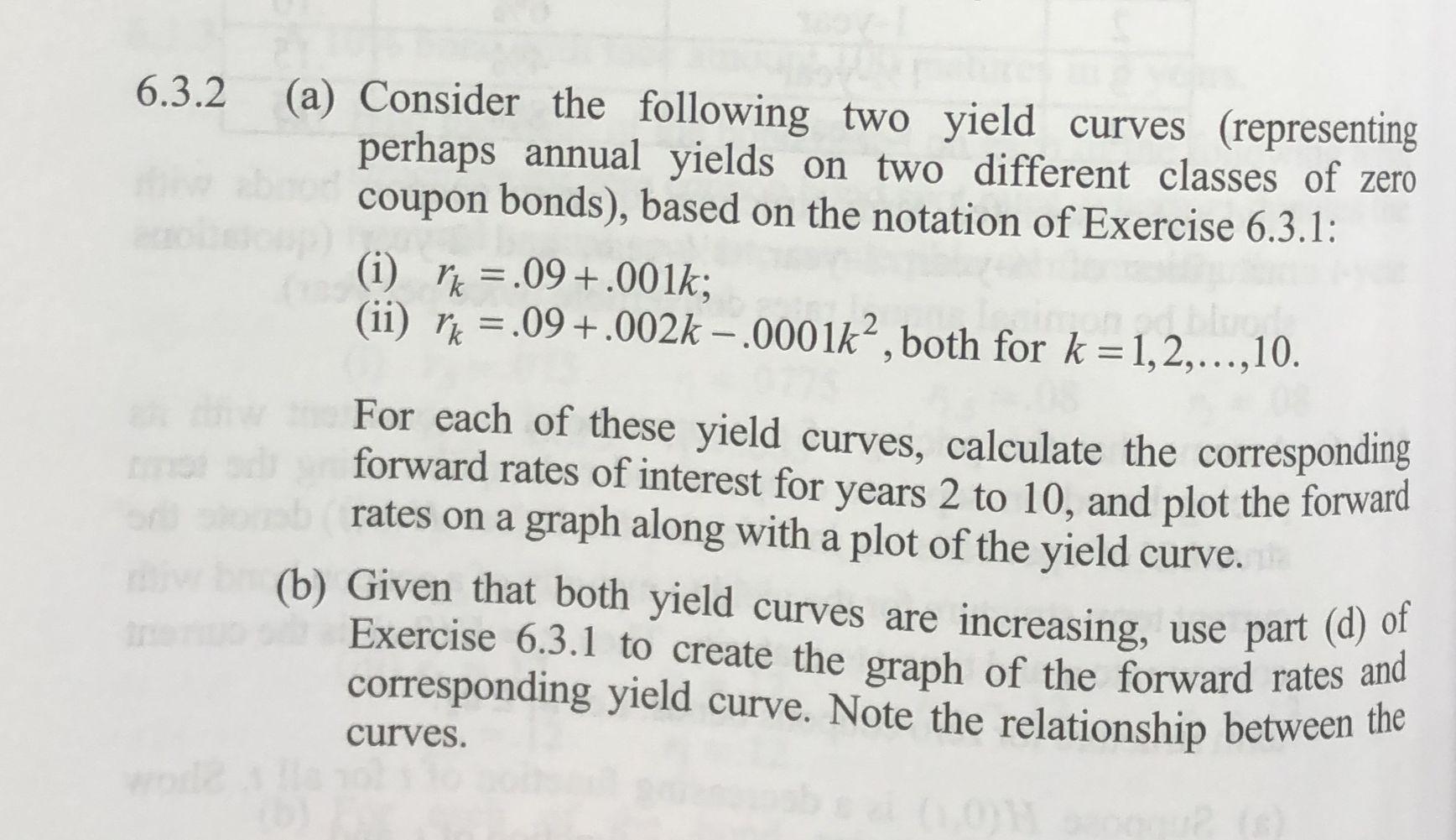

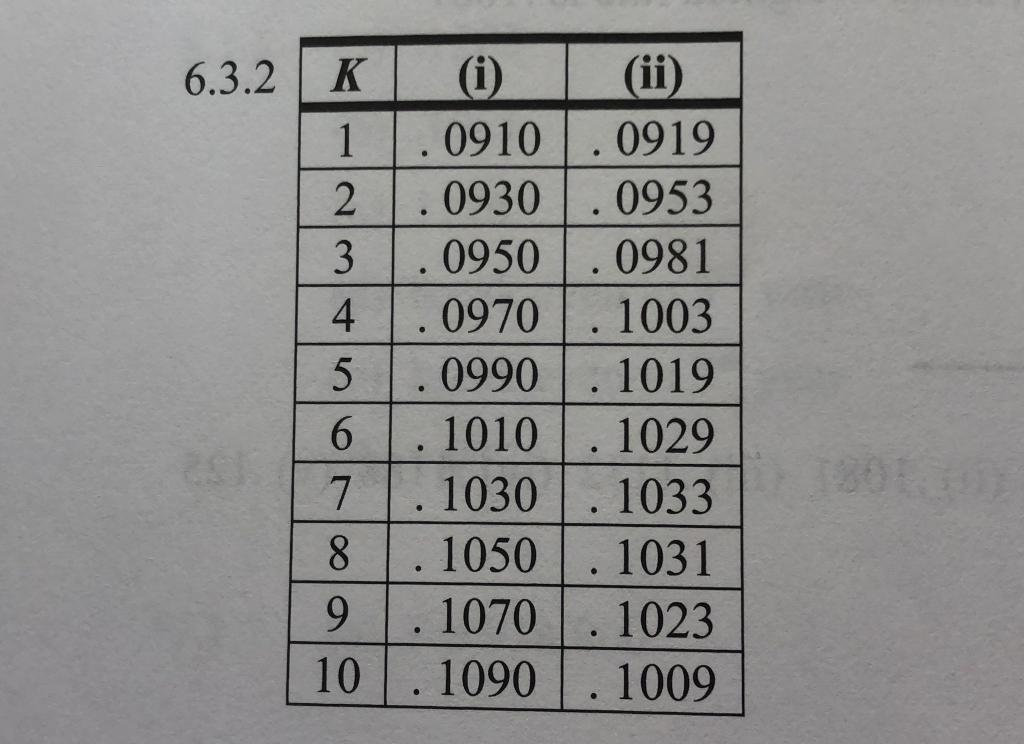

(a) Consider the following two yield curves (representing perhaps annual yields on two different classes of zero coupon bonds), based on the notation of Exercise 6.3.1: (i) rk=.09+.001k (ii) rk=.09+.002k.0001k2, both for k=1,2,,10. For each of these yield curves, calculate the corresponding forward rates of interest for years 2 to 10 , and plot the forward rates on a graph along with a plot of the yield curve. (b) Given that both yield curves are increasing, use part (d) of Exercise 6.3 .1 to create the graph of the forward rates and corresponding yield curve. Note the relationship between the curves. 6.3 .2

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock