Question: Answer: a Diff: M Bond value - annual payment 21. Marie Snell recently inherited some bonds (face value $100,000) from her father, and soon thereafter

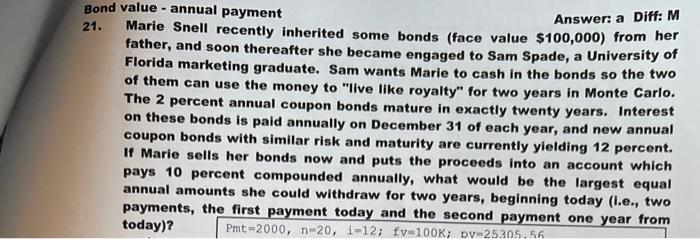

Answer: a Diff: M Bond value - annual payment 21. Marie Snell recently inherited some bonds (face value $100,000) from her father, and soon thereafter she became engaged to Sam Spade, a University of Florida marketing graduate. Sam wants Marie to cash in the bonds so the two of them can use the money to "live like royalty" for two years in Monte Carlo. The 2 percent annual coupon bonds mature in exactly twenty years. Interest on these bonds is paid annually on December 31 of each year, and new annual coupon bonds with similar risk and maturity are currently yielding 12 percent. If Marie sells her bonds now and puts the proceeds into an account which pays 10 percent compounded annually, what would be the largest equal annual amounts she could withdraw for two years, beginning today (i.e., two payments, the first payment today and the second payment one year from today)? Prt-2000, n-20, 1-12; fy=100K; Dv25205.56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts