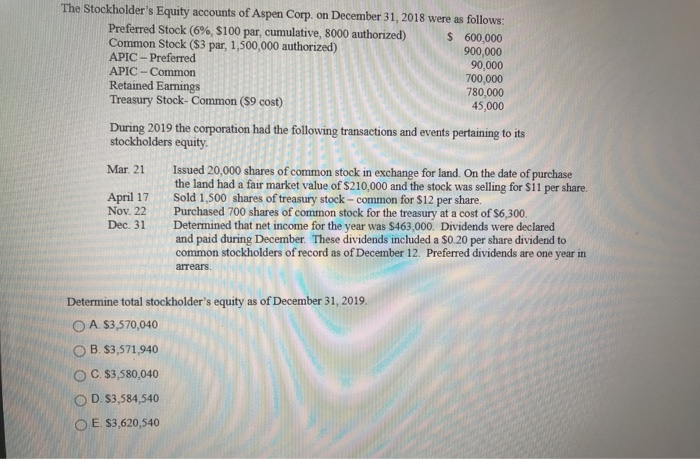

Question: Answer A is incorrect. Please help! The Stockholder's Equity accounts of Aspen Corp. on December 31, 2018 were as follows: Preferred Stock (6%, $100 par,

The Stockholder's Equity accounts of Aspen Corp. on December 31, 2018 were as follows: Preferred Stock (6%, $100 par, cumulative, 8000 authorized) $ 600,000 Common Stock (53 par, 1,500,000 authorized) 900,000 APIC - Preferred 90,000 APIC - Common 700,000 Retained Earnings 780,000 Treasury Stock- Common ($9 cost) 45,000 During 2019 the corporation had the following transactions and events pertaining to its stockholders equity Mar. 21 Issued 20,000 shares of common stock in exchange for land. On the date of purchase the land had a fair market value of $210,000 and the stock was selling for sin per share. Sold 1,500 shares of treasury stock - common for $12 per share. Nov. 22 Purchased 700 shares of common stock for the treasury at a cost of $6,300 Dec. 31 Determined that net income for the year was $463,000. Dividends were declared and paid during December. These dividends included a $0.20 per share dividend to common stockholders of record as of December 12. Preferred dividends are one year in arrears. April 17 Determine total stockholder's equity as of December 31, 2019. O A. $3,570,040 OB. $3,571,940 OC. $3,580,040 OD. $3,584,540 O E. $3,620,540

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts