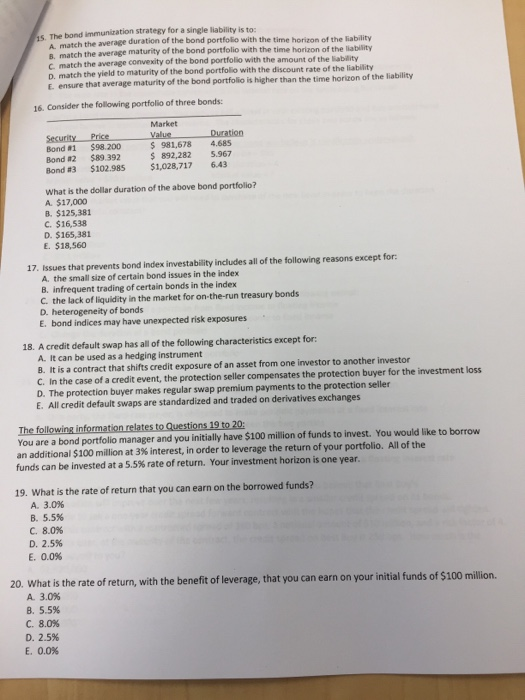

Question: answer all 1S. The bond immunization strategy for a single liability is to: duration of the bond portfolio with the time horizon of the liability

1S. The bond immunization strategy for a single liability is to: duration of the bond portfolio with the time horizon of the liability maturity of the bond portfolio with the time horizon of the liablity A. match the average B. match the average C. match the average convexity of the bond portfolio D. match the yield to maturity of the bond portfolio with the discount rate of the liability E. ensure that average maturity of the bond portfolio is higher than the time horizon of the liability with the amount of the liability 16. Consider the following portfolio of three bonds Market Bond #1 $98.200 Bond 82 $89.392 Bond #3 $102.985 981,678 4.685 892,282 5.967 6.43 si,028,717 What is the dollar duration of the above bond portfolioi A. $17,000 B. $125,381 C. $16,538 D. $165,381 E. $18,560 17. Issues that prevents bond index investability includes all of the following reasons except for A. the small size of certain bond issues in the index B. infrequent trading of certain bonds in the index C. the lack of liquidity in the market for on-the-run treasury bonds D. heterogeneity of bonds E. bond indices may have unexpected risk exposures 18. A credit default swap has all of the following characteristics except for: A. it can be used as a hedging instrument B. it is a contract that shifts credit exposure of an asset from one investor to another investor C. In the case of a credit event, t D. The protection buyer makes regular swap premium payments to the protection seller E. All credit default swaps are standardized and traded on derivatives exchanges he protection seller compensates the protection buyer for the investment loss The You are a bond portfolio manager and you initially have $100 million of funds to invest. You would like to borrow an additional S100 million at 3% interest, in order to leverage the return of your portfolio. All of the funds can be invested at a 5.5% rate of return. Your investment horizon is one year 19. What is the rate of return that you can earn on the borrowed funds? A. 3.0% B. 5.5% C. 8.0% D. 2.5% E. 0.0% 20. What is the rate of return, with the benefit of leverage, that you can earn on your initial funds of $100 million. A. 3.0% B. 5.5% C. 8.0% D. 2.5% E. 0.0% 1S. The bond immunization strategy for a single liability is to: duration of the bond portfolio with the time horizon of the liability maturity of the bond portfolio with the time horizon of the liablity A. match the average B. match the average C. match the average convexity of the bond portfolio D. match the yield to maturity of the bond portfolio with the discount rate of the liability E. ensure that average maturity of the bond portfolio is higher than the time horizon of the liability with the amount of the liability 16. Consider the following portfolio of three bonds Market Bond #1 $98.200 Bond 82 $89.392 Bond #3 $102.985 981,678 4.685 892,282 5.967 6.43 si,028,717 What is the dollar duration of the above bond portfolioi A. $17,000 B. $125,381 C. $16,538 D. $165,381 E. $18,560 17. Issues that prevents bond index investability includes all of the following reasons except for A. the small size of certain bond issues in the index B. infrequent trading of certain bonds in the index C. the lack of liquidity in the market for on-the-run treasury bonds D. heterogeneity of bonds E. bond indices may have unexpected risk exposures 18. A credit default swap has all of the following characteristics except for: A. it can be used as a hedging instrument B. it is a contract that shifts credit exposure of an asset from one investor to another investor C. In the case of a credit event, t D. The protection buyer makes regular swap premium payments to the protection seller E. All credit default swaps are standardized and traded on derivatives exchanges he protection seller compensates the protection buyer for the investment loss The You are a bond portfolio manager and you initially have $100 million of funds to invest. You would like to borrow an additional S100 million at 3% interest, in order to leverage the return of your portfolio. All of the funds can be invested at a 5.5% rate of return. Your investment horizon is one year 19. What is the rate of return that you can earn on the borrowed funds? A. 3.0% B. 5.5% C. 8.0% D. 2.5% E. 0.0% 20. What is the rate of return, with the benefit of leverage, that you can earn on your initial funds of $100 million. A. 3.0% B. 5.5% C. 8.0% D. 2.5% E. 0.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts