Question: answer all 3 please 44) You are given a $100,000 30-year fixed-rate mortgage (fully amortizing) at a 10% interest rate. What are the monthly payments

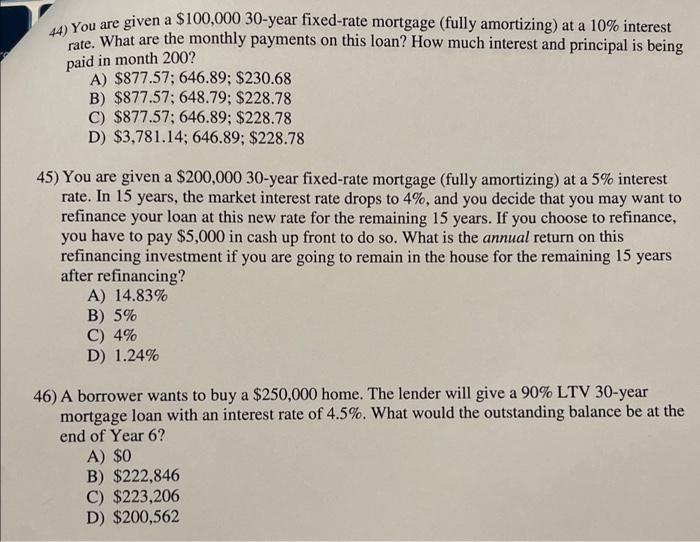

44) You are given a $100,000 30-year fixed-rate mortgage (fully amortizing) at a 10% interest rate. What are the monthly payments on this loan? How much interest and principal is being paid in month 200? A) $877.57; 646.89; $230.68 B) $877.57; 648.79; $228.78 C) $877.57; 646.89; $228.78 D) $3,781.14; 646.89; $228.78 45) You are given a $200,000 30-year fixed-rate mortgage (fully amortizing) at a 5% interest rate. In 15 years, the market interest rate drops to 4%, and you decide that you may want to refinance your loan at this new rate for the remaining 15 years. If you choose to refinance, you have to pay $5,000 in cash up front to do so. What is the annual return on this refinancing investment if you are going to remain in the house for the remaining 15 years after refinancing? A) 14.83% B) 5% C) 4% D) 1.24% 46) A borrower wants to buy a $250,000 home. The lender will give a 90% LTV 30-year mortgage loan with an interest rate of 4.5%. What would the outstanding balance be at the end of Year 6? A) $0 B) $222,846 C) $223,206 D) $200,562

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts