Question: Answer all 3 PLEASEE! optiong for 14 are- a. 2.10 b. 3.00 c. 1.00 d. 1.50 Question 12 5 pts Frisco Fitness Clubs, a firm

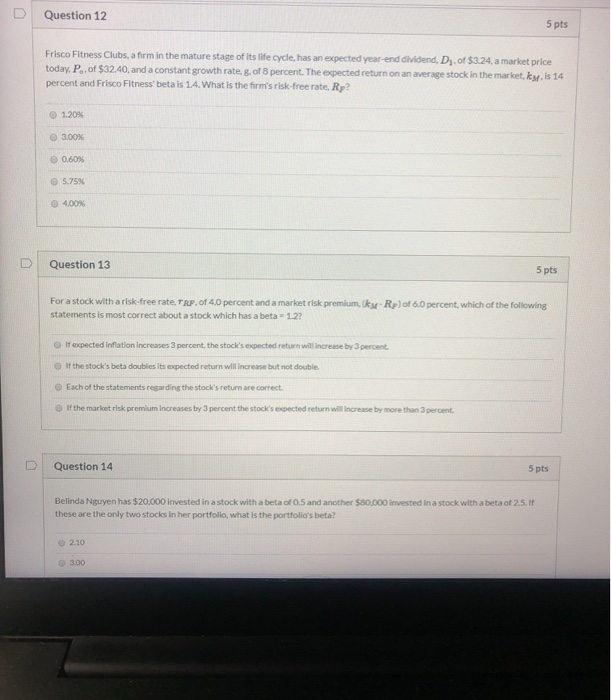

Question 12 5 pts Frisco Fitness Clubs, a firm in the mature stage of its life cycle, has an expected year-end dividend. D. of $3.24, a market price today. P..of $32.40, and a constant growth rates of 8 percent. The expected return on an average stock in the market ky is 14 percent and Frisco Fitness' betais 14. What is the firm's risk-free rate, R? 1.20% 3.00% 0.60% 5.75% 4.00% Question 13 5 pts For a stock with a risk-free rate. Pof 40 percent and a market risk premium ky Ryl of 60 percent, which of the following statements is most correct about a stock which has a beta = 1.22 It expected inflation increases 3 percent, the stock's expected return will increase by 3 percent If the stock's beta doubles its expected return will increase but not double Each of the statements regarding the stock's return are correct. If the market risk premium increases by 3 percent the stock's expected return will increase by more than 3 percent. Question 14 5 pts Belinda Nguyen has $20.000 invested in a stock with a beta of 0.5 and another $80,000 invested in a stock with a beta of 25. If these are the only two stocks in her portfolio, what is the portfolio's beta? 2.10 300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts