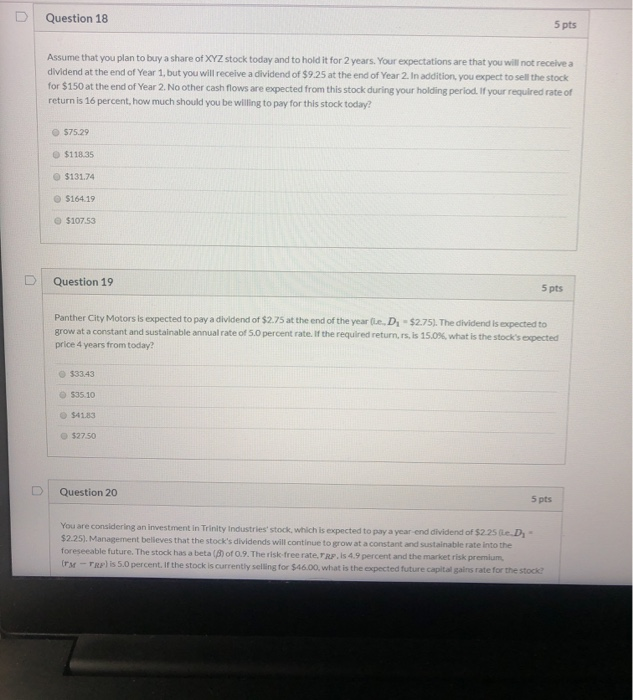

Question: Answer all 3 PLEASEE! The choices for 20 arw a. 4.9% b. 9.5% c. 4.5% d. 5.0% Question 18 5 pts Assume that you plan

Question 18 5 pts Assume that you plan to buy a share of XYZ stock today and to hold it for 2 years. Your expectations are that you will not receive a dividend at the end of Year 1, but you will receive a dividend of $9.25 at the end of Year 2. In addition you expect to sell the stock for $150 at the end of Year 2. No other cash flows are expected from this stock during your holding period. If your required rate of return is 16 percent, how much should you be willing to pay for this stock today? 575.29 $118.35 $131.74 5164.19 $107.53 Question 19 5 pts Panther City Motors is expected to pay a dividend of $2.75 at the end of the year (e. D. $2.751. The dividend is expected to grow at a constant and sustainable annual rate of 5.0 percent rate. If the required return, is, is 15.0% what is the stock's expected price 4 years from today? 535 10 S4183 $2750 Question 20 5 pts You are considering an investment in Trinity Industries' stock, which is expected to pay a year end dividend of $2.25 ie D $2.25). Management believes that the stock's dividends will continue to grow at a constant and sustainable rate into the foreseeable future. The stock has a beta (1 of 0.9. The risk-free rate TRF is 4.9 percent and the market risk premium Ore - Tapis 5.0 percent. If the stock is currently selling for $46.00, what is the aspected future capital gains rate for the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts