Question: ANSWER ALL 5 1. All else equal, the market value of a stock will tend to decrease by roughly the aftertax value of the dividend

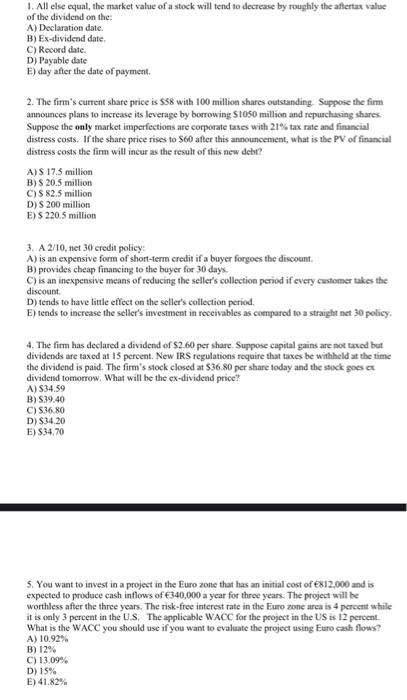

1. All else equal, the market value of a stock will tend to decrease by roughly the aftertax value of the dividend on the A) Declaration date. B) Ex-dividend date. C) Record date D) Payable date E) day after the date of payment. 2. The firm's current share price is $88 with 100 million shares outstanding. Suppose the firm announces plans to increase its leverage by borrowing S1050 million and repurchasing shares Suppose the only market imperfections are corporate taxes with 21% tax rate and financial distress costs. If the share price rises to $60 after this announcement, what is the PV of financial distress costs the firm will incur as the result of this new debt? A) S 17.5 million B) S 20.5 million C) S 82.5 million D) S 200 million E) S 220.5 million 3. A 2/10, net 30 credit policy A) is an expensive form of short-term credit if a buyer forgoes the discount B) provides cheap financing to the buyer for 30 days C) is an inexpensive means of reducing the seller's collection period if every customer takes the discount D) tends to have little effect on the seller's collection period. E) tends to increase the seller's investment in receivables as compared to a straight net 30 policy 4. The firm has declared a dividend of $2.60 per share. Suppose capital gains are not taxed but dividends are taxed at 15 percent. New IRS regulations require that taxes be withheld at the time the dividend is paid. The firm's stock closed at $36.80 per share today and the stock goes ex dividend tomorrow. What will be the ex-dividend price? A) S34.59 B) S39.40 C) S36.80 D) $34,20 E) $34.70 5. You want to invest in a project in the Euro zone that has an initial cost of 812,000 and is expected to produce cash inflows of E340,000 a year for three years. The project will be worthless after the three years. The risk-free interest rate in the Euro zone area is 4 percent while it is only 3 percent in the US. The applicable WACC for the project in the US is 12 percent. What is the WACC you should use if you want to evaluate the project using Euro cash flows? A) 10.92% B) 12% C) 13.09% D) 15% E) 41.82%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts