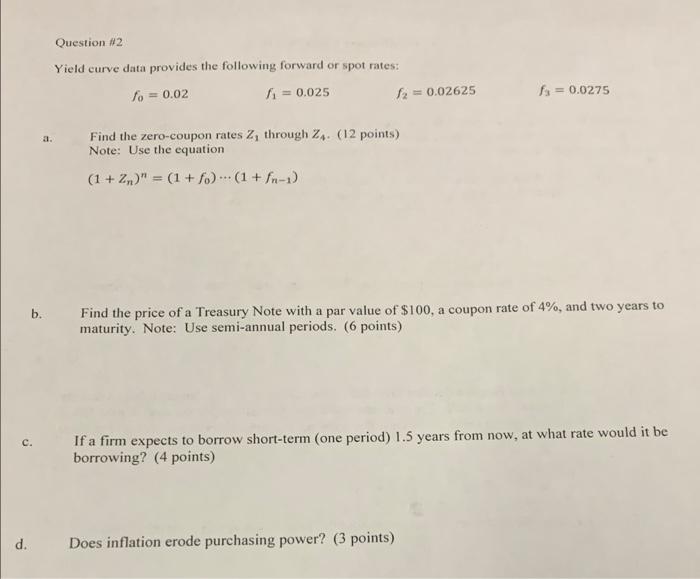

Question: answer all and show full work. Question 2 Yield curve data provides the following forward or spot rates: fo = 0.02 f = 0.025 12

Question 2 Yield curve data provides the following forward or spot rates: fo = 0.02 f = 0.025 12 0.02625 f = 0.0275 a. Find the zero-coupon rates 2, through Z. (12 points) Note: Use the equation (1 + 2n" = (1 + f2) (1 + fn-1) b. Find the price of a Treasury Note with a par value of $100, a coupon rate of 4%, and two years to maturity. Note: Use semi-annual periods. (6 points) c. If a firm expects to borrow short-term (one period) 1.5 years from now, at what rate would it be borrowing? (4 points) d. Does inflation erode purchasing power? (3 points) Question 2 Yield curve data provides the following forward or spot rates: fo = 0.02 f = 0.025 12 0.02625 f = 0.0275 a. Find the zero-coupon rates 2, through Z. (12 points) Note: Use the equation (1 + 2n" = (1 + f2) (1 + fn-1) b. Find the price of a Treasury Note with a par value of $100, a coupon rate of 4%, and two years to maturity. Note: Use semi-annual periods. (6 points) c. If a firm expects to borrow short-term (one period) 1.5 years from now, at what rate would it be borrowing? (4 points) d. Does inflation erode purchasing power? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts