Question: answer all areas correctly please You are preparing the tax section of your company's financial statements. During the year 2022 , your company acquired equipment

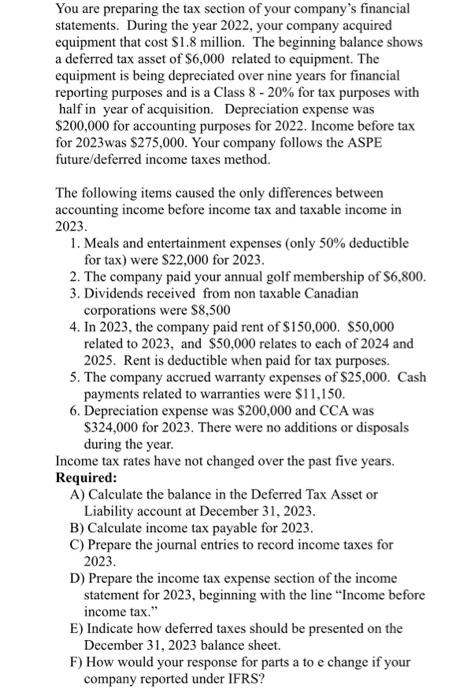

You are preparing the tax section of your company's financial statements. During the year 2022 , your company acquired equipment that cost $1.8 million. The beginning balance shows a deferred tax asset of $6,000 related to equipment. The equipment is being depreciated over nine years for financial reporting purposes and is a Class 820% for tax purposes with half in year of acquisition. Depreciation expense was $200,000 for accounting purposes for 2022 . Income before tax for 2023 was $275,000. Your company follows the ASPE future/deferred income taxes method. The following items caused the only differences between accounting income before income tax and taxable income in 2023. 1. Meals and entertainment expenses (only 50% deductible for tax ) were $22,000 for 2023 . 2. The company paid your annual golf membership of $6,800. 3. Dividends received from non taxable Canadian corporations were $8,500 4. In 2023, the company paid rent of $150,000. $50,000 related to 2023 , and $50,000 relates to each of 2024 and 2025. Rent is deductible when paid for tax purposes. 5. The company accrued warranty expenses of $25,000. Cash payments related to warranties were $11,150. 6. Depreciation expense was $200,000 and CCA was $324,000 for 2023 . There were no additions or disposals during the year. Income tax rates have not changed over the past five years. Required: A) Calculate the balance in the Deferred Tax Asset or Liability account at December 31, 2023. B) Calculate income tax payable for 2023 . C) Prepare the journal entries to record income taxes for 2023. D) Prepare the income tax expense section of the income statement for 2023 , beginning with the line "Income before income tax." E) Indicate how deferred taxes should be presented on the December 31,2023 balance sheet. F) How would your response for parts a to e change if your company reported under IFRS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts