Question: ANSWER ALL AS THEY ARE WITH THE SAME QUESTION Taft Holdings is interested in purchasing Farmcorp and would like to know if the takeover is

ANSWER ALL AS THEY ARE WITH THE SAME QUESTION

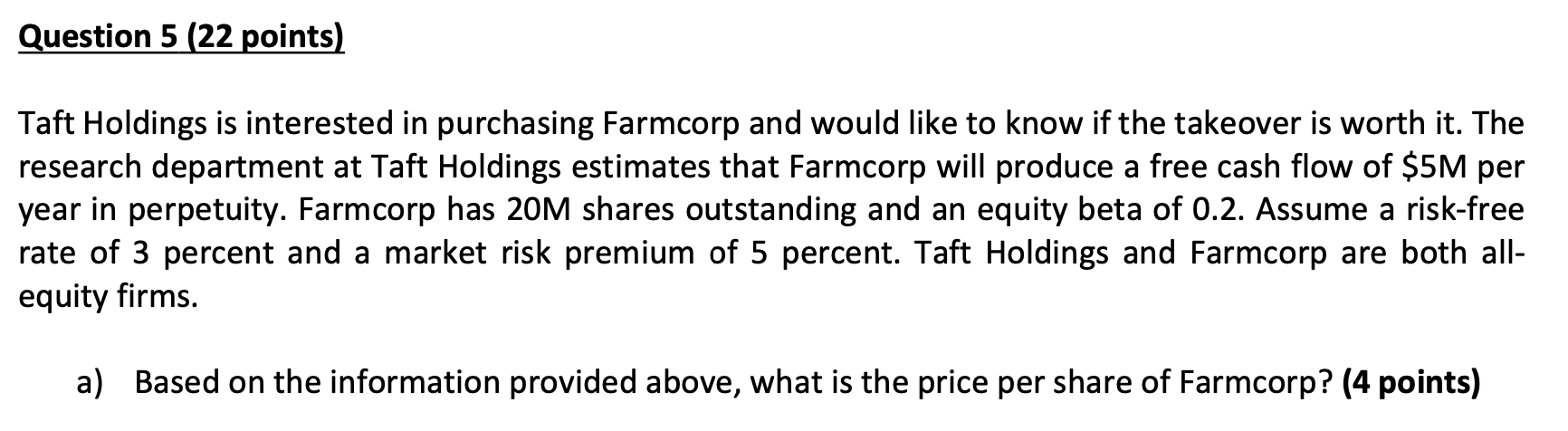

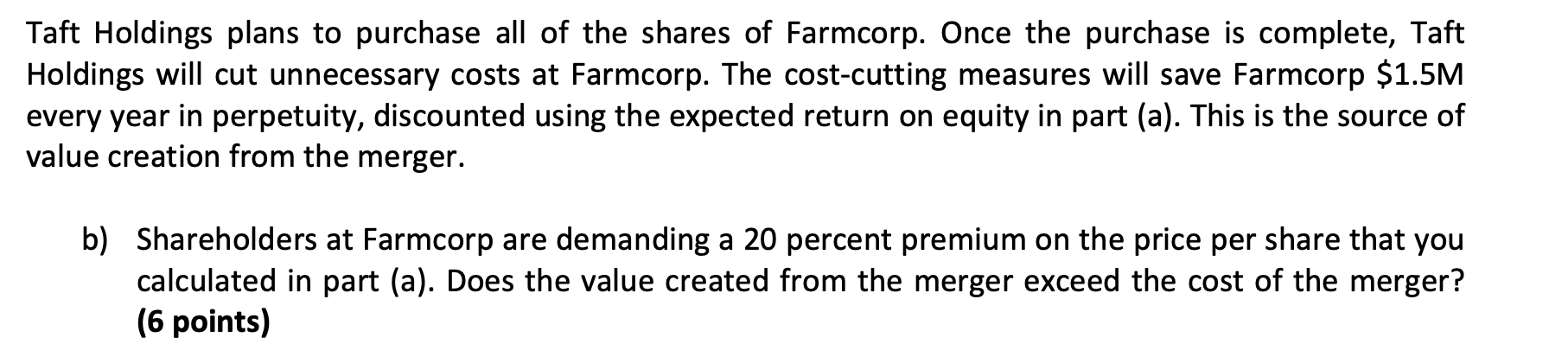

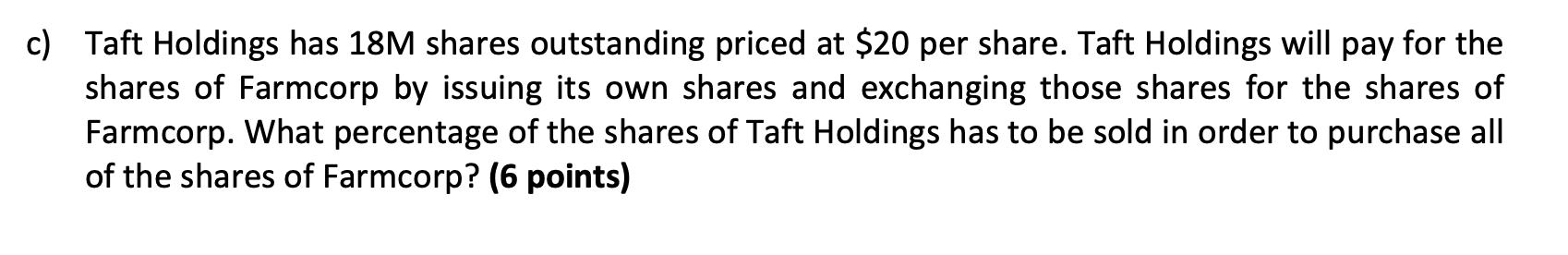

Taft Holdings is interested in purchasing Farmcorp and would like to know if the takeover is worth it. The research department at Taft Holdings estimates that Farmcorp will produce a free cash flow of $5M per year in perpetuity. Farmcorp has 20M shares outstanding and an equity beta of 0.2. Assume a risk-free rate of 3 percent and a market risk premium of 5 percent. Taft Holdings and Farmcorp are both allequity firms. a) Based on the information provided above, what is the price per share of Farmcorp? (4 points) Taft Holdings plans to purchase all of the shares of Farmcorp. Once the purchase is complete, Taft Holdings will cut unnecessary costs at Farmcorp. The cost-cutting measures will save Farmcorp \$1.5M every year in perpetuity, discounted using the expected return on equity in part (a). This is the source of value creation from the merger. b) Shareholders at Farmcorp are demanding a 20 percent premium on the price per share that you calculated in part (a). Does the value created from the merger exceed the cost of the merger? (6 points) Taft Holdings has 18M shares outstanding priced at $20 per share. Taft Holdings will pay for the shares of Farmcorp by issuing its own shares and exchanging those shares for the shares of Farmcorp. What percentage of the shares of Taft Holdings has to be sold in order to purchase all of the shares of Farmcorp? (6 points) d) What is the new price per share of Taft Holdings after the merger is complete? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts