Question: ANSWER all below: (See BKM Chapter 7.2, Equations 7.2 and 7.7 for this question). Stock As expected return and standard deviation are E[ra] = 8%

ANSWER all below:

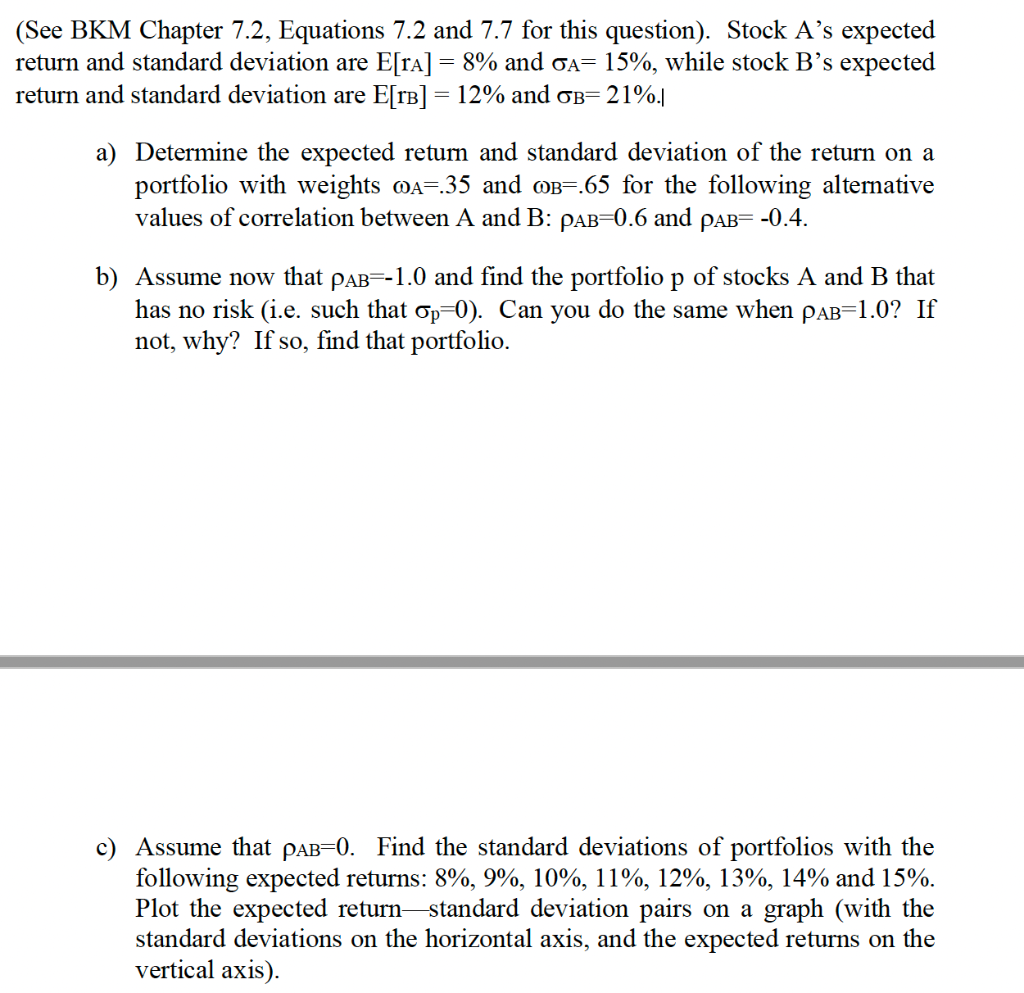

(See BKM Chapter 7.2, Equations 7.2 and 7.7 for this question). Stock As expected return and standard deviation are E[ra] = 8% and on= 15%, while stock B's expected return and standard deviation are E[TB] = 12% and oB= 21%. a) Determine the expected return and standard deviation of the return on a portfolio with weights @A=.35 and @B=.65 for the following alternative values of correlation between A and B: PAB=0.6 and PAB= -0.4. b) Assume now that PAB=-1.0 and find the portfolio p of stocks A and B that has no risk (i.e. such that Op=0). Can you do the same when PAB=1.0? If not, why? If so, find that portfolio. c) Assume that PAB=0. Find the standard deviations of portfolios with the following expected returns: 8%, 9%, 10%, 11%, 12%, 13%, 14% and 15%. Plot the expected return standard deviation pairs on a graph (with the standard deviations on the horizontal axis, and the expected returns on the vertical axis). (See BKM Chapter 7.2, Equations 7.2 and 7.7 for this question). Stock As expected return and standard deviation are E[ra] = 8% and on= 15%, while stock B's expected return and standard deviation are E[TB] = 12% and oB= 21%. a) Determine the expected return and standard deviation of the return on a portfolio with weights @A=.35 and @B=.65 for the following alternative values of correlation between A and B: PAB=0.6 and PAB= -0.4. b) Assume now that PAB=-1.0 and find the portfolio p of stocks A and B that has no risk (i.e. such that Op=0). Can you do the same when PAB=1.0? If not, why? If so, find that portfolio. c) Assume that PAB=0. Find the standard deviations of portfolios with the following expected returns: 8%, 9%, 10%, 11%, 12%, 13%, 14% and 15%. Plot the expected return standard deviation pairs on a graph (with the standard deviations on the horizontal axis, and the expected returns on the vertical axis)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts