Question: answer all boxes please even the IRR and accept the project part at the bottom Hallmark Corp. is a family-owned manufacturer of Christmas ornaments. Hallmark

answer all boxes please even the IRR and accept the project part at the bottom

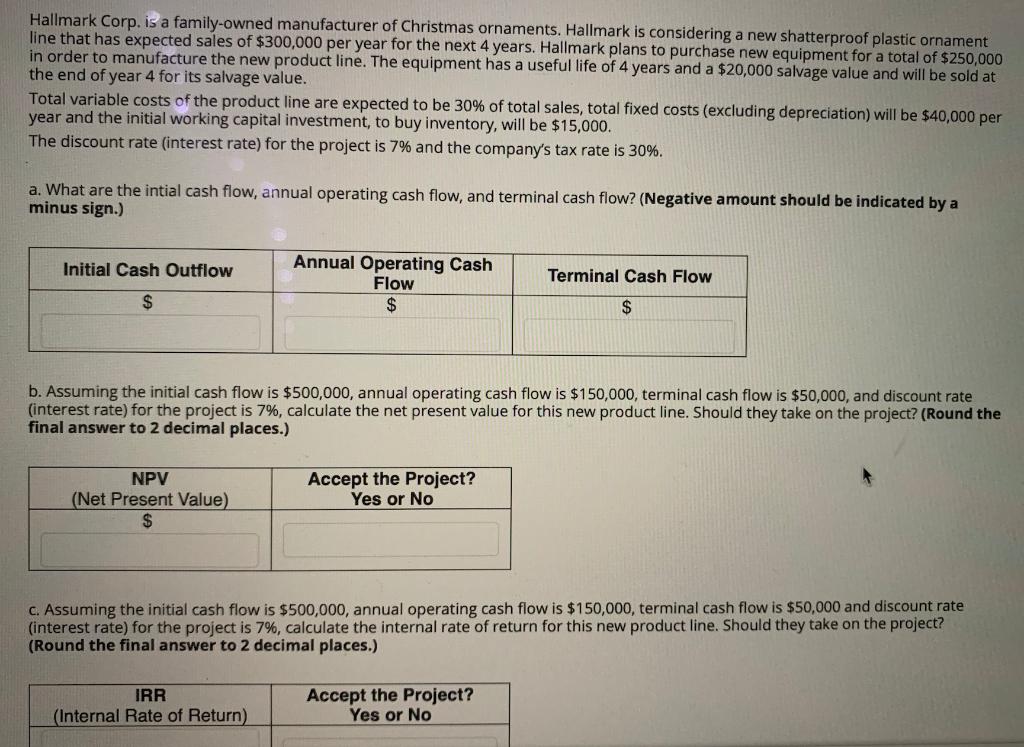

Hallmark Corp. is a family-owned manufacturer of Christmas ornaments. Hallmark is considering a new shatterproof plastic ornament line that has expected sales of $300,000 per year for the next 4 years. Hallmark plans to purchase new equipment for a total of $250,000 in order to manufacture the new product line. The equipment has a useful life of 4 years and a $20,000 salvage value and will be sold at the end of year 4 for its salvage value. Total variable costs of the product line are expected to be 30% of total sales, total fixed costs (excluding depreciation) will be $40,000 per year and the initial working capital investment, to buy inventory, will be $15,000. The discount rate (interest rate) for the project is 7% and the company's tax rate is 30%. a. What are the intial cash flow, annual operating cash flow, and terminal cash flow? (Negative amount should be indicated by a minus sign.) Initial Cash Outflow Annual Operating Cash Flow $ Terminal Cash Flow $ $ b. Assuming the initial cash flow is $500,000, annual operating cash flow is $150,000, terminal cash flow is $50,000, and discount rate (interest rate) for the project is 7%, calculate the net present value for this new product line. Should they take on the project? (Round the final answer to 2 decimal places.) NPV (Net Present Value) $ Accept the Project? Yes or No c. Assuming the initial cash flow is $500,000, annual operating cash flow is $150,000, terminal cash flow is $50,000 and discount rate (interest rate) for the project is 7%, calculate the internal rate of return for this new product line. Should they take on the project? (Round the final answer to 2 decimal places.) IRR (Internal Rate of Return) Accept the Project? Yes or No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts