Question: Answer all correct and fast. only answers are enough but must be correct. #. Which of the following statements is FALSE if the stock market

Answer all correct and fast. only answers are enough but must be correct.

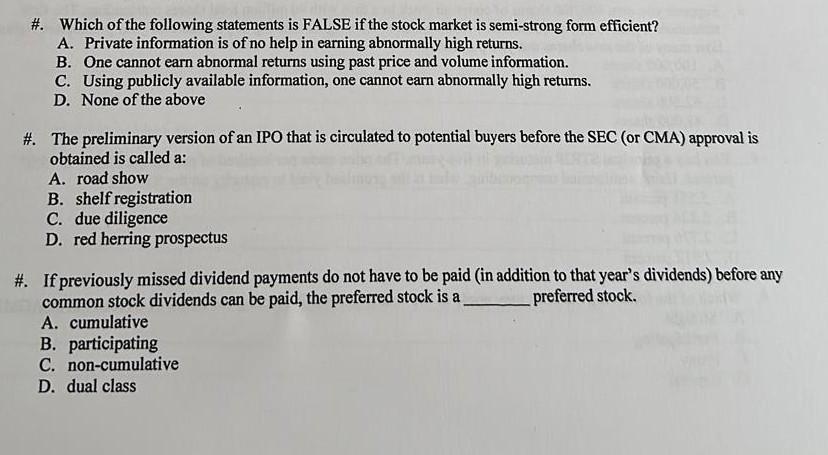

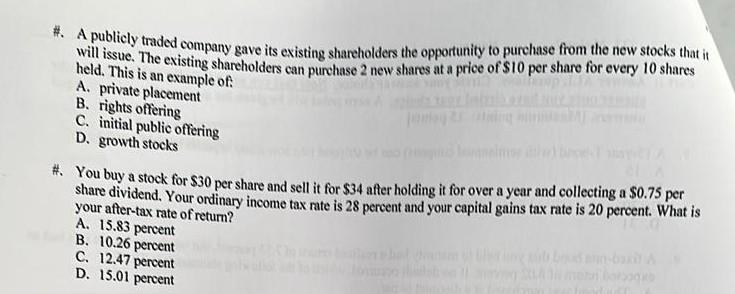

\#. Which of the following statements is FALSE if the stock market is semi-strong form efficient? A. Private information is of no help in earning abnormally high returns. B. One cannot earn abnormal returns using past price and volume information. C. Using publicly available information, one cannot earn abnormally high returns. D. None of the above \#. The preliminary version of an IPO that is circulated to potential buyers before the SEC (or CMA) approval is obtained is called a: A. road show B. shelf registration C. due diligence D. red herring prospectus \#. If previously missed dividend payments do not have to be paid (in addition to that year's dividends) before any common stock dividends can be paid, the preferred stock is a preferred stock. A. cumulative B. participating C. non-cumulative D. dual class \#. A publicly traded company gave its existing shareholders the opportunity to purchase from the new stocks that it will issue. The existing shareholders can purchase 2 new shares at a price of \$10 per share for every 10 shares held. This is an example of: A. private placement B. rights offering C. initial public offering D. growth stocks \#. You buy a stock for $30 per share and sell it for $34 after holding it for over a year and collecting a $0.75 per share dividend. Your ordinary income tax rate is 28 percent and your capital gains tax rate is 20 percent. What is your after-tax rate of return? A. 15.83 percent B. 10.26 percent C. 12.47 percent D. 15.01 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts