Question: ANSWER ALL!!!!! Exercise 2.11. Calculate the prices for the spread consisting of one call and one put using the following settings: 3 level tree (one

ANSWER ALL!!!!!

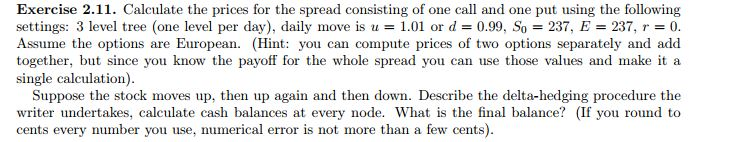

Exercise 2.11. Calculate the prices for the spread consisting of one call and one put using the following settings: 3 level tree (one level per day), daily move is u-1.01 or d-0.99. So-237, E-237, r-0. Assume the options are European. (Hint: you can compute prices of two options separately and add together, but since you know the payoff for the whole spread you can use those values and make ita single calculation) Suppose the stock moves up, then up again and then down. Describe the delta-hedging procedure the writer undertakes, calculate cash balances at every node. What is the final balance? (If you round to cents every number you use, numerical error is not more than a few cents). Exercise 2.11. Calculate the prices for the spread consisting of one call and one put using the following settings: 3 level tree (one level per day), daily move is u-1.01 or d-0.99. So-237, E-237, r-0. Assume the options are European. (Hint: you can compute prices of two options separately and add together, but since you know the payoff for the whole spread you can use those values and make ita single calculation) Suppose the stock moves up, then up again and then down. Describe the delta-hedging procedure the writer undertakes, calculate cash balances at every node. What is the final balance? (If you round to cents every number you use, numerical error is not more than a few cents)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts