Question: answer all five or not at all. or i rate thumbs down! 5:29 Expert Q&A (Preferred stock valuation) What is the value of a preferred

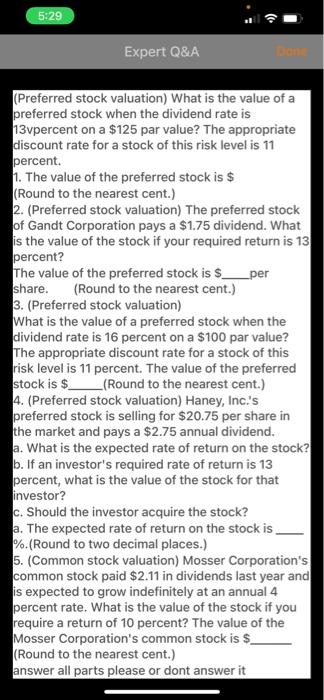

5:29 Expert Q&A (Preferred stock valuation) What is the value of a preferred stock when the dividend rate is 13vpercent on a $125 par value? The appropriate discount rate for a stock of this risk level is 11 percent. 1. The value of the preferred stock is $ (Round to the nearest cent.) 2. (Preferred stock valuation) The preferred stock of Gandt Corporation pays a $1.75 dividend. What is the value of the stock if your required return is 13 percent? The value of the preferred stock is $_per share. (Round to the nearest cent.) 3. (Preferred stock valuation) What is the value of a preferred stock when the dividend rate is 16 percent on a $100 par value? The appropriate discount rate for a stock of this risk level is 11 percent. The value of the preferred stock is $(Round to the nearest cent.) 4. (Preferred stock valuation) Haney, Inc.'s preferred stock is selling for $20.75 per share in the market and pays a $2.75 annual dividend. a. What is the expected rate of return on the stock? b. If an investor's required rate of return is 13 percent, what is the value of the stock for that investor? c. Should the investor acquire the stock? a. The expected rate of return on the stock is %.(Round to two decimal places.) 5. (Common stock valuation) Mosser Corporation's common stock paid $2.11 in dividends last year and is expected to grow indefinitely at an annual 4 percent rate. What is the value of the stock if you require a return of 10 percent? The value of the Mosser Corporation's common stock is $ (Round to the nearest cent.) answer all parts please or dont answer it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts