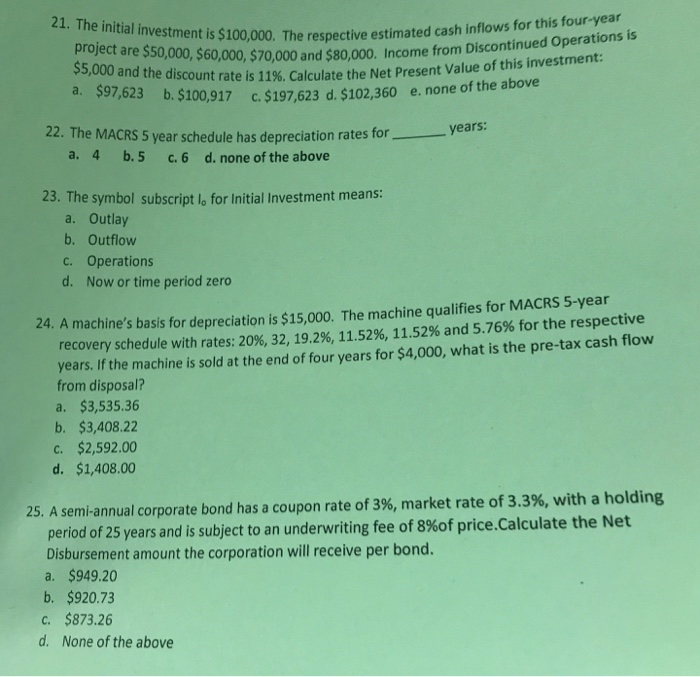

Question: answer all for thumbs up please 21. The initial investment is $100,000. The respective estimated cash inflows for this four-year project are $50,000, $60,000, $70,000

answer all for thumbs up please

answer all for thumbs up please21. The initial investment is $100,000. The respective estimated cash inflows for this four-year project are $50,000, $60,000, $70,000 and $5,000 and $80,000 Income from Discontinued Operations is the discount rate is 11%. Calculate the Net Present Value of this investment: 3 b, $100,917 c.$197,623 d. $102,360 e, none of the above 22. The MACRS 5 year schedule has depreciation rates foryears a. 4 b.5 c.6 d. none of the above 23. The symbol subscript lo for Initial Investment means: a. Outlay b. Outflow c. Operations d. Now or time period zero recovery schedule with rates: 20%, 32, 19.2%, 11.52%, 11.52% and 5.76% for the respective years. If the machine is sold at the end of four years for $4,000, what is the pre-tax cash flow from disposal? a. $3,535.36 b. $3,408.22 c. $2,592.00 d. $1,408.00 24. A machine's basis for depreciation is $%15,000. The machine qualifies for MACRS 5-year 5. A semi-annual corporate bond has a coupon rate of 3%, market rate of 3.3%, with a holding period of 25 years and is subject to an underwriting fee of 8%of price.Calculate the Net Disbursement amount the corporation will receive per bond. a. $949.20 b. $920.73 . $873.26 d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts