Question: answer all four parts please Question 5 1point Use the following information to answer the next four questions: The SEP index has a spot price

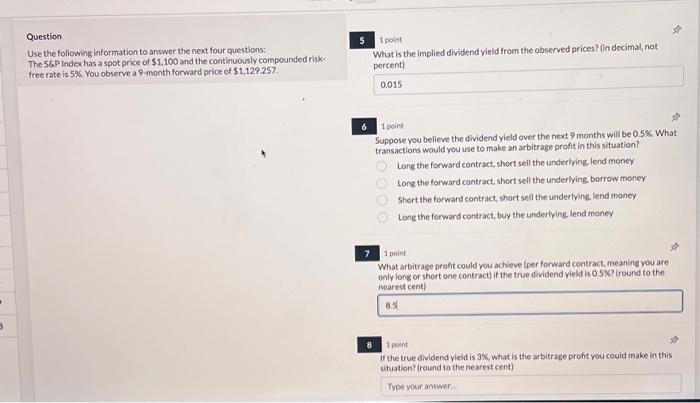

Question 5 1point Use the following information to answer the next four questions: The SEP index has a spot price of $1,100 and the continuously compounded risk: free rate is 5%. You observe a 9-month forward price of $1,129.257. What is the implied dividend yield from the observed prices? lin decimal, not nerrentl 6 1 point Suppose you believe the dividend yield over the next 9 months will be 0.5%. What transactions would you use to make an arbitrage profit in this situation? Long the forward contract, short sell the underlying, lend money Long the forward contract, short sell the underlying borrow money Stort the forward contract, short sell the underlying, lend money Long the forward contract, buy the underfying, lend money 7 1 point What arbitrage profit could you achieve (per forward contract, meaning you are only long or short one contract) if the true dividend vield is 0.5\%? (round to the nearest cent) 8 1 point If the true dividend yield is 3%, what is the arbitrage profit you could make in this ituation? (round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts