Question: Answer all in detail please Some quick rate and return questions from Chapter 10 : 1) You bought 100 shares of stock at $20 each.

Answer all in detail please

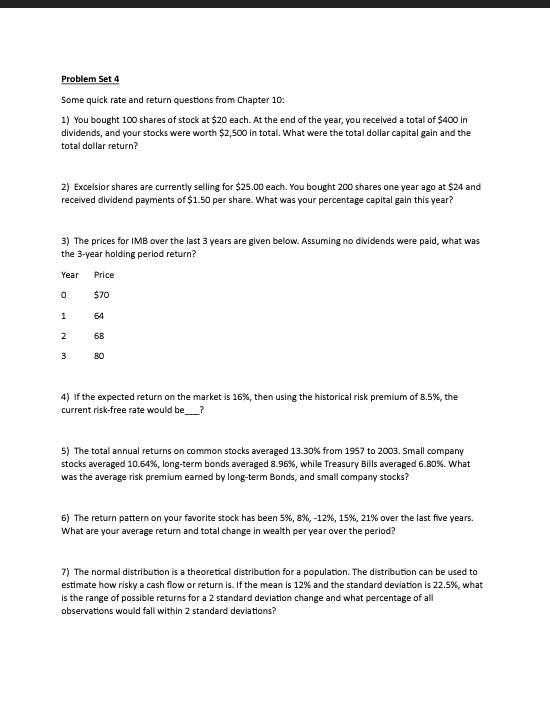

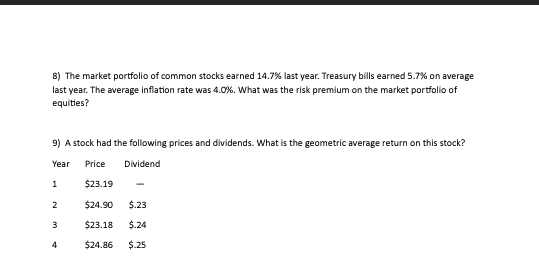

Some quick rate and return questions from Chapter 10 : 1) You bought 100 shares of stock at $20 each. At the end of the year, you recelved a total of $400 in dividends, and your stocks were worth $2,500 in total. What were the total dollar capital gain and the total dollar return? 2) Excelsior shares are currently selling for $25.00 each. You bought 200 shares one year ago at $24 and recelved dividend payments of $1.50 per share. What was your percentage capital gain this year? 3) The prices for IMB over the last 3 years are given below. Assuming no dividends were paid, what was the 3-year holding period return? 4) If the expected return on the market is 16%, then using the historical risk premium of 8.5%, the current risk-free rate would be 5) The total annual returns on common stocks averaged 13.30% from 1957 to 2003 . Small company stocks averaged 10.64%, long-term bonds averaged 8.96%, while Treasury Bills averaged 6.80%. What was the average risk premium eamed by long-term Bonds, and small company stocks? 6) The return pattern on your favorite stock has been 5%,8%,12%,15%,21% over the last five years. What are your average return and total change in wealth per year over the period? 7) The normal distribution is a theoretical distribution for a population. The distribution can be used to estimate how risky a cash flow or return is. If the mean is 12% and the standard deviation is 22.5%, what is the range of possible returns for a 2 standard deviation change and what percentage of all observations would fall within 2 standard deviations? 8) The market portfolio of common stocks earned 14.7% last year. Treasury bills earned 5.7\% on average last year. The average inflation rate was 4.0%. What was the risk premium on the market portfolio of equities? 9) A stock had the following prices and dividends. What is the geometric average return on this stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts