Question: Answer all MC2's on the MC04nswer Sheerprovided. Each question has only ONE correct answer. Correct answers score Twomarks. There is NO megative marking. 1. You

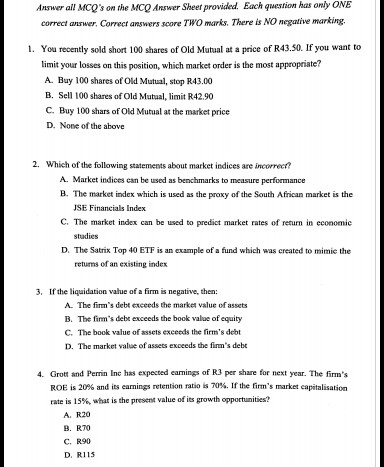

Answer all MC2's on the MC04nswer Sheerprovided. Each question has only ONE correct answer. Correct answers score Twomarks. There is NO megative marking. 1. You recently sold short 100 shares of old Mutual at a price of R43.50. If you want to limit your losses on this position, which market order is the most appropriate? A. Buy 100 shares of Old Mutual, stop R43.00 B. Sell 100 shares of Old Mutual, limit R42.90 C. Buy 100 shans of old Mutual at the market price D. None of the above 2. Which of the following statements about market indices are incorrect? A. Market indices can be used as benchmarks to measure performance B. The market index which is used as the proxy of the South African market is the JSE Financials Index C. The market index can be used to predict market rates of return in economi studies D. The Satrix Top 40 ETF is an example of a fund which was created to mimic the retums of an existing index 3, If the liquidation value of a firm is net gative, then A. The firm's debt exceeds the market value of assets B. The firm's debt exceeds the book value of equity C. The book value of assets exeeeds the firm's debt D. The market value of assets exceeds the finm's debt 4. Grott and Perrin Inc has expected eamings of R3 per share for next year. The firm's ROE is 20% and its eamings retention ratio is 701%. If the firm's market capitalisation rate is 15%, what is the present value of its growth opportunities? A. R20 B. R70 C. R90 D, R115

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts