Question: Answer all MCQ Questions and no need to explain the answer 12. Bankof America is trading at 27/share, USBancorp at 52/share. Which of the following

Answer all MCQ Questions and no need to explain the answer

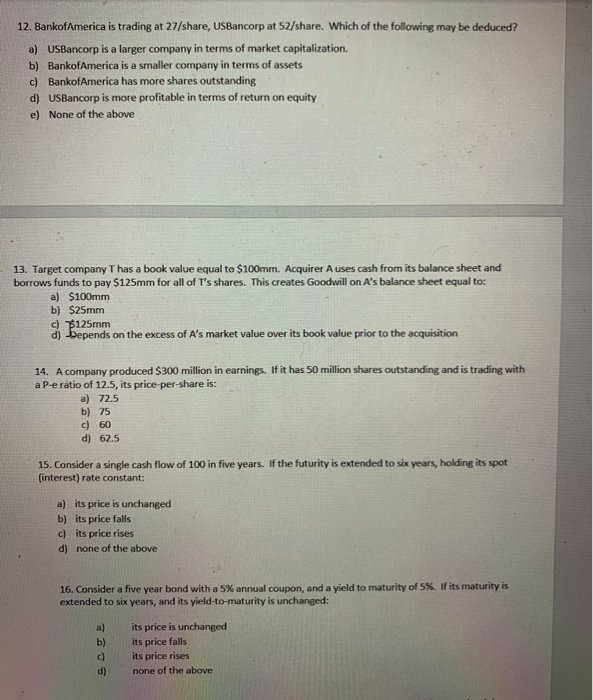

Answer all MCQ Questions and no need to explain the answer 12. Bankof America is trading at 27/share, USBancorp at 52/share. Which of the following may be deduced? a) USBancorp is a larger company in terms of market capitalization b) BankofAmerica is a smaller company in terms of assets c) BankofAmerica has more shares outstanding d) USBancorp is more profitable in terms of return on equity e) None of the above 13. Target company T has a book value equal to $100mm. Acquirer A uses cash from its balance sheet and borrows funds to pay $125mm for all of T's shares. This creates Goodwill on A's balance sheet equal to: a) $100mm b) $25mm c) $125mm d) -Depends on the excess of A's market value over its book value prior to the acquisition 14. A company produced $300 million in earnings. If it has 50 million shares outstanding and is trading with a P-e ratio of 12.5, its price-per-share is: a) 72.5 b) 75 c) 60 d) 62.5 15. Consider a single cash flow of 100 in five years. If the futurity is extended to six years, holding its spot (interest) rate constant: a) its price is unchanged b) its price falls c) its price rises d) none of the above 16. Consider a five year bond with a 5% annual coupon, and a yield to maturity of 5%. If its maturity is extended to six years, and its yield-to-maturity is unchanged: a) b) its price is unchanged its price falls its price rises none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts