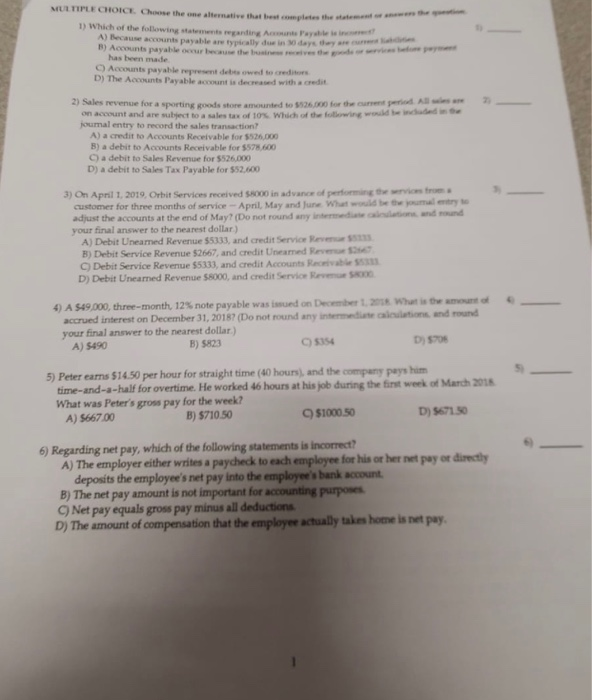

Question: answer all MULTIPLE CHOICE. Choose the wealt h 1) Which of the following statement Pay s A) Because accounts payable arutally du d a 5)

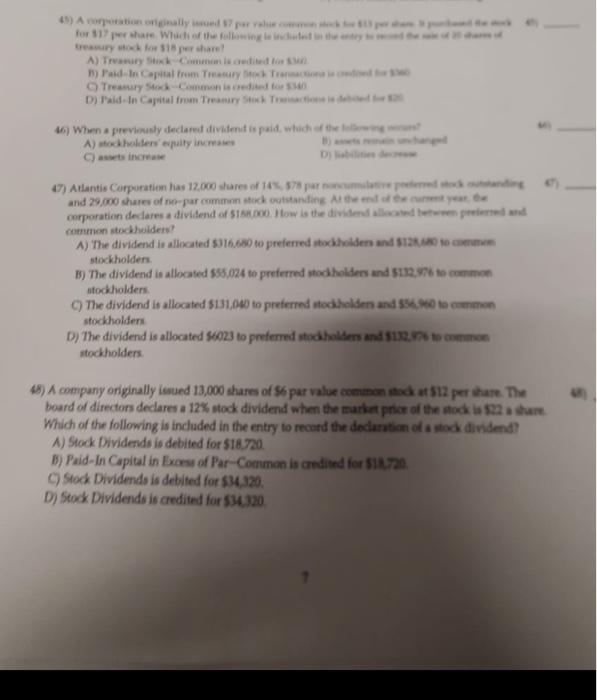

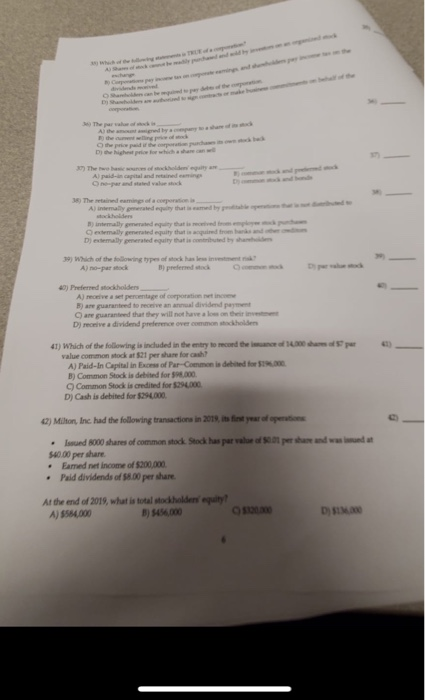

MULTIPLE CHOICE. Choose the wealt h 1) Which of the following statement Pay s A) Because accounts payable arutally du d a 5) Accounts payable our has been made Accounts payable represent owed to create D) The Accounts Payable a nd is decreased with a credit the current woul A d 21 Sales revenue for a sporting Goods store mund on account and are subject to a sales to which Jumal entry to record the sales transaction? A) a credit to Accounts Receivable for $525.000 B) a debit to Accounts Receivable for $57600 C) a debit to Sales Revenue for 5526.000 D) a debit to Sales Tax Payable for $52.600 r ms omary to mund n 3) On April 1, 2019. Orbit Services received 8000 in advance of performing te customer for three months of service - April, May and June What would be t adjust the accounts at the end of May (Do not round any india your final answer to the nearest dollar) A) Debit Uneamed Revenue 55333, and credit Service Reven 13 B) Debit Service Revenue $2667, and credit Uneamed Reven C) Debit Service Revenue $5333, and credit Accounts Receive D) Debit Uneamed Revenue $8000, and credit Service Reve What is the amount of tions and round 4) A $49.000, three-month, 12% note payable was issued on December 1. accrued interest on December 31, 20187 (Do not found any ac your final answer to the nearest dollar) A) $490 B) $823 5154 D) $708 5) Peter earns $14.50 per hour for straight time (40 hours), and the company pays him time-and-a-half for overtime. He worked 46 hours at his job during the first week of March 2013 What was Peter's gross pay for the week? A) 5667.00 B) $710.50 $1000.50 D)5671.50 6) Regarding net pay, which of the following statements is incorrect? A) The employer either writes a paycheck to each employee for his or her net pay or directly deposits the employee's net pay into the employees bank account B) The net pay amount is not important for accounting purposes Net pay equals gross pay minus all deductions D) The amount of compensation that the employee actually takes home is net pay. for $17 per share. Which of the following is included in the treasury w for 18 per share A) Treasury Stock Common is credited for m) Paid-in Capital from Treasury Stock Transactions Treasury Stock Common is credited for D) Paldin Capital from Treasury Stock Transactions 46) When a previously declared dividend is paid, which of the A) stockholders equity increases assets increase 47) Atlantis Corporation has 12,000 shares of 14% 578 proc e ed i ng and 29,000 shares of no-par common stock outstanding At the end of the current year the corporation declares a dividend of S18000How is the dividend allocated between p eredand common stockholders? A) The dividend is allocated 516,680 to preferred stockholders and 12 to comme stockholders B) The dividend is allocated $55,024 to preferred stockholders and $132.976 to common stockholders C) The dividend is allocated $131,040 to preferred stockholders and 556.96 to commen stockholders D) The dividend is allocated $6023 to preferred stod holders and 5112. to com stockholders 48) A company originally issued 13,000 shares of S6 par value common mod at 512 per share. The board of directors declares a 12% stock dividend when the market price of the stock is 22 Which of the following is included in the entry to record the declaration of a stod dividend A) Stock Dividends is debited for $18,720. B) Pald-In Capital in Excess of Par-Common is credited for 1 23 C) Stock Dividends is debited for $34,320 D) Stock Dividends is credited for $34.320 Dichte which was 3) The tw o of schedulity A) paidan capital and read ing 3) The mains of a corporation mally generated equity that is Decemally requiry that is from the o 19) Wich of the owing t A)no-parteck work has been pretende 40) Preferred stockholders A) receive a set percentage of corporatio n B) are guaranteed to receive an annual dividend payment are guarantee that they will not have a lo v e Dy receive a dividend preference ove common holder 41) Which of the following is included in the entry to record the value common stock at 21 perse for cash A) Paid-In Capital in Excess of Per-Common is debido B) Common Stock is debited for 8000 Common Stock is credited for $29400 D) Cash is debited for 240.000 2) Milion, Inc. had the following transactions in 2019, its first year of open Issued 8000 shares of common stock Stock has per value of a person and was bad at 500.00 per share Eamed net income of $200,000 Paid dividends of $8.00 per share At the end of 2019, what is total odholdene equity! A) 584.000 B) $450,000 D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts