Question: answer all of them asap please Determine the missing amount for each letter Case Direct materials used 59.700 $ 4010 Direct labor 5.100 8.170 Manufacturing

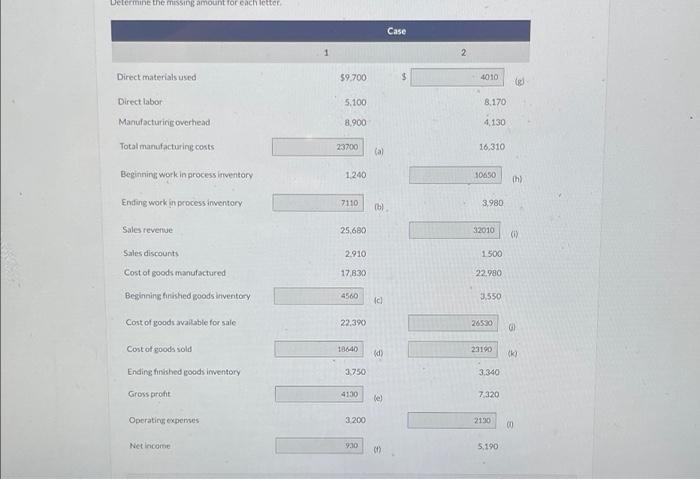

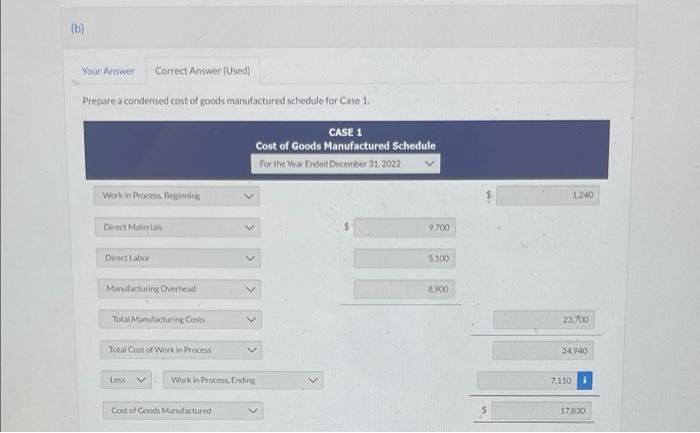

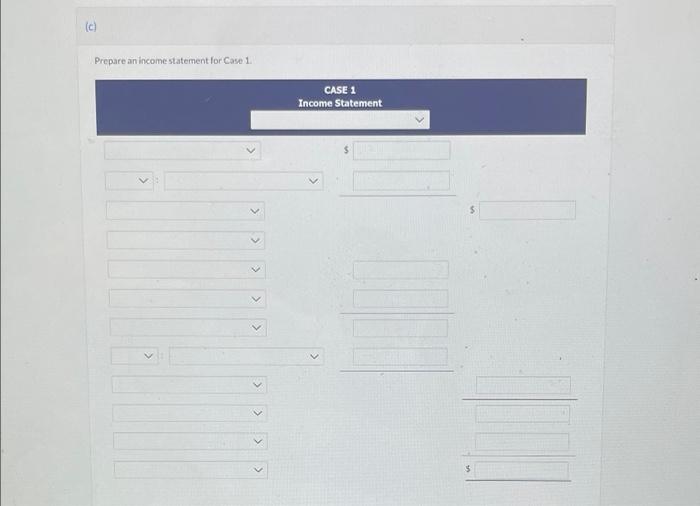

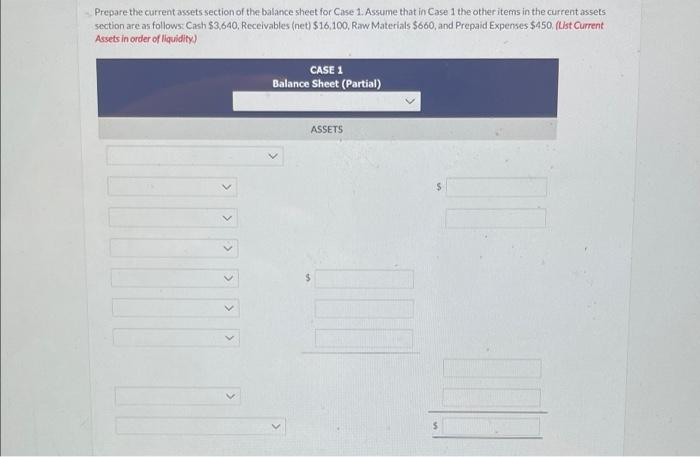

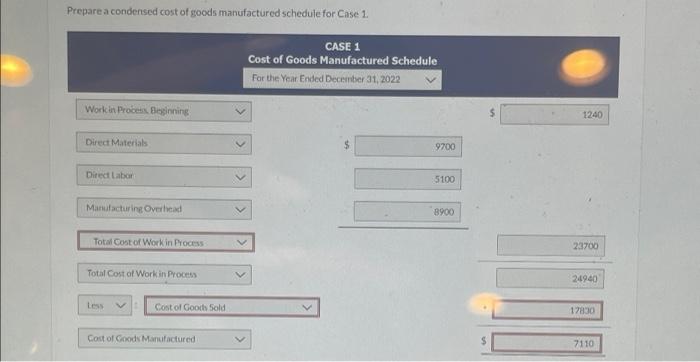

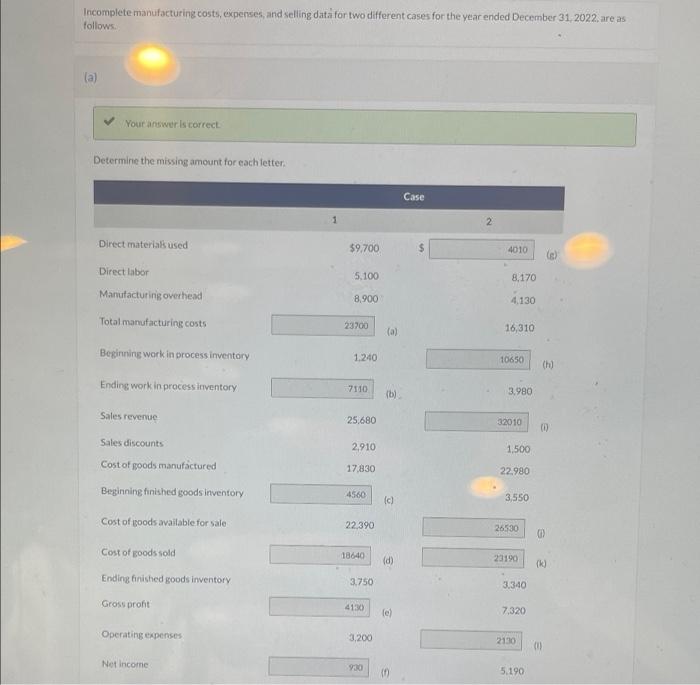

Determine the missing amount for each letter Case Direct materials used 59.700 $ 4010 Direct labor 5.100 8.170 Manufacturing overhead 8.900 4130 Total manufacturing costs 23700 16,310 (a) Beginning work in process inventory 1 240 10650 th) Ending work in process inventory 7110 06) 3.980 Sales revenue 25.680 32010 Sales discounts 2.910 1500 Cost of goods manufactured 17.830 22.080 4560 Ich Beginning finished poods inventory Cost of goods walkable for sale TITI 3.550 22.390 26530 G Cost of goods sold 13640 id) 23190 Ending finished goods inventory 3.750 3340 Gross proht 4130 le) 7320 Operating expenses 3200 2130 Net Income 930 01) 5.190 (b) Your Answer Correct Answer (Used) Prepare a condensed cost of goods manufactured schedule for Case 1 CASE 1 Cost of Goods Manufactured Schedule For the Year Ended December 31, 2022 Work in Proces. Beinnig 1200 Direct Materials 9.700 Direct Labor 5.100 Manufacturing Overhead 8.900 Total Manufacturing Costs 23.700 Total Cost of Work in Process 24 940 V Work in Process Ending 7.110 Cost of Goods Manufactured 17830 (c) Prepare an income statement for Cose 1 CASE 1 Income Statement $ >> > > > > Prepare a condensed cost of goods manufactured schedule for Case 1 CASE 1 Cost of Goods Manufactured Schedule For the Year Ended December 31, 2022 Work in ProceBeginning 1240 Direct Materials 9700 Direct Labor 5100 Manufacturing Overhead 8900 Total Cost of Work in Process 23700 Total Cost of Work in Process 24940 Cost of Goods Sold 17830 Cost of Good Manufactured 7110 Incomplete manufacturing costs, expenses and selling data for two different cases for the year ended December 31, 2022, are as follows (a) Your answer is correct Determine the missing amount for each letter Case 2 Direct materials used $9.700 $ 4010 Direct labor 5.100 8,170 8.900 4,130 Manufacturing overhead Total manufacturing costs 23700 (a) 16,310 Beginning work in process inventory 1.240 10650 (h) Ending work in process inventory 7110 ib) 3.980 Sales revenue 25.680 32010 Sales discounts 2.910 1.500 Cost of goods manufactured 17.830 22.980 Beginning finished goods inventory 4560 c) 3,550 Cost of oods available for sale 22,390 26530 0 Cost of goods sold 18640 (d) ) 23190 (k Ending hinished goods inventory 3.750 3.340 Gross pront 4130 le 7,320 Operating expenses 3,200 2130 (0) Not income 930 5.190

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts