Question: answer all or none :) You are 30 and you want to retire when you are 70 with an income of $100,000 per year for

answer all or none :)

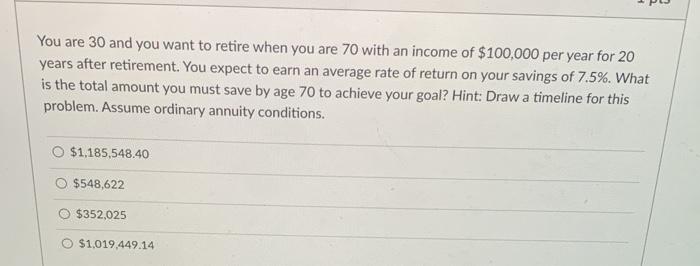

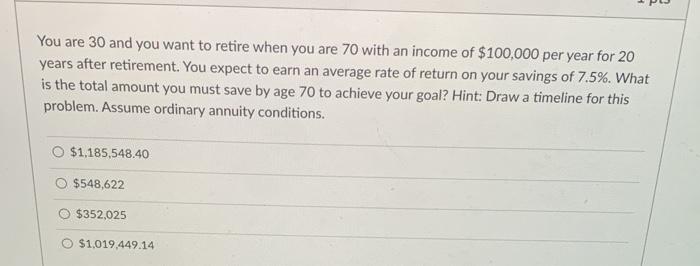

You are 30 and you want to retire when you are 70 with an income of $100,000 per year for 20 years after retirement. You expect to earn an average rate of return on your savings of 7.5%. What is the total amount you must save by age 70 to achieve your goal? Hint: Draw a timeline for this problem. Assume ordinary annuity conditions. O $1,185,548.40 $548,622 $352,025 O $1,019,449.14 Question 4 1 pts Calculate the portion of the first monthly payment that will pay down the principal of the loan on your condo given the following data: Length of mortgage: 30 years APR: 6.5% Loan amount: $57,500 $51.98 $311.46 $51.70 $363.44

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock