Question: ANSWER ALL OR THUMBS DOWN Question 10 0 / 1 pts A Big Mac costs about $5.04 in the US and about $2.79 in China

ANSWER ALL OR THUMBS DOWN

ANSWER ALL OR THUMBS DOWN

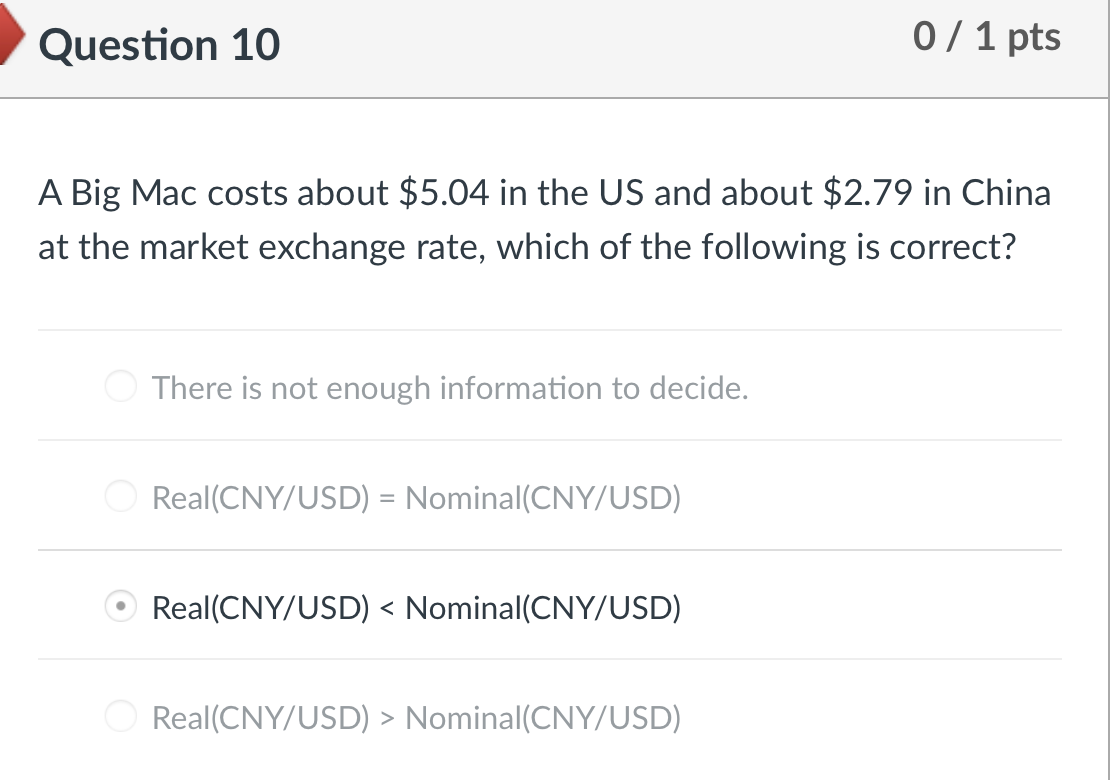

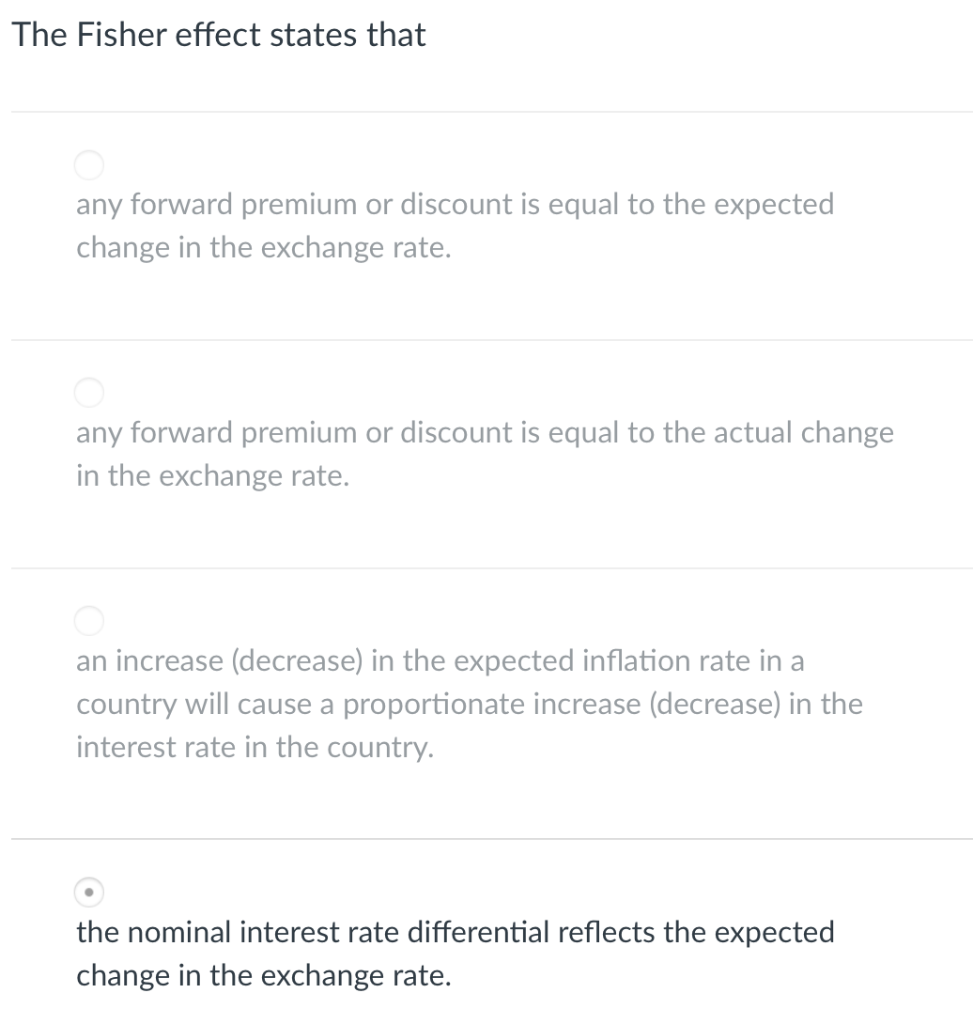

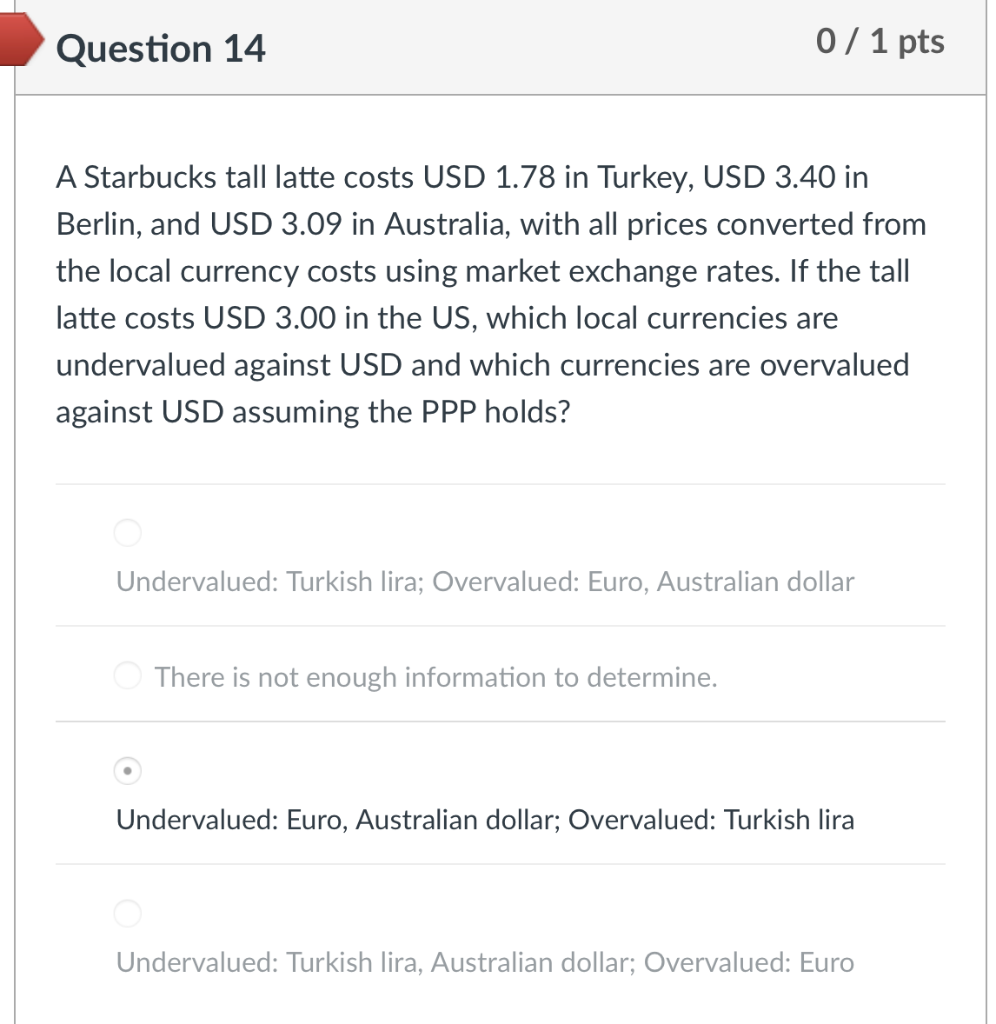

Question 10 0 / 1 pts A Big Mac costs about $5.04 in the US and about $2.79 in China at the market exchange rate, which of the following is correct? There is not enough information to decide. Real(CNY/USD) = Nominal(CNY/USD) Real(CNY/USD) Nominal(CNY/USD) The Fisher effect states that any forward premium or discount is equal to the expected change in the exchange rate. any forward premium or discount is equal to the actual change in the exchange rate. an increase (decrease) in the expected inflation rate in a country will cause a proportionate increase (decrease) in the interest rate in the country. the nominal interest rate differential reflects the expected change in the exchange rate. Question 14 0 / 1 pts A Starbucks tall latte costs USD 1.78 in Turkey, USD 3.40 in Berlin, and USD 3.09 in Australia, with all prices converted from the local currency costs using market exchange rates. If the tall latte costs USD 3.00 in the US, which local currencies are undervalued against USD and which currencies are overvalued against USD assuming the PPP holds? Undervalued: Turkish lira; Overvalued: Euro, Australian dollar There is not enough information to determine. Undervalued: Euro, Australian dollar; Overvalued: Turkish lira Undervalued: Turkish lira, Australian dollar; Overvalued: Euro Question 10 0 / 1 pts A Big Mac costs about $5.04 in the US and about $2.79 in China at the market exchange rate, which of the following is correct? There is not enough information to decide. Real(CNY/USD) = Nominal(CNY/USD) Real(CNY/USD) Nominal(CNY/USD) The Fisher effect states that any forward premium or discount is equal to the expected change in the exchange rate. any forward premium or discount is equal to the actual change in the exchange rate. an increase (decrease) in the expected inflation rate in a country will cause a proportionate increase (decrease) in the interest rate in the country. the nominal interest rate differential reflects the expected change in the exchange rate. Question 14 0 / 1 pts A Starbucks tall latte costs USD 1.78 in Turkey, USD 3.40 in Berlin, and USD 3.09 in Australia, with all prices converted from the local currency costs using market exchange rates. If the tall latte costs USD 3.00 in the US, which local currencies are undervalued against USD and which currencies are overvalued against USD assuming the PPP holds? Undervalued: Turkish lira; Overvalued: Euro, Australian dollar There is not enough information to determine. Undervalued: Euro, Australian dollar; Overvalued: Turkish lira Undervalued: Turkish lira, Australian dollar; Overvalued: Euro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts