Question: Answer all parts complete and with full steps with all inputs and outputs mentioned. Do it with hands (No excel allowed). Handwritten only otherwise dont

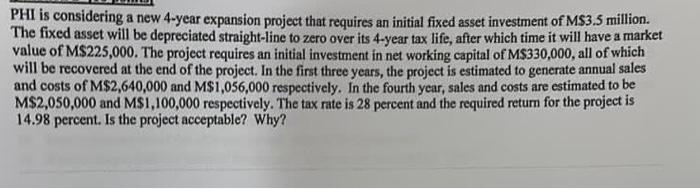

PHI is considering a new 4-year expansion project that requires an initial fixed asset investment of M\$3.5 million. The fixed asset will be depreciated straight-line to zero over its 4-year tax life, after which time it will have a market value of M $225,000. The project requires an initial investment in net working capital of M\$330,000, all of which will be recovered at the end of the project. In the first three years, the project is estimated to generate annual sales and costs of M$2,640,000 and M$1,056,000 respectively. In the fourth year, sales and costs are estimated to be M\$2,050,000 and MS1,100,000 respectively. The tax rate is 28 percent and the required return for the project is 14.98 percent. Is the project acceptable? Why? PHI is considering a new 4-year expansion project that requires an initial fixed asset investment of M\$3.5 million. The fixed asset will be depreciated straight-line to zero over its 4-year tax life, after which time it will have a market value of M $225,000. The project requires an initial investment in net working capital of M\$330,000, all of which will be recovered at the end of the project. In the first three years, the project is estimated to generate annual sales and costs of M$2,640,000 and M$1,056,000 respectively. In the fourth year, sales and costs are estimated to be M\$2,050,000 and MS1,100,000 respectively. The tax rate is 28 percent and the required return for the project is 14.98 percent. Is the project acceptable? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts