Question: answer all parts please. all the information is there Problem A-1 (Algo) Derivatives; interest rate swap [LOA-2] On January 1, 2021, Labtech Circuits borrowed $130,000

![(Algo) Derivatives; interest rate swap [LOA-2] On January 1, 2021, Labtech Circuits](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f712fdd40bc_28566f712fd76bb0.jpg)

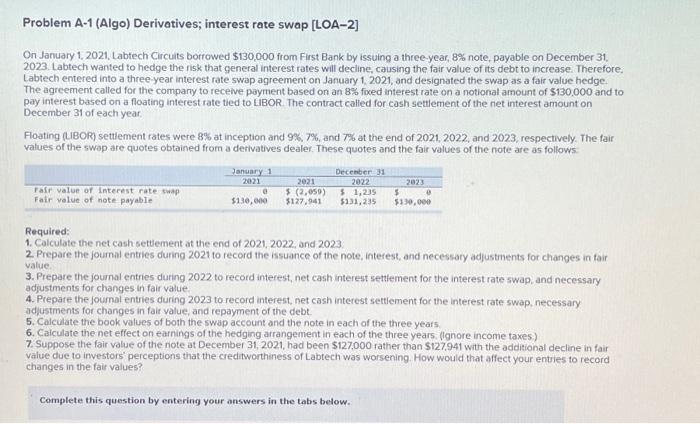

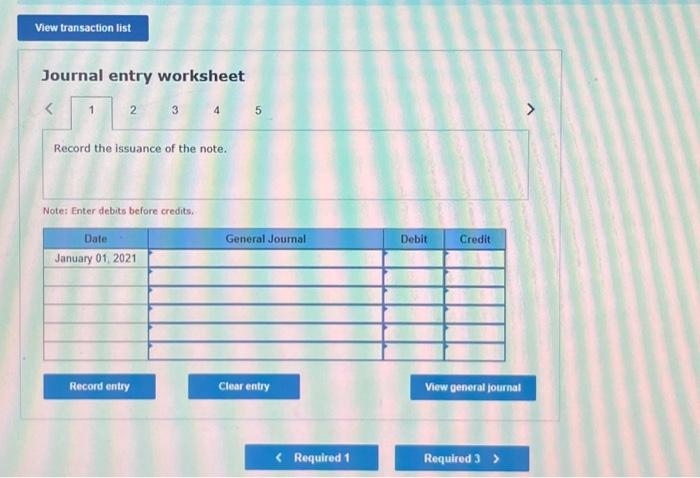

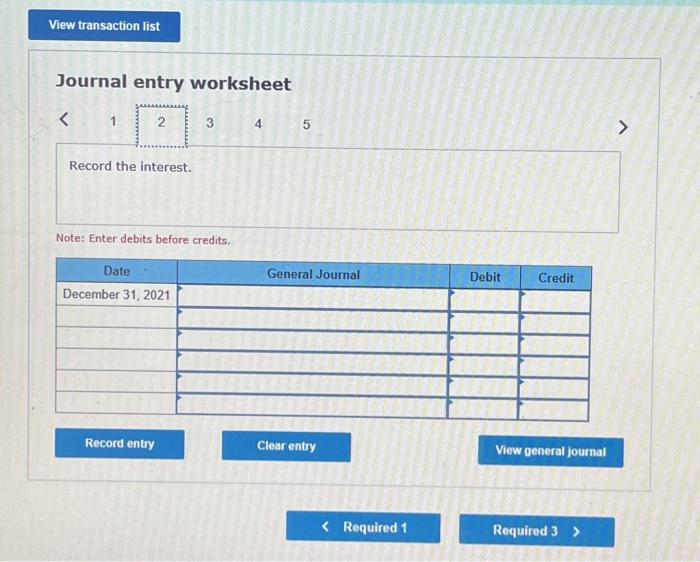

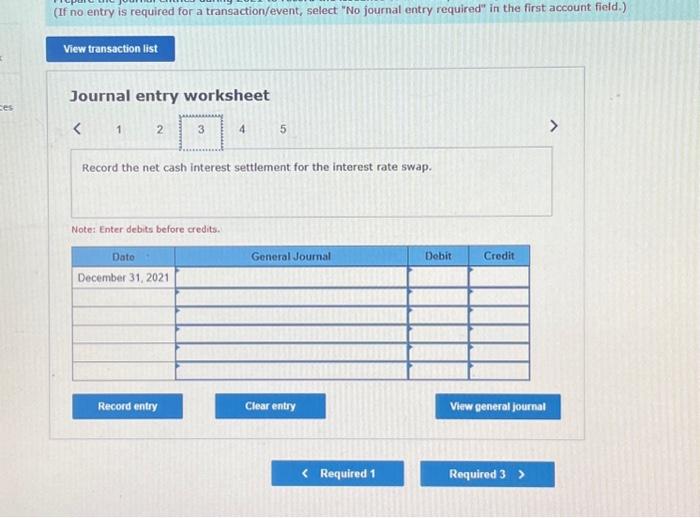

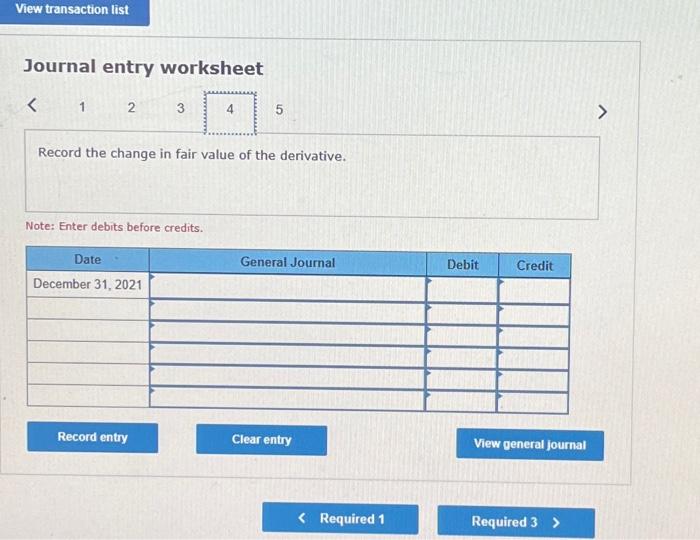

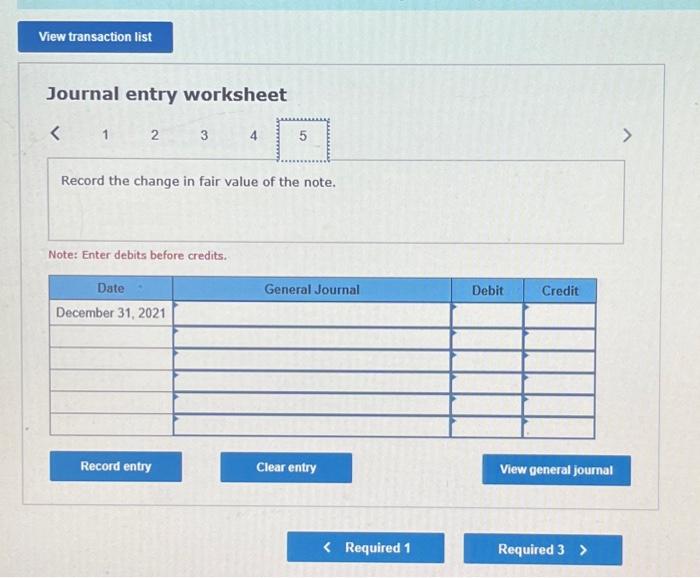

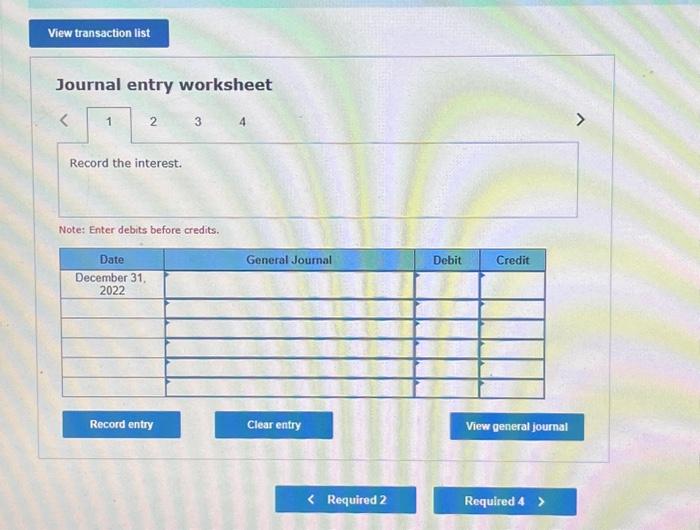

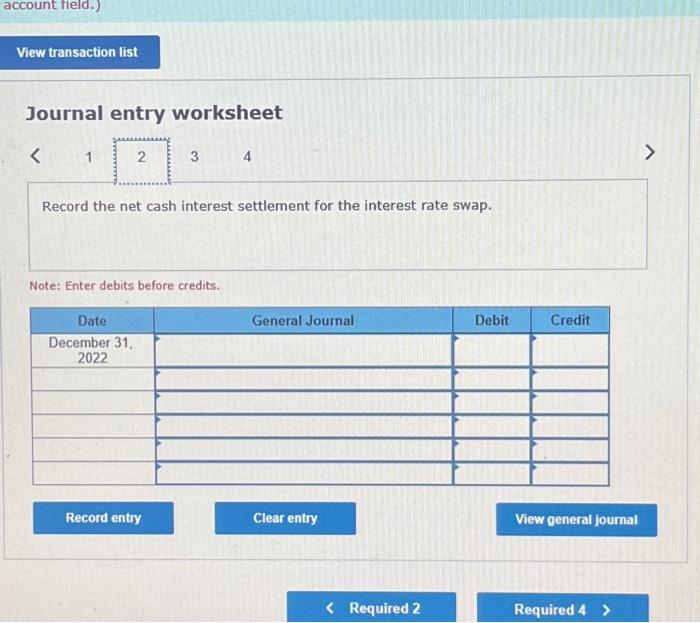

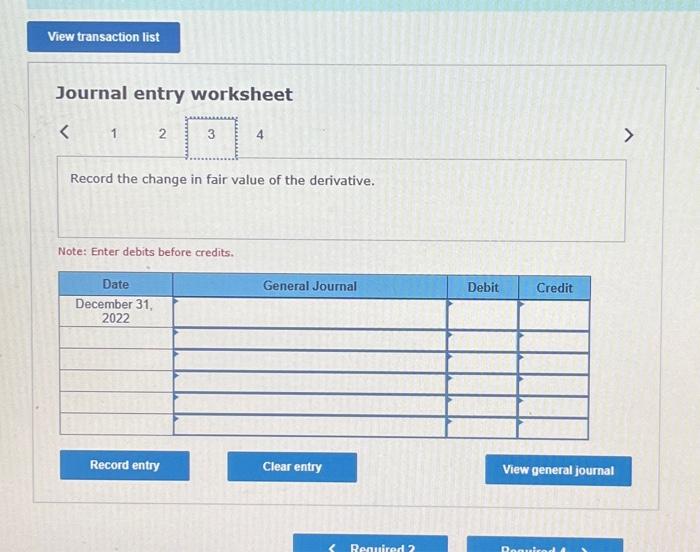

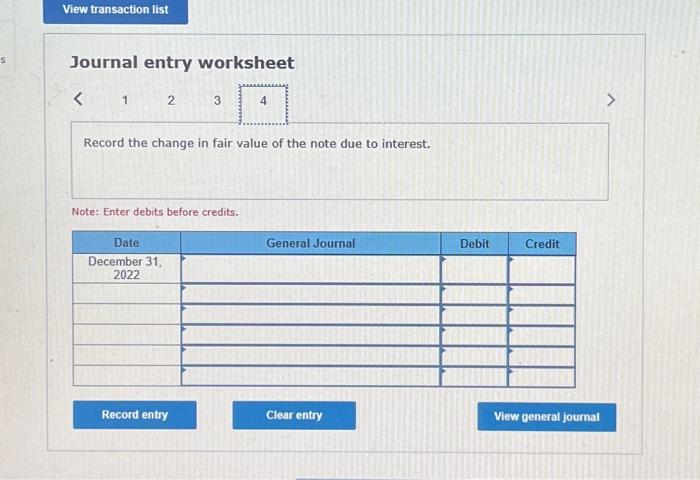

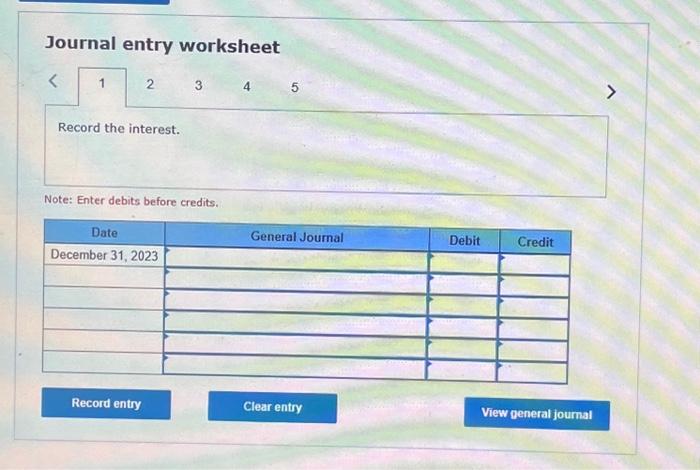

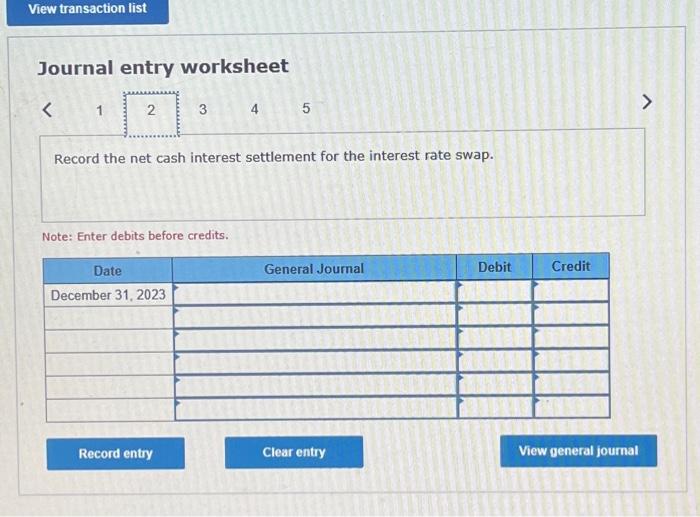

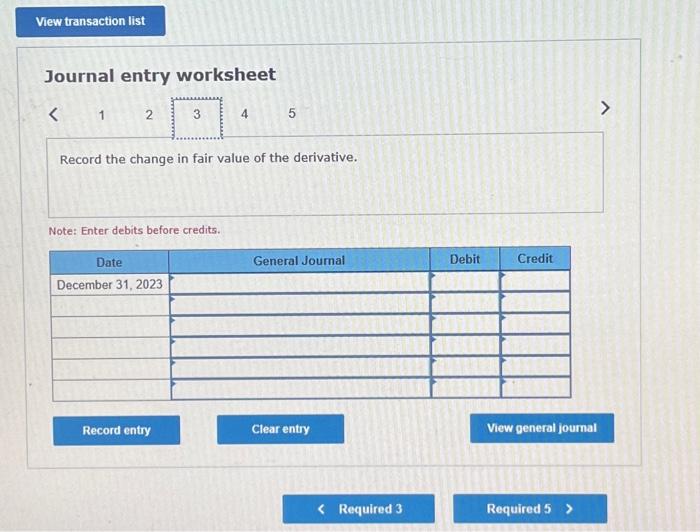

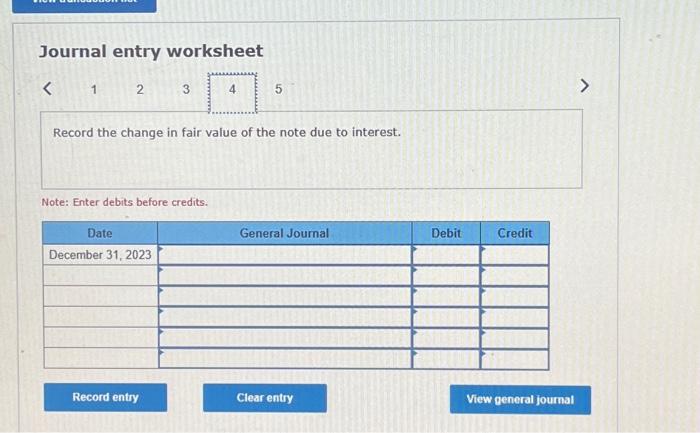

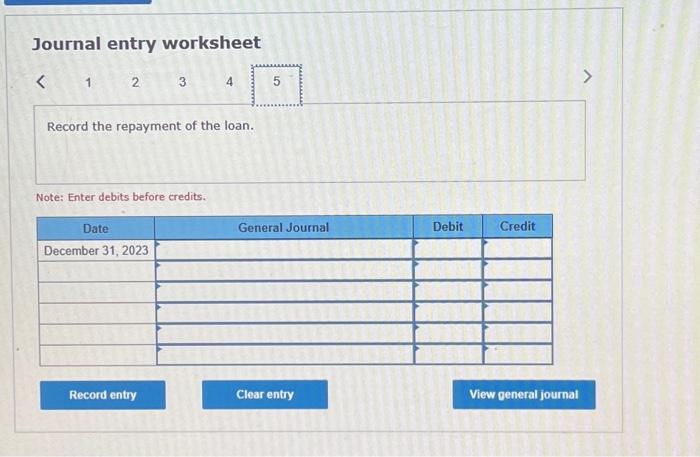

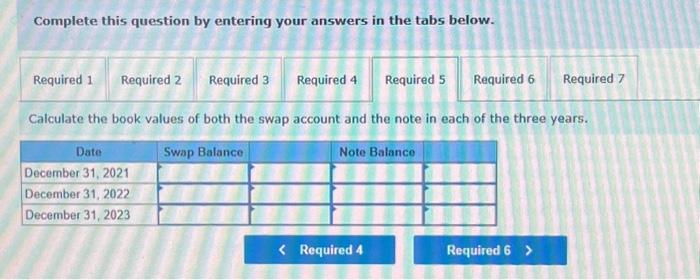

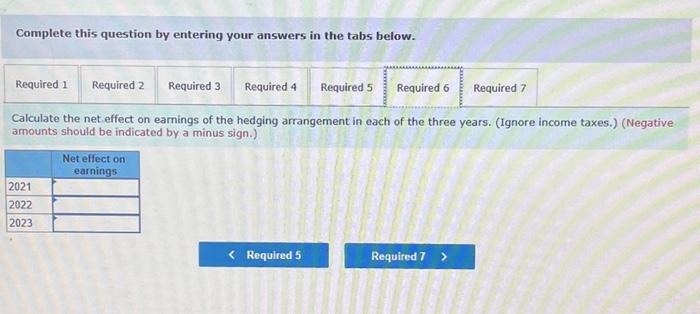

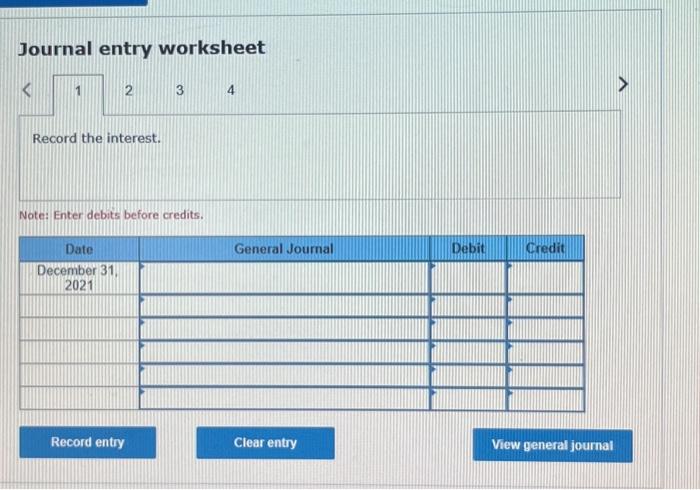

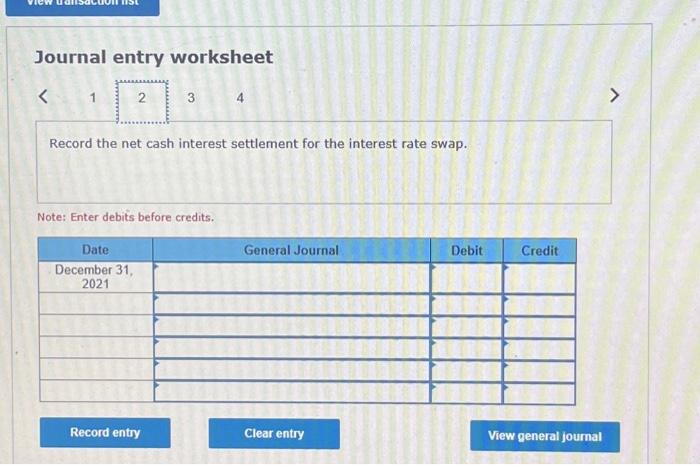

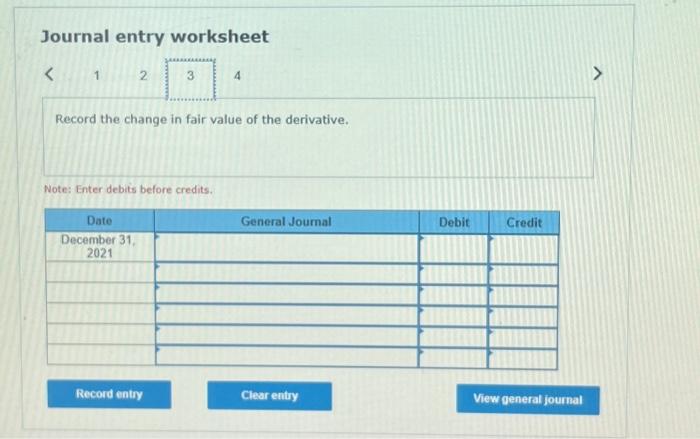

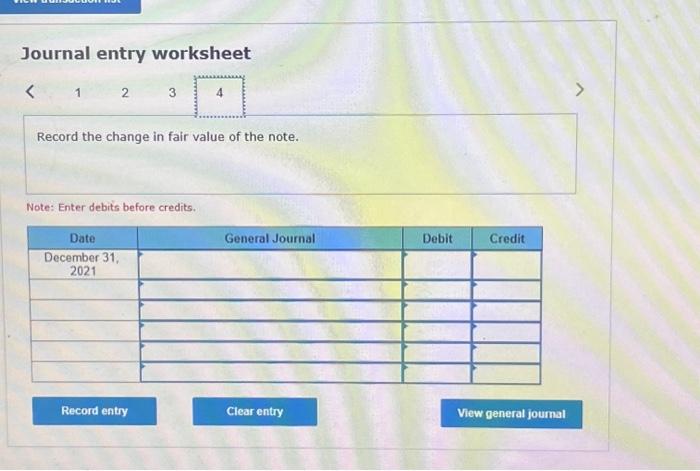

Problem A-1 (Algo) Derivatives; interest rate swap [LOA-2] On January 1, 2021, Labtech Circuits borrowed $130,000 from First Bank by issuing a three year, 8% note, payable on December 31 . 2023. Labtech wanted to hedge the fisk that general interest rates will decline, causing the fair value of its debt to increase. Therefore. Labtech entered into a three-year interest rate swap agreement on January 1,2021 , and designated the swap as a fair value hedge. The agreement called for the company to receive payment based on an 8% fixed interest rate on a notionat amount of $130,000 and to pay interest based on a floating interest rate tied to LBBOR. The contract called for cash settlement of the net interest amount on December 31 of each year Floating (LBOR) settlement rates were 8% at inception and 9%,7%, and 7% at the end of 2021,2022 , and 2023, respectively. The fair values of the swop are quotes obtained from a derivatives dealer. These quotes and the fair values of the note are as follows: Required: 1. Calculate the net cash settement at the end of 2021,2022 , and 2023 . 2. Prepare the joumal entries during 2021 to record the issuance of the note, interest, and necessary adjustments for changes in fair value. 3. Prepare the joumal entries during 2022 to record interest, net cash interest settlement for the interest rate swap, and necessary adjustments for changes in fair value 4. Prepate the joumal entries during 2023 to record interest, net cash interest settiement for the interest rate swap, necessary adjustments for changes in fair value, and repayment of the debt. 5. Calculate the book values of both the swap account and the note in each of the three years. 6. Caiculate the net effect on earnings of the hedging arrangement in each of the three years. (llgnore income taxes) 7. Suppose the fair value of the note at December 31,2021 , had been $127,000 rather than $127,941 with the additional decline in fair value due to investors perceptions that the crediworthiness of Labtech was warsening. How would that affect your entries to record changes in the fair values? Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Calculate the net cash settlement at the end of 2021, 2022, and 2023. (Negative amounts should be indicated by a minus sign.) Journal entry worksheet Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts