Question: answer all parts please and excel i cannot figure it out Excel Activity: Financial Statements, Cash Flow, and Taxes Laiho Industries's 2020 and 2021 balance

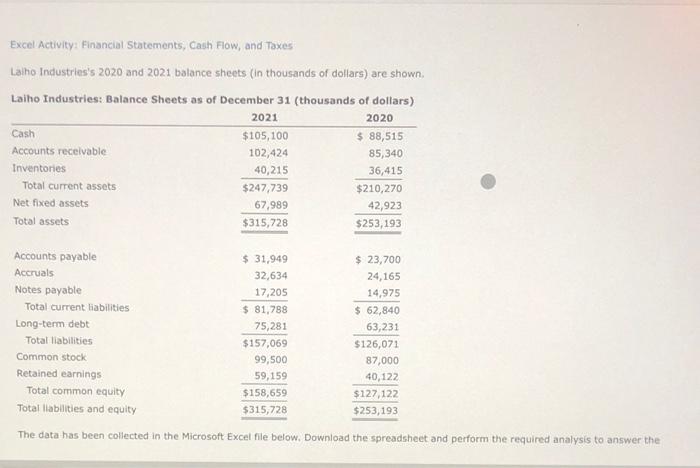

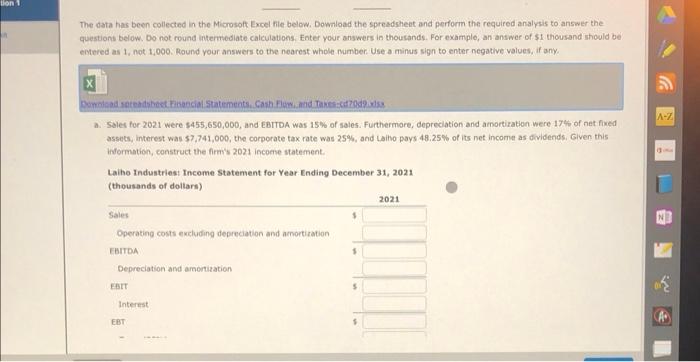

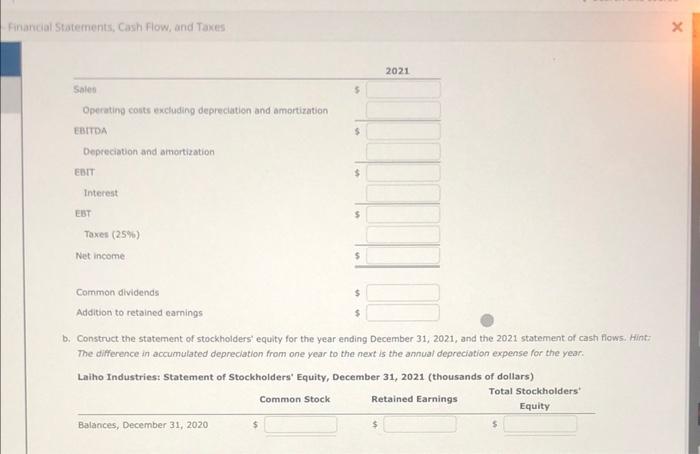

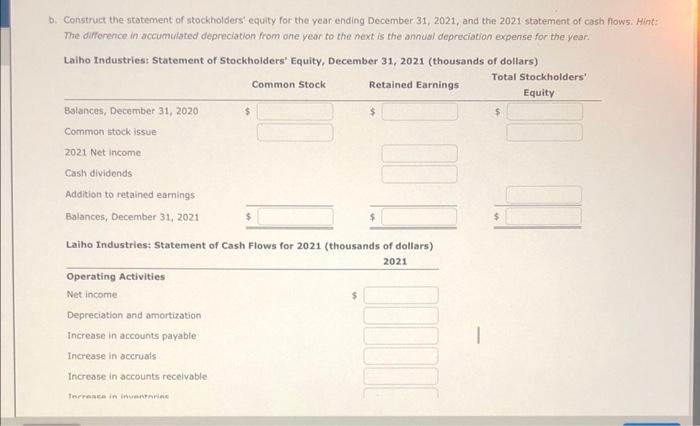

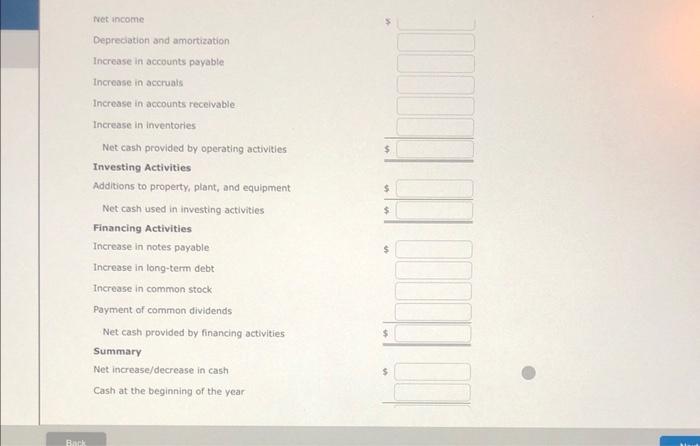

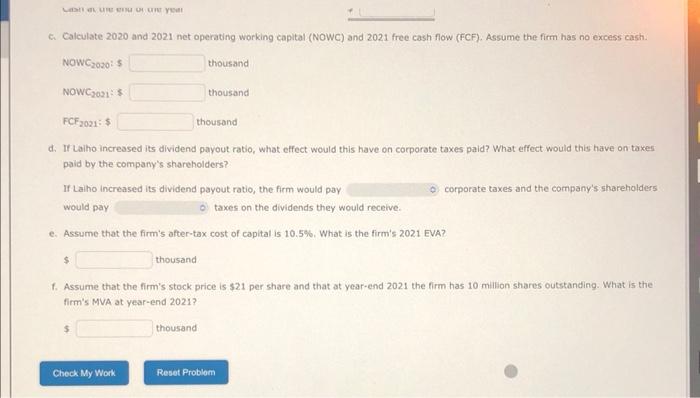

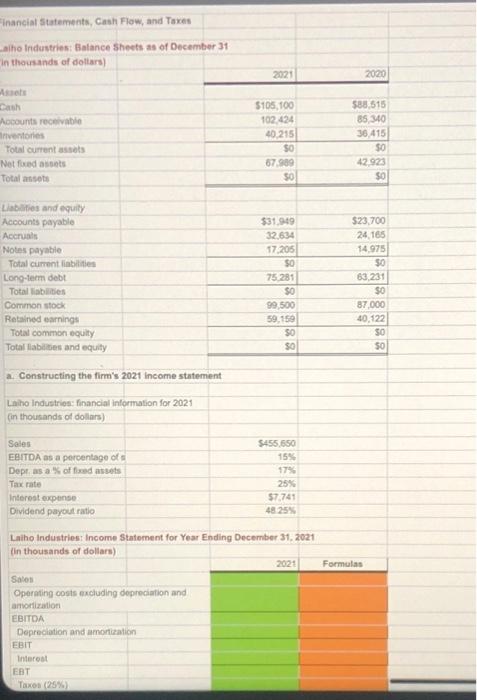

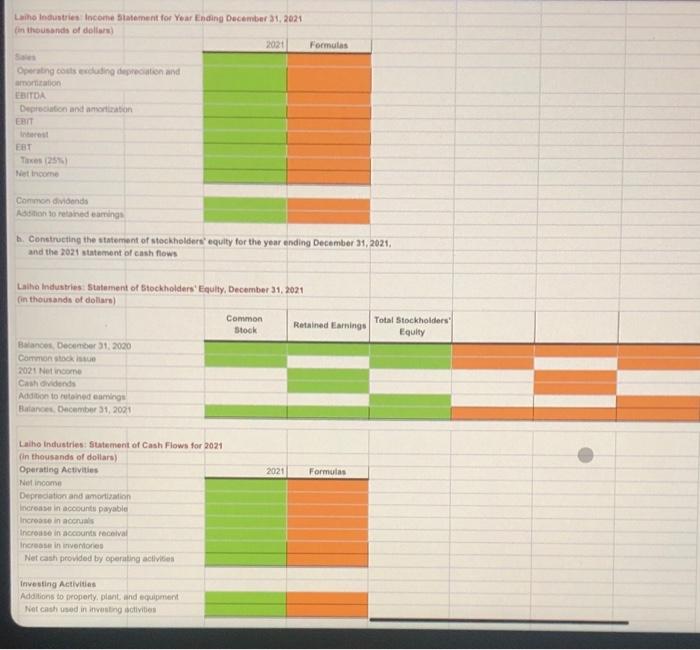

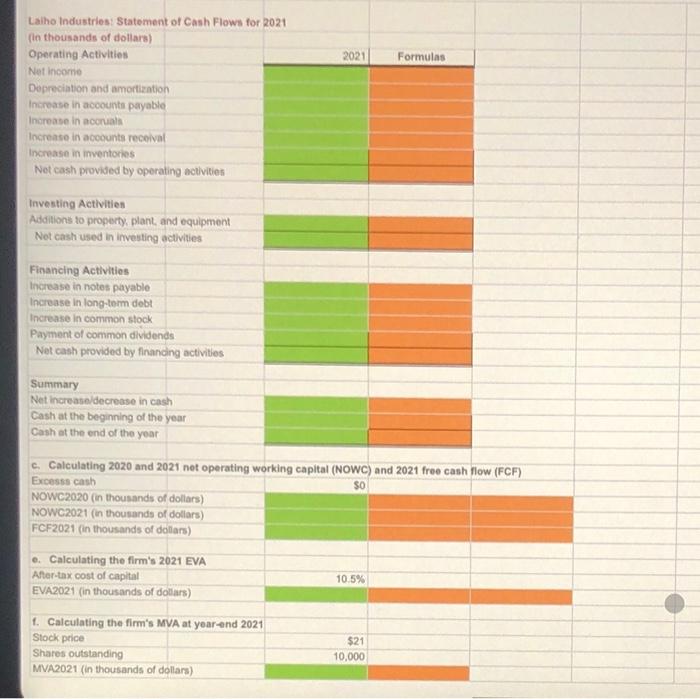

Excel Activity: Financial Statements, Cash Flow, and Taxes Laiho Industries's 2020 and 2021 balance sheets (in thousands of dollars) are shown. Laiho Industries: Balance Sheets as of December 31 (thousande nf dollare) The data has been collected in the Microsoft Excel file below. Dowiload the spreadsheit and perform the required analysis to answer the questions below. Do not round intermediate calculations, Enter your answers in thousands. For example, an answer of $1 thousand should be emtered as 1, not 1,000. Round your answers to the nearest whole number. Use a minus sign to enter negative values, if any, a. Sales for 2021 were 5455,650,000, and EBITDA was 15\% of sales. Furthermore, depreciation and amortiration were 17\% of net fixed assets, interest was 57,741,000, the corporate tax rate was 25%, and Laitho pays 48.25% of its net income as dividends. Glven this information, construct the firm's 2021 income statement. Laiho Industries: Income statement for Year Ending December 31, 2021 (thousands of dollars) Construct the statement of stockholders' equity for the year ending December 31, 2021, and the 2021 statement of cash flows. Hint: The difference in accumulated depreciation from one year to the next is the annual depreciation expense for the year: Construct the statement of stockholders' equity for the year ending December 31, 2021, and the 2021 stotement of cash flows. Hint: The difference in accumulated depreciation from one year to the next is the annual depreciation expense for the year. rvekancome Depreciation and amortization Increase in accounts payable Increose in accruals Increase in accounts receivable Increase in inventories Net cash provided by operating activities Investing Activities Additions to property, plant, and equipment Net cash used in investing activities Financing Activities Increase in notes payable Increase in long-term debt Increase in common stock Payment of common dividends Net cash provided by financing activities Summary Net increase/decrease in cash Cash at the beginning of the year NOWC E2020: 5 thousand NOWC 2021:5 thousand FCF2021:5 thousand d. If Laiho increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taxes paid by the company's shareholders? If Laiho increased its dividend payout ratio, the firm would pay corporate taxes and the company's shareholders would pay taxes on the dividends they would receive. e. Assume that the firm's after-tax cost of capital is 10.5\%, What is the firm's 2021 EVA? $ thousand f. Assume that the firm's stock price is 521 per share and that at year-end 2021 the firm has 10 million shares outstanding. What is the firm's MVA at year-end 2021? $ thousand Tinancial Statements, Cash Flow, and Taxes a. Constructina the firm's 2021 income statement I aihn Induntries: Income Staternent for Year Endinn December 31. 2021 Laino incustries Inceme Statement for Year Ending December 31,2021 (in theusands of deliars) Operating conets esclustrg depreculen and arromitation. HAITDR. Depreciuton and anorization ERIT interest BT Tinnes (25\%) Net thoome Conmon divoends Astaion lo retained earning: h. Constructing the statement of steckholders' equity for the year ending December 31, 2021, and the 2021 statement of cash flows Laihs Industries: Statement of Stockholders' Equity, December 31, 2021 (in thousands of doliars) Laiho industries: Sutement of Cash Flows for 2021 (in theusands of dollars) Operating Activies Nut income Deprecationand amortization increase in acoounts payable Increase in aconuais Increase in accounts recelval Increase in urventones Net cash provided by operathg aclivices Investing Activities Additions to iroperty, plant, and equipment Nat cath osed in invanting sctivibes Laiho Industries: Statement of Cash Flows for 2021 (in thousands of dollars) Operating Activities Nat income \begin{tabular}{|r|r|} \hline 2021 & Formulas \\ \hline \end{tabular} Dopreciation and amortization Increase in accounts payable Increase in accouals Increase in acoounts recelval Increase in inventories Net cash provided by operating activitien Investing Activitien Additions to property, plant, and equipment Net cash used in investing activities Financing Activitios thcrease in notes payable Increase in long-torm debt Increase in common stock Payment of common dividends Net cash provided by financing activities Summary Net increaseldecrease in cash Cash at the beginning of the year Cash at the end of the year c. Calculating 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF) Excesss cash NOWC2020 (in thousands of dollars) NOWC2021 (in thousands of dollars) FCF2021 (in thousands of doliars) e. Calculating the firm's 2021 EVA After-tax cost of capital EVA2021 (in thousands of doliars) f. Calculating the firm's MVA at year-end 2021 Stock price Shares outstanding $ MVA2021 (in thousands of dollars) Excel Activity: Financial Statements, Cash Flow, and Taxes Laiho Industries's 2020 and 2021 balance sheets (in thousands of dollars) are shown. Laiho Industries: Balance Sheets as of December 31 (thousande nf dollare) The data has been collected in the Microsoft Excel file below. Dowiload the spreadsheit and perform the required analysis to answer the questions below. Do not round intermediate calculations, Enter your answers in thousands. For example, an answer of $1 thousand should be emtered as 1, not 1,000. Round your answers to the nearest whole number. Use a minus sign to enter negative values, if any, a. Sales for 2021 were 5455,650,000, and EBITDA was 15\% of sales. Furthermore, depreciation and amortiration were 17\% of net fixed assets, interest was 57,741,000, the corporate tax rate was 25%, and Laitho pays 48.25% of its net income as dividends. Glven this information, construct the firm's 2021 income statement. Laiho Industries: Income statement for Year Ending December 31, 2021 (thousands of dollars) Construct the statement of stockholders' equity for the year ending December 31, 2021, and the 2021 statement of cash flows. Hint: The difference in accumulated depreciation from one year to the next is the annual depreciation expense for the year: Construct the statement of stockholders' equity for the year ending December 31, 2021, and the 2021 stotement of cash flows. Hint: The difference in accumulated depreciation from one year to the next is the annual depreciation expense for the year. rvekancome Depreciation and amortization Increase in accounts payable Increose in accruals Increase in accounts receivable Increase in inventories Net cash provided by operating activities Investing Activities Additions to property, plant, and equipment Net cash used in investing activities Financing Activities Increase in notes payable Increase in long-term debt Increase in common stock Payment of common dividends Net cash provided by financing activities Summary Net increase/decrease in cash Cash at the beginning of the year NOWC E2020: 5 thousand NOWC 2021:5 thousand FCF2021:5 thousand d. If Laiho increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taxes paid by the company's shareholders? If Laiho increased its dividend payout ratio, the firm would pay corporate taxes and the company's shareholders would pay taxes on the dividends they would receive. e. Assume that the firm's after-tax cost of capital is 10.5\%, What is the firm's 2021 EVA? $ thousand f. Assume that the firm's stock price is 521 per share and that at year-end 2021 the firm has 10 million shares outstanding. What is the firm's MVA at year-end 2021? $ thousand Tinancial Statements, Cash Flow, and Taxes a. Constructina the firm's 2021 income statement I aihn Induntries: Income Staternent for Year Endinn December 31. 2021 Laino incustries Inceme Statement for Year Ending December 31,2021 (in theusands of deliars) Operating conets esclustrg depreculen and arromitation. HAITDR. Depreciuton and anorization ERIT interest BT Tinnes (25\%) Net thoome Conmon divoends Astaion lo retained earning: h. Constructing the statement of steckholders' equity for the year ending December 31, 2021, and the 2021 statement of cash flows Laihs Industries: Statement of Stockholders' Equity, December 31, 2021 (in thousands of doliars) Laiho industries: Sutement of Cash Flows for 2021 (in theusands of dollars) Operating Activies Nut income Deprecationand amortization increase in acoounts payable Increase in aconuais Increase in accounts recelval Increase in urventones Net cash provided by operathg aclivices Investing Activities Additions to iroperty, plant, and equipment Nat cath osed in invanting sctivibes Laiho Industries: Statement of Cash Flows for 2021 (in thousands of dollars) Operating Activities Nat income \begin{tabular}{|r|r|} \hline 2021 & Formulas \\ \hline \end{tabular} Dopreciation and amortization Increase in accounts payable Increase in accouals Increase in acoounts recelval Increase in inventories Net cash provided by operating activitien Investing Activitien Additions to property, plant, and equipment Net cash used in investing activities Financing Activitios thcrease in notes payable Increase in long-torm debt Increase in common stock Payment of common dividends Net cash provided by financing activities Summary Net increaseldecrease in cash Cash at the beginning of the year Cash at the end of the year c. Calculating 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF) Excesss cash NOWC2020 (in thousands of dollars) NOWC2021 (in thousands of dollars) FCF2021 (in thousands of doliars) e. Calculating the firm's 2021 EVA After-tax cost of capital EVA2021 (in thousands of doliars) f. Calculating the firm's MVA at year-end 2021 Stock price Shares outstanding $ MVA2021 (in thousands of dollars)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts