Question: answer all parts please, in excel if possible Score: 0 of 1 pt 6 of 7 (5 complete) HW Score: 52.02%, 3.64 of 7 pts

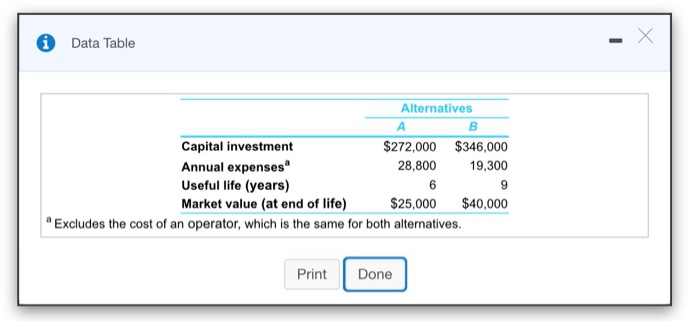

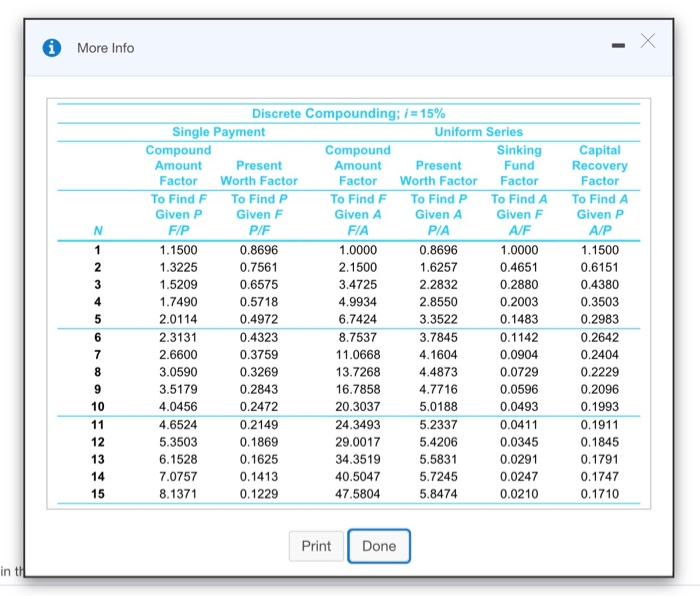

Score: 0 of 1 pt 6 of 7 (5 complete) HW Score: 52.02%, 3.64 of 7 pts Problem 6-32 (book/static) Question Help As the supervisor of a facilities engineering department, you consider mobile cranes to be critical equipment. The purchase of a new medium-sized, truck-mounted Crane is being evaluated. The economic estimates for the two best alternatives are shown in the table below. You have selected the longest useful life (nine years) for the study period and would lease a crane for the final three years under Alternative A. On the basis of previous experience, the estimated annual leasing costat that time will be $66,000 per year (plus the annual expenses of $28,800 per year). The MARR is 15% per year. Show that the same selection is made with (a) the PW method, (b) the IRR method. (c) the ERR method. (d) Would leasing crane A for nine years, assuming the same costs per year as for three years, be preferred over your present selection? (e = MARR = 15%). Click the icon to view the alternatives description Click the icon to view the interest and annuity table for discrete compounding when i=15% per year. Data Table B Alternatives Capital investment $272,000 $346,000 Annual expenses 28,800 19,300 Useful life (years) 6 9 Market value (at end of life) $25,000 $40,000 "Excludes the cost of an operator, which is the same for both alternatives. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts