Question: Answer all parts with showing your work please!!!!! PYTEC ENGINEERED MATERIALS, INC Pytec Engineered Materials, Inc. is a wholesale distributor of plane parts that is

Answer all parts with showing your work please!!!!!

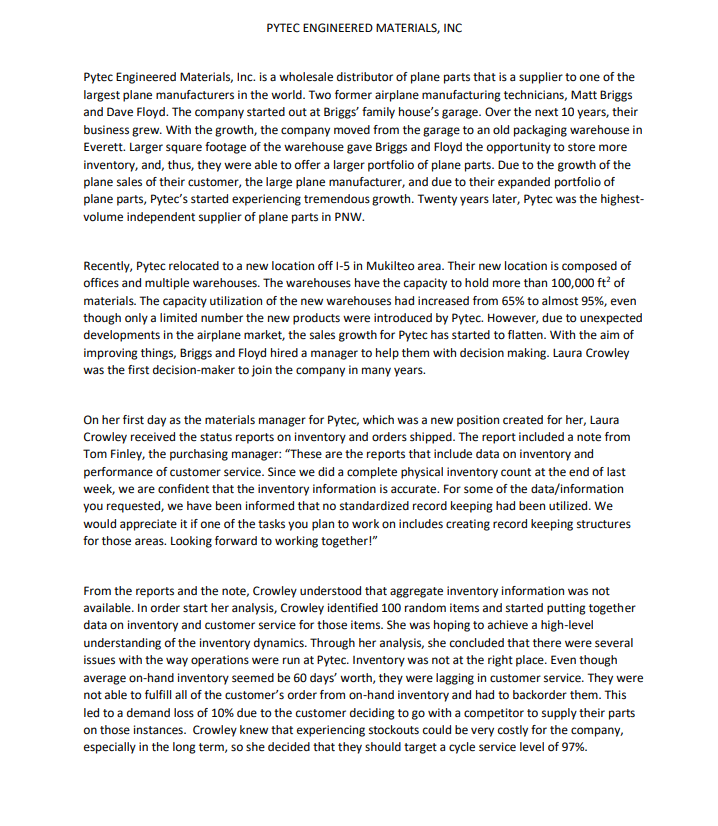

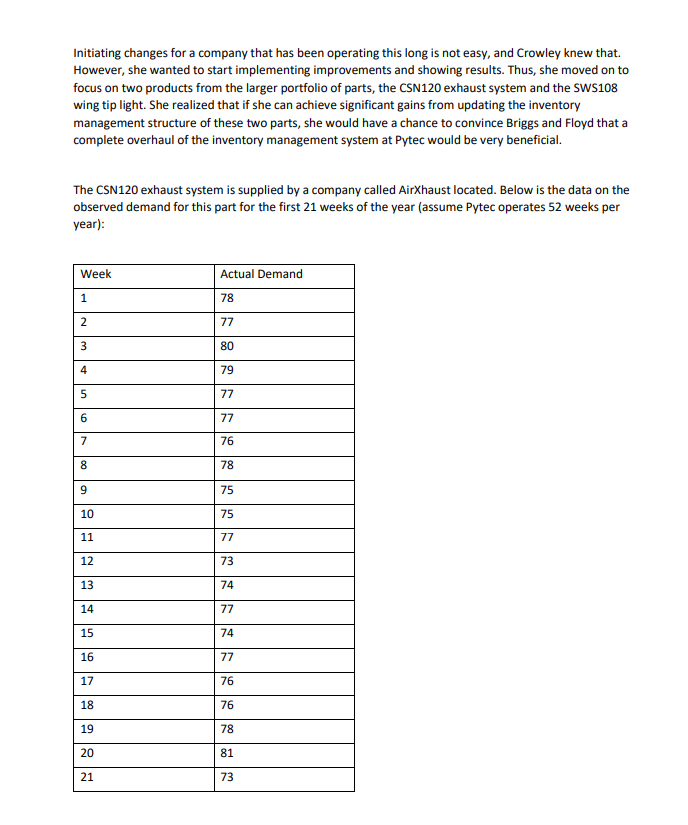

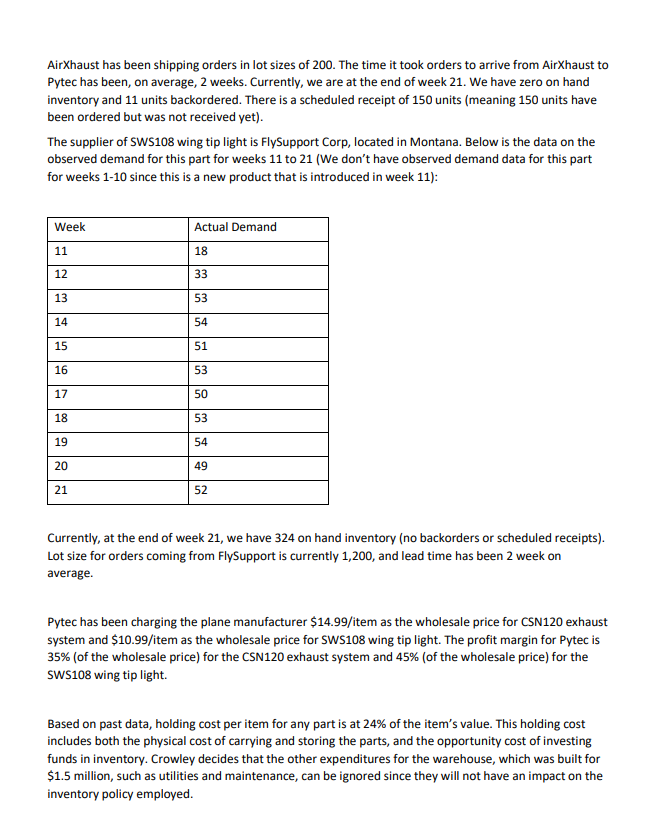

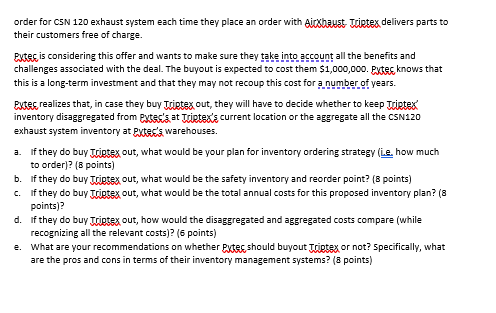

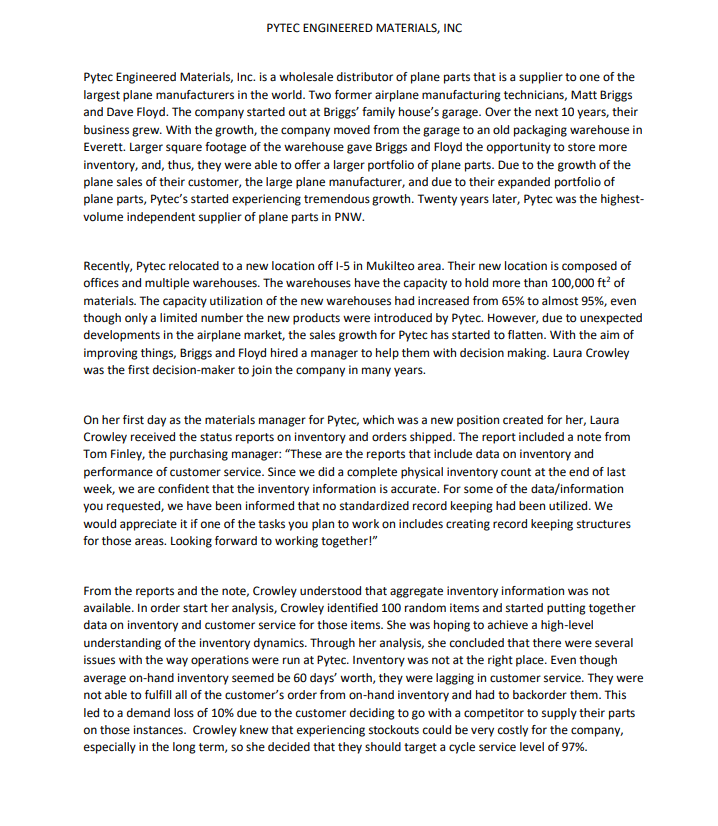

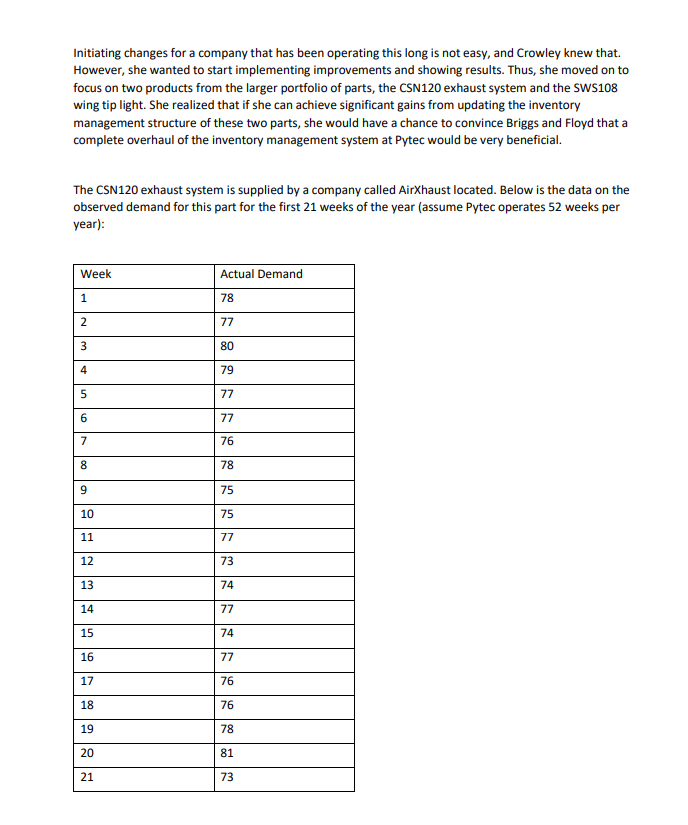

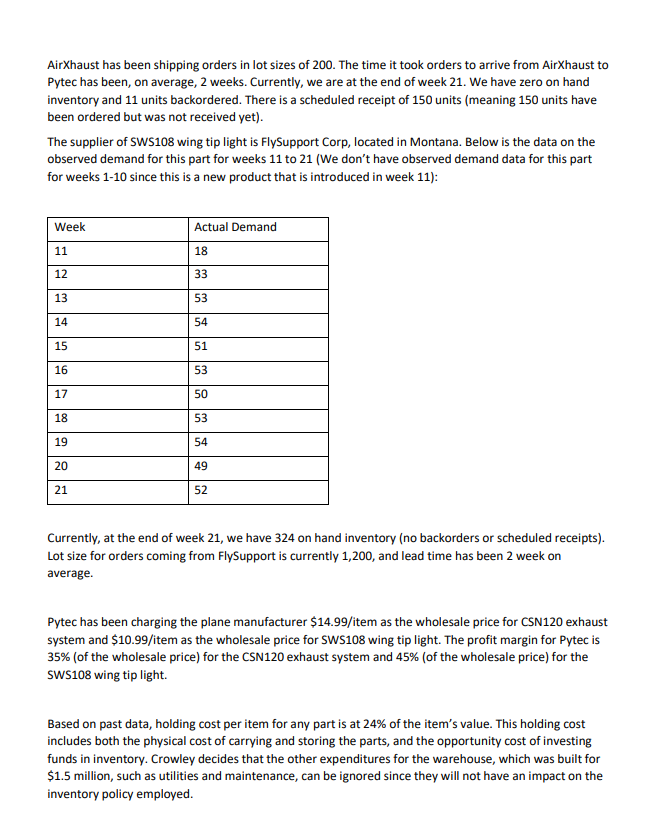

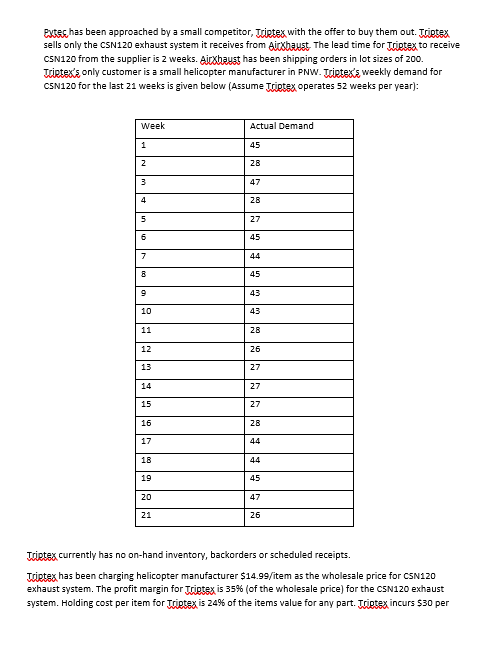

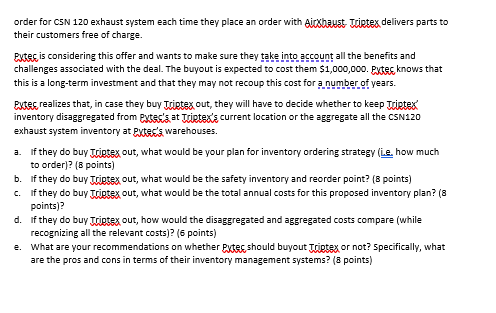

PYTEC ENGINEERED MATERIALS, INC Pytec Engineered Materials, Inc. is a wholesale distributor of plane parts that is a supplier to one of the largest plane manufacturers in the world. Two former airplane manufacturing technicians, Matt Briggs and Dave Floyd. The company started out at Briggs' family house's garage. Over the next 10 years, their business grew. With the growth, the company moved from the garage to an old packaging warehouse in Everett. Larger square footage of the warehouse gave Briggs and Floyd the opportunity to store more inventory, and, thus, they were able to offer a larger portfolio of plane parts. Due to the growth of the plane sales of their customer, the large plane manufacturer, and due to their expanded portfolio of plane parts, Pytec's started experiencing tremendous growth. Twenty years later, Pytec was the highest- volume independent supplier of plane parts in PNW. Recently, Pytec relocated to a new location off 1-5 in Mukilteo area. Their new location is composed of offices and multiple warehouses. The warehouses have the capacity to hold more than 100,000 ft of materials. The capacity utilization of the new warehouses had increased from 65% to almost 95%, even though only a limited number the new products were introduced by Pytec. However, due to unexpected developments in the airplane market, the sales growth for Pytec has started to flatten. With the aim of improving things, Briggs and Floyd hired a manager to help them with decision making. Laura Crowley was the first decision-maker to join the company in many years. On her first day as the materials manager for Pytec, which was a new position created for her, Laura Crowley received the status reports on inventory and orders shipped. The report included a note from Tom Finley, the purchasing manager: "These are the reports that include data on inventory and performance of customer service. Since we did a complete physical inventory count at the end of last week, we are confident that the inventory information is accurate. For some of the data/information you requested, we have been informed that no standardized record keeping had been utilized. We would appreciate it if one of the tasks you plan to work on includes creating record keeping structures for those areas. Looking forward to working together!" From the reports and the note, Crowley understood that aggregate inventory information was not available. In order start her analysis, Crowley identified 100 random items and started putting together data on inventory and customer service for those items. She was hoping to achieve a high-level understanding of the inventory dynamics. Through her analysis, she concluded that there were several issues with the way operations were run at Pytec. Inventory was not at the right place. Even though average on-hand inventory seemed be 60 days' worth, they were lagging in customer service. They were not able to fulfill all of the customer's order from on-hand inventory and had to backorder them. This led to a demand loss of 10% due to the customer deciding to go with a competitor to supply their parts on those instances. Crowley knew that experiencing stockouts could be very costly for the company, especially in the long term, so she decided that they should target a cycle service level of 97%. Initiating changes for a company that has been operating this long is not easy, and Crowley knew that. However, she wanted to start implementing improvements and showing results. Thus, she moved on to focus on two products from the larger portfolio of parts, the CSN120 exhaust system and the SWS108 wing tip light. She realized that if she can achieve significant gains from updating the inventory management structure of these two parts, she would have a chance to convince Briggs and Floyd that a complete overhaul of the inventory management system at Pytec would be very beneficial. The CSN120 exhaust system is supplied by a company called AirXhaust located. Below is the data on the observed demand for this part for the first 21 weeks of the year (assume Pytec operates 52 weeks per year): Week Actual Demand 1 78 2 77 3 80 4 79 5 77 6 77 7 76 8 78 9 75 10 75 11 77 12 73 13 74 14 77 | 15 74 16 77 17 76 18 76 19 78 20 81 21 73 Airxhaust has been shipping orders in lot sizes of 200. The time it took orders to arrive from Airxhaust to Pytec has been, on average, 2 weeks. Currently, we are at the end of week 21. We have zero on hand inventory and 11 units backordered. There is a scheduled receipt of 150 units (meaning 150 units have been ordered but was not received yet). The supplier of SWS108 wing tip light is FlySupport Corp, located in Montana. Below is the data on the observed demand for this part for weeks 11 to 21 (We don't have observed demand data for this part for weeks 1-10 since this is a new product that is introduced in week 11): Week Actual Demand 11 18 12 33 13 53 14 54 15 51 16 53 17 50 18 53 19 54 20 49 21 52 Currently, at the end of week 21, we have 324 on hand inventory (no backorders or scheduled receipts). Lot size for orders coming from FlySupport is currently 1,200, and lead time has been 2 week on average. Pytec has been charging the plane manufacturer $14.99/item as the wholesale price for CSN120 exhaust system and $10.99/item as the wholesale price for SWS108 wing tip light. The profit margin for Pytec is 35% (of the wholesale price) for the CSN120 exhaust system and 45% (of the wholesale price) for the SWS108 wing tip light. Based on past data, holding cost per item for any part is at 24% of the item's value. This holding cost includes both the physical cost of carrying and storing the parts, and the opportunity cost of investing funds in inventory. Crowley decides that the other expenditures for the warehouse, which was built for $1.5 million, such as utilities and maintenance, can be ignored since they will not have an impact on the inventory policy employed. extes has been approached by a small competitor, Triptex with the offer to buy them out. Triptex sells only the CSN120 exhaust system it receives from sirahaust. The lead time for Thirtex to receive CSN120 from the supplier is 2 weeks. Aicxhaust has been shipping orders in lot sizes of 200. Jcirtex's only customer is a small helicopter manufacturer in PNW. Tvirtex's weekly demand for CSN120 for the last 1 weeks is given below (Assume Triptex operates 52 weeks per year): Week Actual Demand 1 45 Z 28 3 47 4 28 5 27 6 45 7 44 B 45 9 43 10 43 11 28 12 26 13 27 14 27 15 27 16 28 17 44 18 44 19 45 20 47 21 26 Tvirtex currently has no on-hand inventory, backorders or scheduled receipts. Trirtex has been charging helicopter manufacturer $14.99/item as the wholesale price for CSN120 exhaust system. The profit margin for Tristex is 35% (of the wholesale price) for the CSN120 exhaust system. Holding cost per item for Triptex is 24% of the items value for any part. Trietax incurs $30 per order for CSN 120 exhaust system each time they place an order with sicxhaust Tvirtex delivers parts to their customers free of charge. Extes is considering this offer and wants to make sure they take into account all the benefits and challenges associated with the deal. The buyout is expected to cost them $1,000,000. Extes knows that this is a long-term investment and that they may not recoup this cost for a number of years. Extes realizes that, in case they buy Triptex out, they will have to decide whether to keep Triptex inventory disaggregated from extec's at Tuirtex's current location or the aggregate all the CSN120 exhaust system inventory at Exteca warehouses. a. If they do buy Triptex out, what would be your plan for inventory ordering strategy (ie, how much to order]? (8 points) b. If they do buy Tristex out, what would be the safety inventory and reorder point? (8 points) c. If they do buy Triptex out, what would be the total annual costs for this proposed inventory plan? (8 points)? d. If they do buy Trigtex out, how would the disaggregated and aggregated costs compare (while recognizing all the relevant costs)? (6 points) e. What are your recommendations on whether Pxtes should buyout Triptex or not? Specifically, what are the pros and cons in terms of their inventory management systems? (8 points) PYTEC ENGINEERED MATERIALS, INC Pytec Engineered Materials, Inc. is a wholesale distributor of plane parts that is a supplier to one of the largest plane manufacturers in the world. Two former airplane manufacturing technicians, Matt Briggs and Dave Floyd. The company started out at Briggs' family house's garage. Over the next 10 years, their business grew. With the growth, the company moved from the garage to an old packaging warehouse in Everett. Larger square footage of the warehouse gave Briggs and Floyd the opportunity to store more inventory, and, thus, they were able to offer a larger portfolio of plane parts. Due to the growth of the plane sales of their customer, the large plane manufacturer, and due to their expanded portfolio of plane parts, Pytec's started experiencing tremendous growth. Twenty years later, Pytec was the highest- volume independent supplier of plane parts in PNW. Recently, Pytec relocated to a new location off 1-5 in Mukilteo area. Their new location is composed of offices and multiple warehouses. The warehouses have the capacity to hold more than 100,000 ft of materials. The capacity utilization of the new warehouses had increased from 65% to almost 95%, even though only a limited number the new products were introduced by Pytec. However, due to unexpected developments in the airplane market, the sales growth for Pytec has started to flatten. With the aim of improving things, Briggs and Floyd hired a manager to help them with decision making. Laura Crowley was the first decision-maker to join the company in many years. On her first day as the materials manager for Pytec, which was a new position created for her, Laura Crowley received the status reports on inventory and orders shipped. The report included a note from Tom Finley, the purchasing manager: "These are the reports that include data on inventory and performance of customer service. Since we did a complete physical inventory count at the end of last week, we are confident that the inventory information is accurate. For some of the data/information you requested, we have been informed that no standardized record keeping had been utilized. We would appreciate it if one of the tasks you plan to work on includes creating record keeping structures for those areas. Looking forward to working together!" From the reports and the note, Crowley understood that aggregate inventory information was not available. In order start her analysis, Crowley identified 100 random items and started putting together data on inventory and customer service for those items. She was hoping to achieve a high-level understanding of the inventory dynamics. Through her analysis, she concluded that there were several issues with the way operations were run at Pytec. Inventory was not at the right place. Even though average on-hand inventory seemed be 60 days' worth, they were lagging in customer service. They were not able to fulfill all of the customer's order from on-hand inventory and had to backorder them. This led to a demand loss of 10% due to the customer deciding to go with a competitor to supply their parts on those instances. Crowley knew that experiencing stockouts could be very costly for the company, especially in the long term, so she decided that they should target a cycle service level of 97%. Initiating changes for a company that has been operating this long is not easy, and Crowley knew that. However, she wanted to start implementing improvements and showing results. Thus, she moved on to focus on two products from the larger portfolio of parts, the CSN120 exhaust system and the SWS108 wing tip light. She realized that if she can achieve significant gains from updating the inventory management structure of these two parts, she would have a chance to convince Briggs and Floyd that a complete overhaul of the inventory management system at Pytec would be very beneficial. The CSN120 exhaust system is supplied by a company called AirXhaust located. Below is the data on the observed demand for this part for the first 21 weeks of the year (assume Pytec operates 52 weeks per year): Week Actual Demand 1 78 2 77 3 80 4 79 5 77 6 77 7 76 8 78 9 75 10 75 11 77 12 73 13 74 14 77 | 15 74 16 77 17 76 18 76 19 78 20 81 21 73 Airxhaust has been shipping orders in lot sizes of 200. The time it took orders to arrive from Airxhaust to Pytec has been, on average, 2 weeks. Currently, we are at the end of week 21. We have zero on hand inventory and 11 units backordered. There is a scheduled receipt of 150 units (meaning 150 units have been ordered but was not received yet). The supplier of SWS108 wing tip light is FlySupport Corp, located in Montana. Below is the data on the observed demand for this part for weeks 11 to 21 (We don't have observed demand data for this part for weeks 1-10 since this is a new product that is introduced in week 11): Week Actual Demand 11 18 12 33 13 53 14 54 15 51 16 53 17 50 18 53 19 54 20 49 21 52 Currently, at the end of week 21, we have 324 on hand inventory (no backorders or scheduled receipts). Lot size for orders coming from FlySupport is currently 1,200, and lead time has been 2 week on average. Pytec has been charging the plane manufacturer $14.99/item as the wholesale price for CSN120 exhaust system and $10.99/item as the wholesale price for SWS108 wing tip light. The profit margin for Pytec is 35% (of the wholesale price) for the CSN120 exhaust system and 45% (of the wholesale price) for the SWS108 wing tip light. Based on past data, holding cost per item for any part is at 24% of the item's value. This holding cost includes both the physical cost of carrying and storing the parts, and the opportunity cost of investing funds in inventory. Crowley decides that the other expenditures for the warehouse, which was built for $1.5 million, such as utilities and maintenance, can be ignored since they will not have an impact on the inventory policy employed. extes has been approached by a small competitor, Triptex with the offer to buy them out. Triptex sells only the CSN120 exhaust system it receives from sirahaust. The lead time for Thirtex to receive CSN120 from the supplier is 2 weeks. Aicxhaust has been shipping orders in lot sizes of 200. Jcirtex's only customer is a small helicopter manufacturer in PNW. Tvirtex's weekly demand for CSN120 for the last 1 weeks is given below (Assume Triptex operates 52 weeks per year): Week Actual Demand 1 45 Z 28 3 47 4 28 5 27 6 45 7 44 B 45 9 43 10 43 11 28 12 26 13 27 14 27 15 27 16 28 17 44 18 44 19 45 20 47 21 26 Tvirtex currently has no on-hand inventory, backorders or scheduled receipts. Trirtex has been charging helicopter manufacturer $14.99/item as the wholesale price for CSN120 exhaust system. The profit margin for Tristex is 35% (of the wholesale price) for the CSN120 exhaust system. Holding cost per item for Triptex is 24% of the items value for any part. Trietax incurs $30 per order for CSN 120 exhaust system each time they place an order with sicxhaust Tvirtex delivers parts to their customers free of charge. Extes is considering this offer and wants to make sure they take into account all the benefits and challenges associated with the deal. The buyout is expected to cost them $1,000,000. Extes knows that this is a long-term investment and that they may not recoup this cost for a number of years. Extes realizes that, in case they buy Triptex out, they will have to decide whether to keep Triptex inventory disaggregated from extec's at Tuirtex's current location or the aggregate all the CSN120 exhaust system inventory at Exteca warehouses. a. If they do buy Triptex out, what would be your plan for inventory ordering strategy (ie, how much to order]? (8 points) b. If they do buy Tristex out, what would be the safety inventory and reorder point? (8 points) c. If they do buy Triptex out, what would be the total annual costs for this proposed inventory plan? (8 points)? d. If they do buy Trigtex out, how would the disaggregated and aggregated costs compare (while recognizing all the relevant costs)? (6 points) e. What are your recommendations on whether Pxtes should buyout Triptex or not? Specifically, what are the pros and cons in terms of their inventory management systems? (8 points)