Question: answer all please 1. The two-asset case The expected return for asset A is 10.00% with a standard deviation of 8.00%, and the expected return

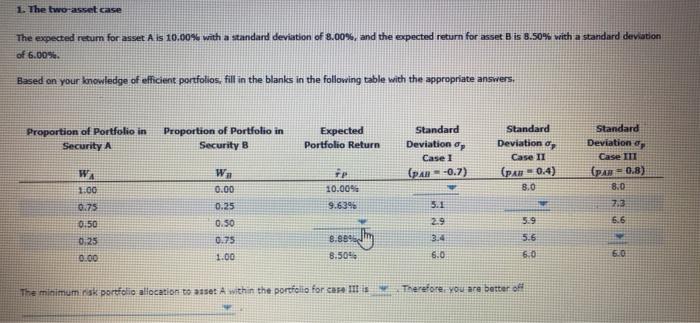

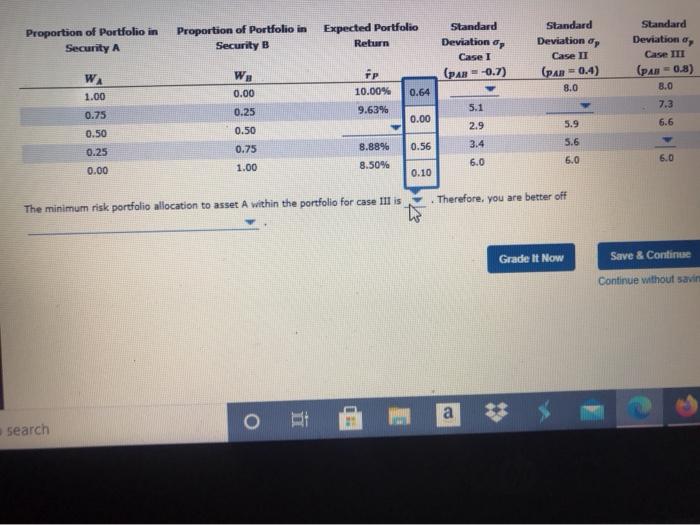

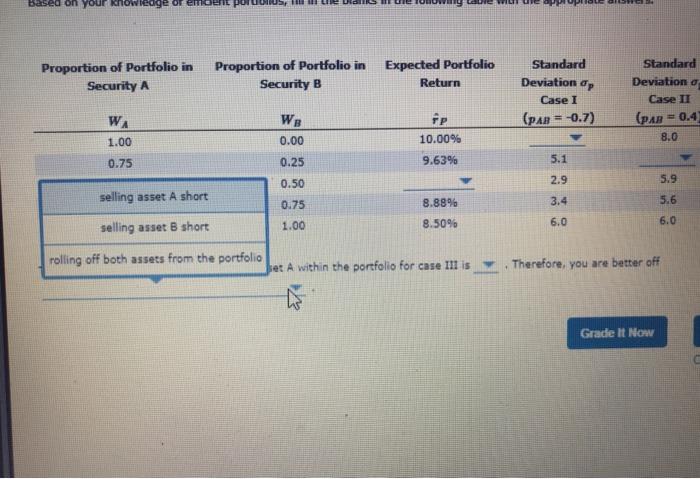

1. The two-asset case The expected return for asset A is 10.00% with a standard deviation of 8.00%, and the expected return for asset B is 8.50% with a standard deviation of 6.00%. Based on your knowledge of efficient portfolios, fill in the blanks in the following table with the appropriate answers, Proportion of Portfolio in Security A Proportion of Portfolio in Security 8 Expected Portfolio Return Standard Deviation or Case 1 (PAR = -0.7) Standard Deviation, Case II (PAN 0.4) 8.0 Standard Deviation Case 111 (PAN=0.8) 8.0 7.3 WA 1.00 W. 0.00 TP 10.00% 9.639 0.75 0:50 0.25 6.6 0.25 0.50 0.75 1.00 5.1 29 3.4 6.909 5.6 6.0 0.00 8.504, 6.0 6.0 The minimum nsk portfolio allocation to 31st A within the portfolio for care is Therefore, you are better off Proportion of Portfolio in Security A Proportion of Portfolio in Security B Expected Portfolio Return Standard Deviations, Case I (par = -0.7) Standard Deviation or Case II (pan=0.4) 8.0 Standard Deviation Case III (pan=0.8) 8.0 WA 1.00 W, 0.00 PP 10.00% 9.63% 0.64 5.1 7.3 0.75 0.25 0.50 0.00 6.6 0.50 2.9 3.4 0.75 0.56 5.9 5.6 6.0 0.25 0.00 8.88% 8.50% 6.0 6.0 1.00 0.10 Therefore, you are better off The minimum risk portfolio allocation to asset A within the portfolio for case III is Grade It Now Save & Continue Continue without savin a OBRA search Based on your knowledge or US Proportion of Portfolio in Security A Proportion of Portfolio in Security B Expected Portfolio Return Standard Deviation op Case 1 (PAR = -0.7) Standard Deviation o Case II (par = 0.4 8.0 WB WA 1.00 0.00 10.00% 9.63% 0.75 0.25 5.1 0.50 2.9 5.9 selling asset A short 0.75 8.88% 3.4 5.6 1.00 8.50% 6.0 selling asset B short 6.0 rolling off both assets from the portfolio Jet A within the portfolio for case III is. Therefore, you are better off Grade It Now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts