Question: answer all please ack to Assignment Attempts Keep the Highest/3 8. Solving for a farm's WACC A firm's weighted average cost of capital (WACC) is

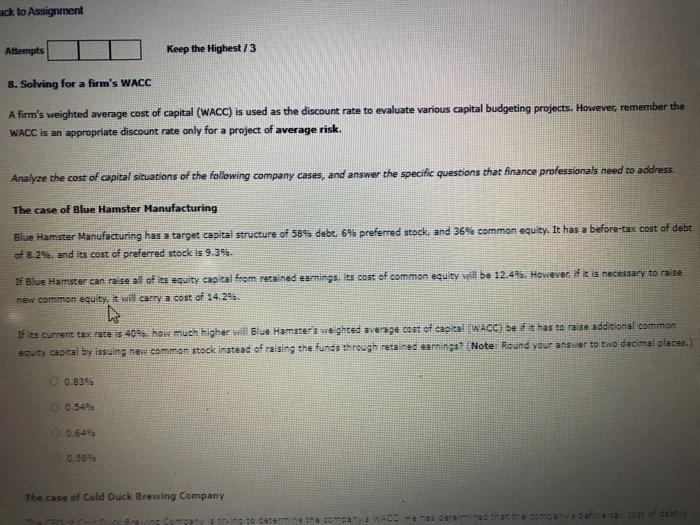

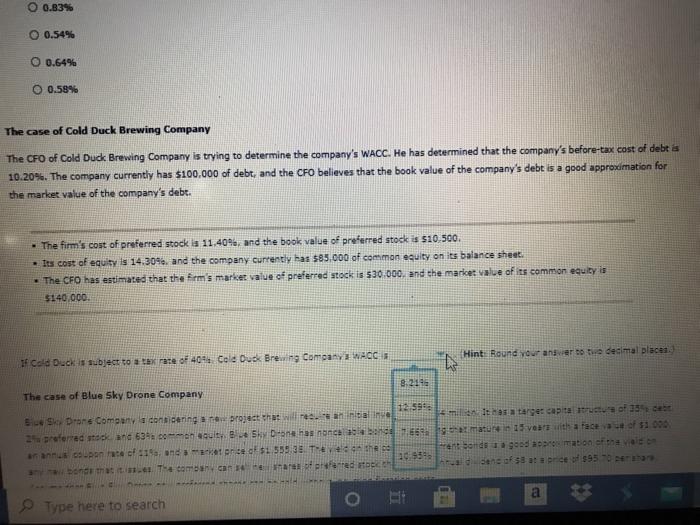

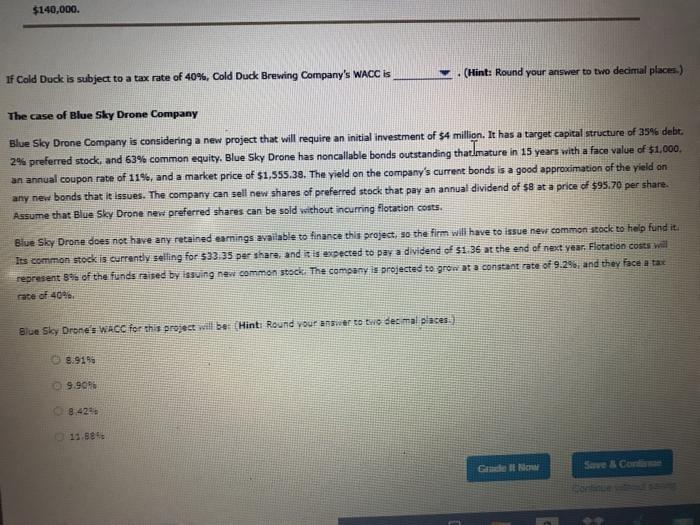

ack to Assignment Attempts Keep the Highest/3 8. Solving for a farm's WACC A firm's weighted average cost of capital (WACC) is used as the discount rate to evaluate various capital budgeting projects. However, remember the WACC is an appropriate discount rate only for a project of average risk. Analyze the cost of capital situations of the following company cases, and answer the specific questions that finance professionals need to address The case of Blue Hamster Manufacturing equity. It has a before-tax cost of debt Blue Hamster Manufacturing has a target capital structure of 5846 debe 6% preferred stock, and 36% comm of 8.2%, and is cost of preferred stock is 9.39 1f Blue Hamster can raise all of its equity capital from retained earnings, its cost of common equity will be 12.49. Howeven if it is necessary to raise new common equity will carry a cost of 14 296 If its current tax rates 4095. how much higher will Blue Hamster's weighted average cost of capital (WACC) be fit has to raise additional common equity capital by issuing a common stock instead of raising the funds through retained earnings Note: Round your answer to two decimal places 6.835 0:54 0.6495 0.58% The case of Cold Duck Brewing Company Com 0.63% 0.54% 0.64% O 0.58% The case of Cold Duck Brewing Company The CFO of Cold Duck Brewing Company is trying to determine the company's WACC. He has determined that the company's before-tax cost of debt is 10.20%. The company currently has $100.000 of debt, and the CFO believes that the book value of the company's debt is a good approximation for the market value of the company's debt. The firm's cost of preferred stock is 11.40%, and the book value of preferred stock is $10.500. Its cost of equitys 14.30%, and the company currently has $85,000 of common equity on its balance sheet, The CFO has estimated that the firm's market value of preferred stock is 530.000 and the market value of its common equity is $140.000 Hint Round your answer to the decimal places Cold Duck subject to a tax rate of 404 Cold Duck Brewing Company WAOC 8219 The case of Blue Sky Drone Company 1659 BS Drone Company consering project that is an initiale militar target capita trutus of 23 ct 24 preferred stock and 6380-menesult B SkyDan har nonca na matat1 vestith a face of $1000 annus OLPRutes 118, onderde of $1 559 3. The these Frent bonds 1990 ton of the valt bondhatit.1. Toman are fred ens of $8 a price of $950 HHH Type here to search $140,000. If Cold Duck is subject to a tax rate of 40%, Cold Duck Brewing Company's WACC is V. (Hint: Round your answer to two decimal places.) The case of Blue Sky Drone Company Blue Sky Drone Company is considering a new project that will require an initial investment of $4 million. It has a target capital structure of 35% debt. 2% preferred stock, and 63% common equity, Blue Sky Drone has noncallable bonds outstanding that mature in 15 years with a face value of $1,000 an annual coupon rate of 11%, and a market price of $1,555.38. The yield on the company's current bonds is a good approximation of the yield on any new bonds that it issues. The company can sell new shares of preferred stock that pay an annual dividend of $8 at a price of $95.70 per share. Assume that Blue Sky Drone new preferred shares can be sold without incurring flotation costs. Blue Sky Drone does not have any retained earnings available to finance this project, so the firm will have to issue new common stock to help fund it. Its common stock is currently selling for $33.35 per share, and it is expected to pay a dividend of 51 36 at the end of next year. Flotation costs will represent 8% of the funds raised by issuing new common stock. The company is projected to grow at a constant rate of 9.296, and they face a tax rate of 40. Blue Sky Drone's WACC for this project will be (Hints Round your answer to two decimal places 8.919 9.90 CNC Save & Co

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts