Question: answer all please and show working. i would love it to be typed thanks 4. Holmes Packaging sold a machine for $49,500. The company bought

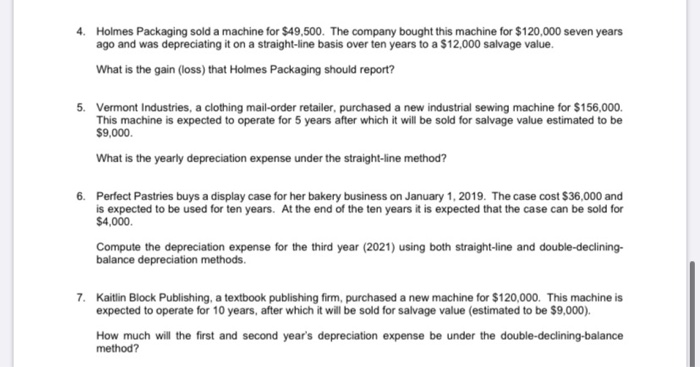

4. Holmes Packaging sold a machine for $49,500. The company bought this machine for $120.000 seven years ago and was depreciating it on a straight-line basis over ten years to a $12,000 salvage value. What is the gain (loss) that Holmes Packaging should report? 5. Vermont Industries, a clothing mail-order retailer, purchased a new industrial sewing machine for $156,000. This machine is expected to operate for 5 years after which it will be sold for salvage value estimated to be $9,000 What is the yearly depreciation expense under the straight-line method? 6. Perfect Pastries buys a display case for her bakery business on January 1, 2019. The case cost $36,000 and is expected to be used for ten years. At the end of the ten years it is expected that the case can be sold for $4,000. Compute the depreciation expense for the third year (2021) using both straight-line and double-declining- balance depreciation methods. 7. Kaitlin Block Publishing, a textbook publishing firm, purchased a new machine for $120,000. This machine is expected to operate for 10 years, after which it will be sold for salvage value (estimated to be $9,000) How much will the first and second year's depreciation expense be under the double-declining-balance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts