Question: answer All please D Question 7 2.5 pts When we determine the value of an asset, we are interested in the present value of the

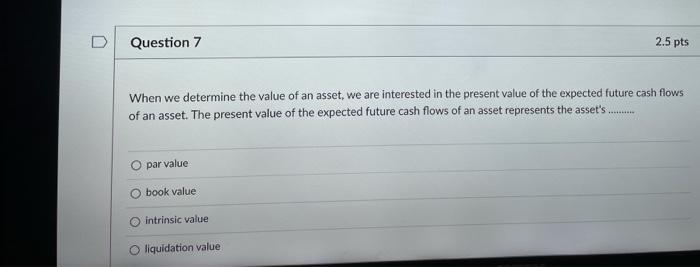

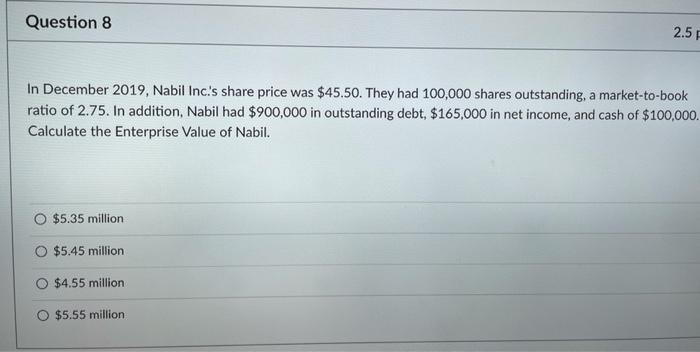

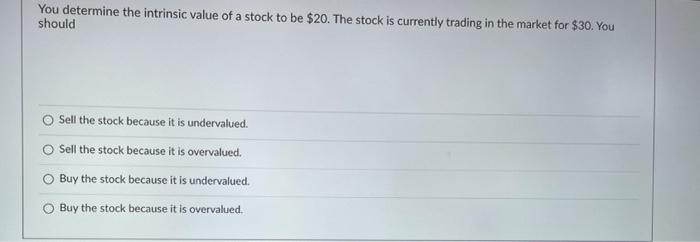

D Question 7 2.5 pts When we determine the value of an asset, we are interested in the present value of the expected future cash flows of an asset. The present value of the expected future cash flows of an asset represents the asset's........ par value book value intrinsic value liquidation value Question 8 2.5 In December 2019, Nabil Incs share price was $45.50. They had 100,000 shares outstanding, a market-to-book ratio of 2.75. In addition, Nabil had $900,000 in outstanding debt, $165,000 in net income, and cash of $100,000. Calculate the Enterprise Value of Nabil. $5.35 million O $5.45 million O $4.55 million O $5.55 million You determine the intrinsic value of a stock to be $20. The stock is currently trading in the market for $30. You should Sell the stock because it is undervalued. Sell the stock because it is overvalued. Buy the stock because it is undervalued. Buy the stock because it is overvalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts