Question: answer all please !!!! Given the following information, calculate the liquidity ratio: (Round your answer to 2 decimal places.) 9 Liabilities = $27,500 Liquid assets

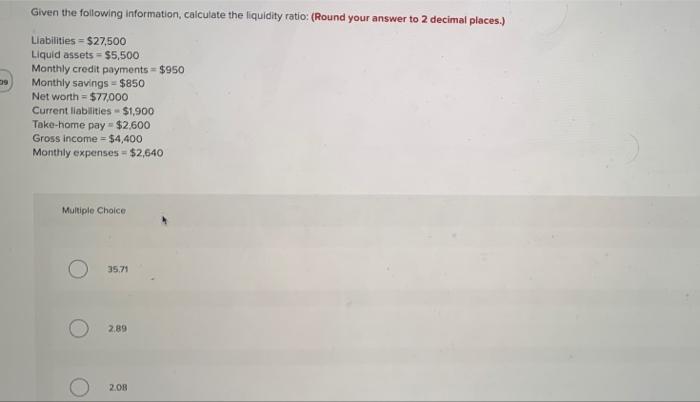

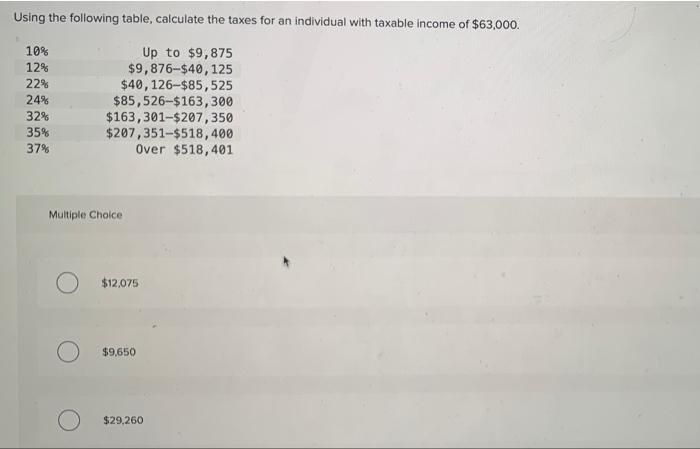

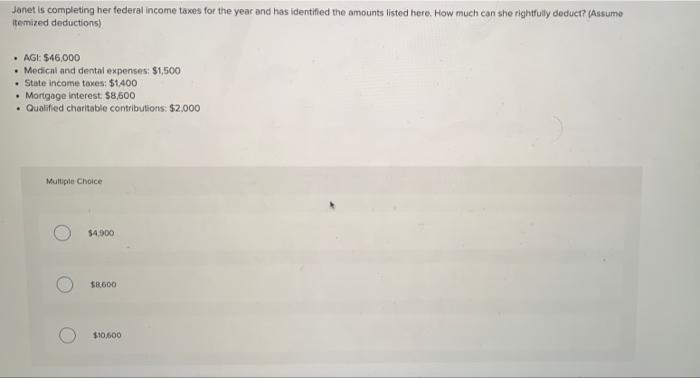

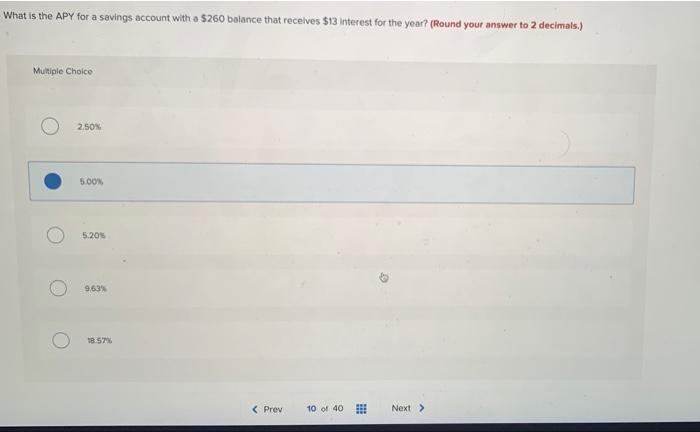

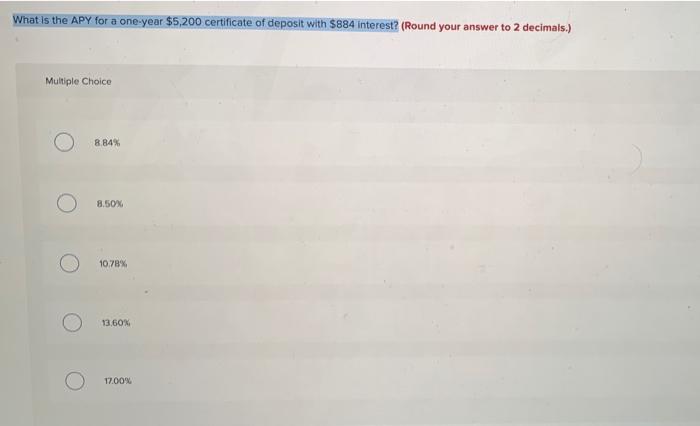

Given the following information, calculate the liquidity ratio: (Round your answer to 2 decimal places.) 9 Liabilities = $27,500 Liquid assets = $5,500 Monthly credit payments = $950 Monthly savings = $850 Net worth = $77,000 Current liabilities - $1,900 Toke-home pay = $2,600 Gross income - $4,400 Monthly expenses - $2,640 Multiple Choice 35.71 2.89 2.08 O Using the following table, calculate the taxes for an individual with taxable income of $63,000. 10% 12% 229 24% 32% 35% 37% Up to $9,875 $9,876-$40,125 $40,126-$85,525 $85,526-$ 163,300 $163,301-$207,350 $207,351-$518,400 Over $518,401 Multiple Choice $12,075 $9,650 $29,260 Janet is completing her federal income taxes for the year and has identified the amounts listed here. How much can she rightfully deduct? (Assume itemized deductions) AGE: $46,000 Medical and dental expenses: $1,500 . State income taxes: $1,400 Mortgage interest $8,600 Qualified charitable contributions: $2.000 Multiple Choice $4,000 58600 $10.600 What is the APY for a savings account with a $260 balance that receives $13 Interest for the year? (Round your answer to 2 decimals.) Multiple Choice 2.50% 5.00 5.20% 9.63 18.57% What is the APY for a one-year $5,200 certificate of deposit with $884 interest? (Round your answer to 2 decimals.) Multiple Choice 8 B4% 8.50% 10.78% 13,60% 17.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts