Question: answer all please Instruction: You are required to answer ALL questions (each contains 25 marks) Q1. Given the following Information Investment Expected Return E(r) Standard

answer all please

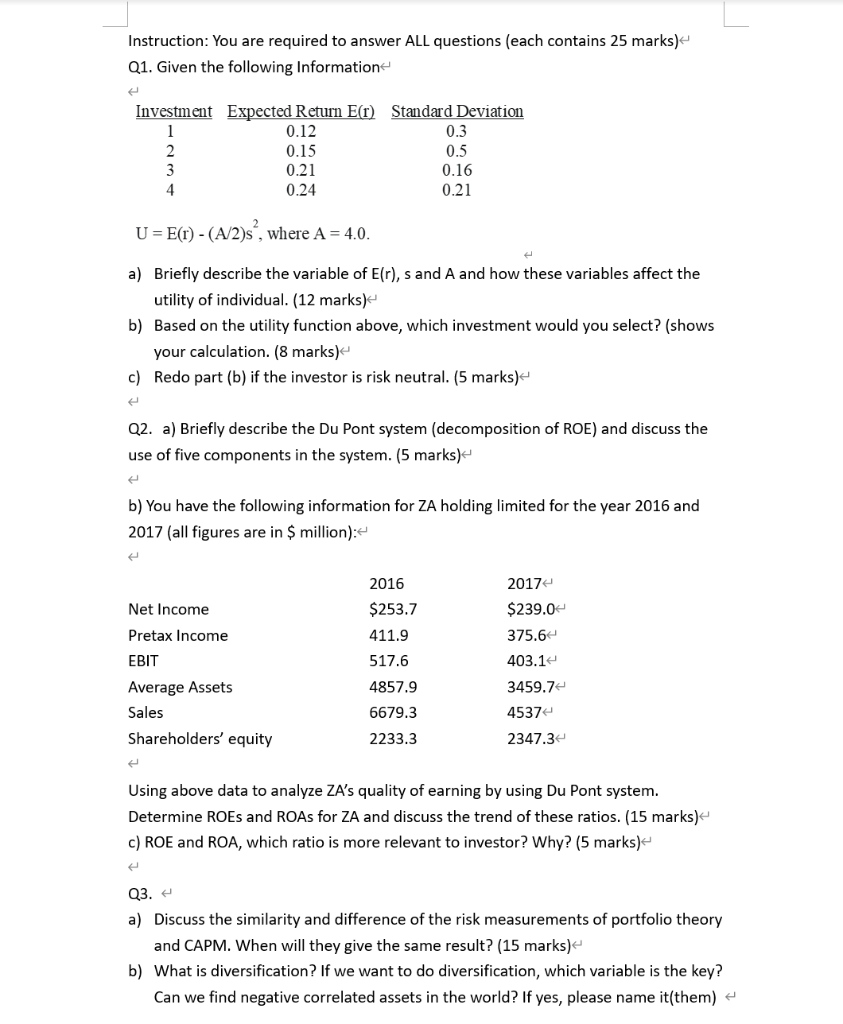

Instruction: You are required to answer ALL questions (each contains 25 marks) Q1. Given the following Information Investment Expected Return E(r) Standard Deviation 0.12 0.3 0.15 0.5 0.21 0.24 0.21 0.16 U = E(r) - (A/2)s", where A = 4.0. a) Briefly describe the variable of E(r), s and A and how these variables affect the utility of individual. (12 marks) b) Based on the utility function above, which investment would you select? (shows your calculation. (8 marks) c) Redo part (b) if the investor is risk neutral. (5 marks) Q2. a) Briefly describe the Du Pont system (decomposition of ROE) and discuss the use of five components in the system. (5 marks) b) You have the following information for ZA holding limited for the year 2016 and 2017 (all figures are in $ million): Net Income Pretax Income EBIT Average Assets 2016 $253.7 411.9 517.6 4857.9 6679.3 2233.3 2017 $239.0 375.6 403.12 3459.7 4537 2347.34 Sales Shareholders' equity Using above data to analyze ZA's quality of earning by using Du Pont system. Determine ROEs and ROAs for ZA and discuss the trend of these ratios. (15 marks) c) ROE and ROA, which ratio is more relevant to investor? Why? (5 marks) Q3. + a) Discuss the similarity and difference of the risk measurements of portfolio theory and CAPM. When will they give the same result? (15 marks) b) What is diversification? If we want to do diversification, which variable is the key? Can we find negative correlated assets in the world? If yes, please name it(them)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts