Question: answer all please Points as stated (10 Points Total) BO 21) What is the total percentage retum for an investor who purchased a stock for

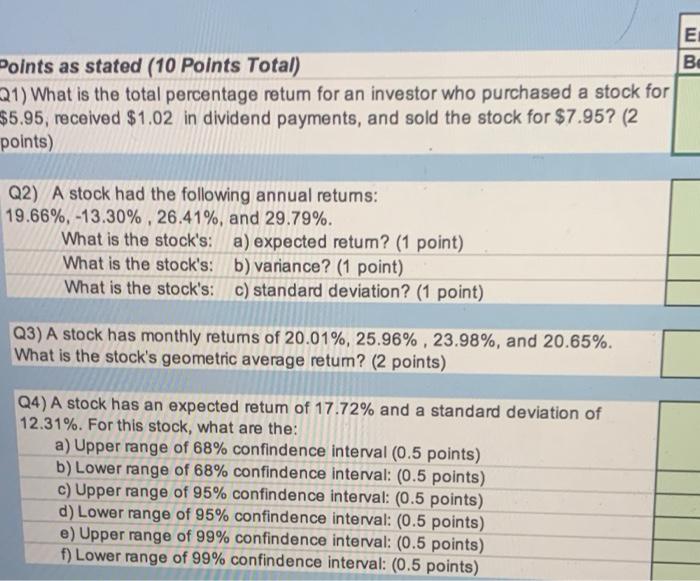

Points as stated (10 Points Total) BO 21) What is the total percentage retum for an investor who purchased a stock for $5.95, received $1.02 in dividend payments, and sold the stock for $7.95? (2 points) Q2) A stock had the following annual retums: 19.66%, -13.30% , 26.41%, and 29.79%. What is the stock's: a) expected retum? (1 point) What is the stock's: b) variance? (1 point) What is the stock's: c) standard deviation? (1 point) Q3) A stock has monthly retums of 20.01%, 25.96% , 23.98%, and 20.65%. What is the stock's geometric average retum? (2 points) Q4) A stock has an expected retum of 17.72% and a standard deviation of 12.31%. For this stock, what are the: a) Upper range of 68% confindence interval (0.5 points) b) Lower range of 68% confindence interval: (0.5 points) c) Upper range of 95% confindence interval: (0.5 points) d) Lower range of 95% confindence interval: (0.5 points) e) Upper range of 99% confindence interval: (0.5 points) f) Lower range of 99% confindence interval: (0.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts