Question: answer all please Question 2 Deepee plc is a well-established company operating in a market with limited growth opportunities. The company's present capital structure is

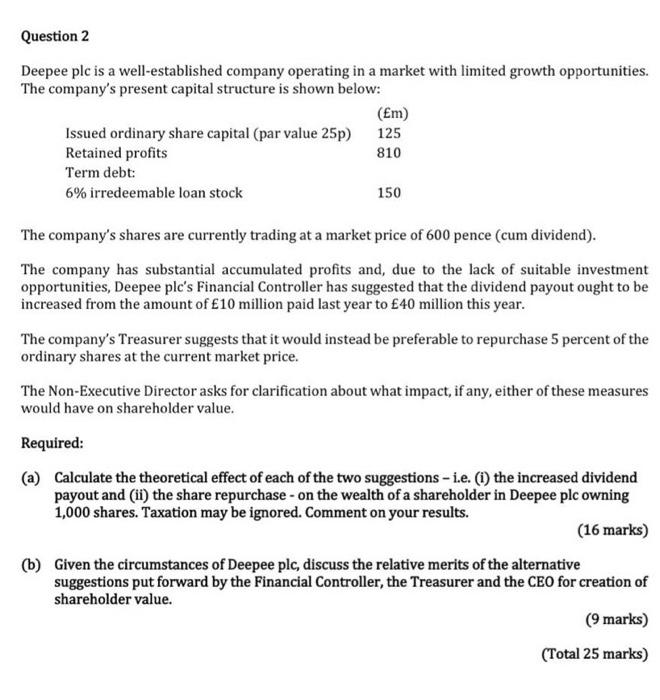

Question 2 Deepee plc is a well-established company operating in a market with limited growth opportunities. The company's present capital structure is shown below: (m) Issued ordinary share capital (par value 25p) 125 Retained profits 810 Term debt: 6% irredeemable loan stock 150 The company's shares are currently trading at a market price of 600 pence (cum dividend). The company has substantial accumulated profits and, due to the lack of suitable investment opportunities, Deepee ple's Financial Controller has suggested that the dividend payout ought to be increased from the amount of 10 million paid last year to 40 million this year. The company's Treasurer suggests that it would instead be preferable to repurchase 5 percent of the ordinary shares at the current market price. The Non-Executive Director asks for clarification about what impact, if any, either of these measures would have on shareholder value. Required: (a) Calculate the theoretical effect of each of the two suggestions - i.e. (i) the increased dividend payout and (ii) the share repurchase - on the wealth of a shareholder in Deepee plc owning 1,000 shares. Taxation may be ignored. Comment on your results. (16 marks) (b) Given the circumstances of Deepee plc, discuss the relative merits of the alternative suggestions put forward by the Financial Controller, the Treasurer and the CEO for creation of shareholder value. (9 marks) (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts