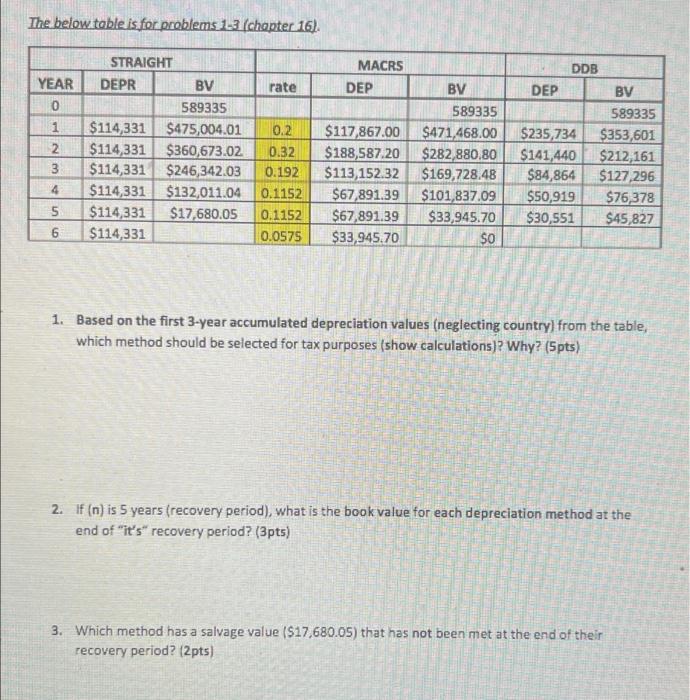

Question: answer all please The below table is for problems 23 (chapter 16). DDB YEAR MACRS DEP DEP O 1 2. STRAIGHT DEPR BV rate 589335

The below table is for problems 23 (chapter 16). DDB YEAR MACRS DEP DEP O 1 2. STRAIGHT DEPR BV rate 589335 $114,331 $475,004.01 0.2 $114,331 $360,673.02 0.32 $114,331 $246,342.03 0.192 $114,331 $132,011.04 0.1152 $114,331 $17,680.05 0.1152 $114,331 0.0575 3 BV 589335 $471,468.00 $282,880.80 $169,728.48 $101,837.09 $33,945.70 $0 $117,867.00 $188,587.20 $113,152.32 $67,891.39 $67,891.39 $33,945.70 BV 589335 $353,601 $212,161 $127,296 $76,378 $45,827 $235,734 $141,440 $84,864 $50,919 $30,551 4 5 ou 6 1. Based on the first 3-year accumulated depreciation values (neglecting country) from the table, which method should be selected for tax purposes (show calculations)? Why? (5pts) 2. If (n) is 5 years (recovery period), what is the book value for each depreciation method at the end of "it's" recovery period? (3pts) 3. Which method has a salvage value ($17,680.05) that has not been met at the end of their recovery period? (2 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts