Question: Answer all please will rate quick The Lees, a family of two adults and two dependent children under age 16 , had a gross annual

Answer all please will rate quick

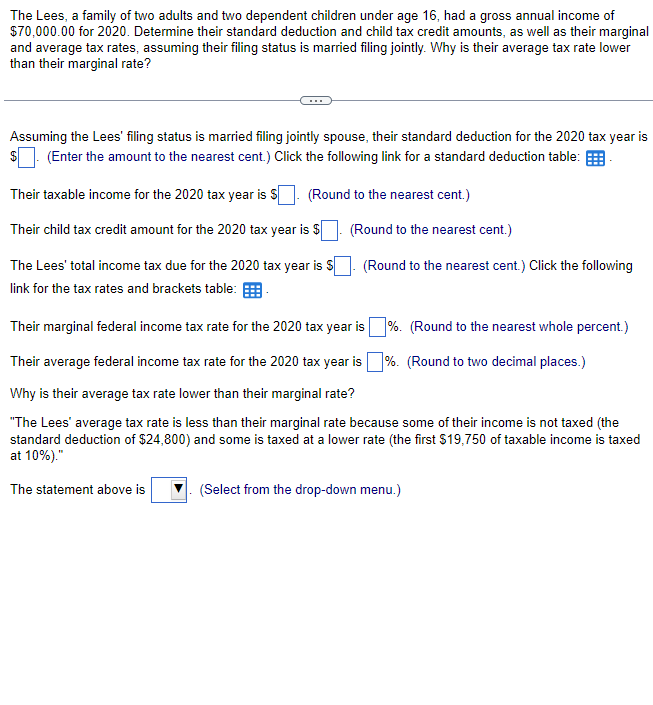

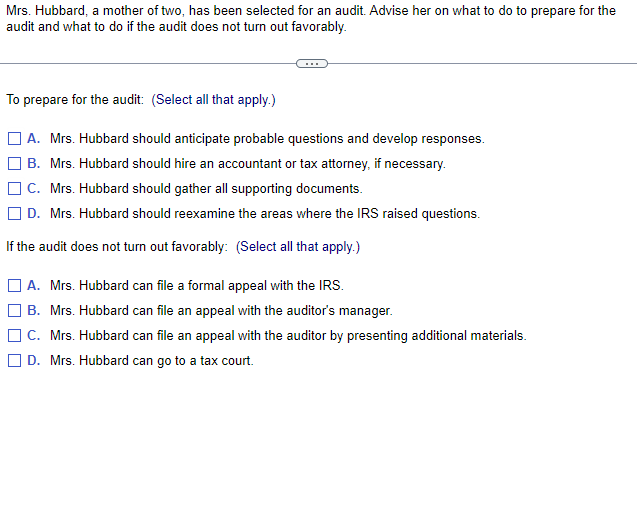

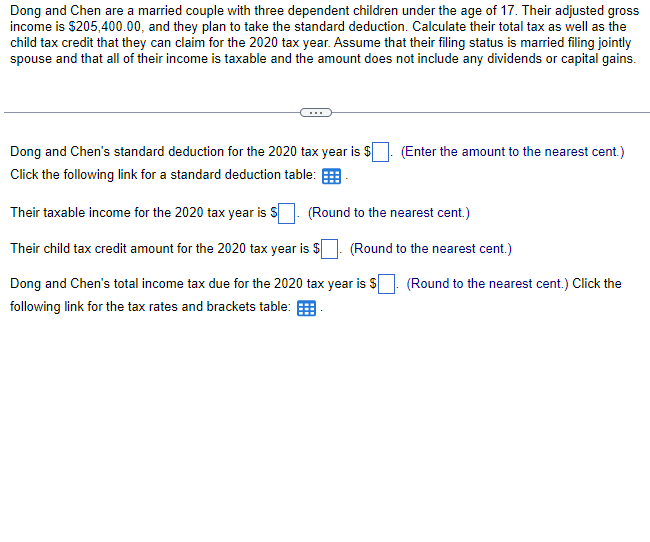

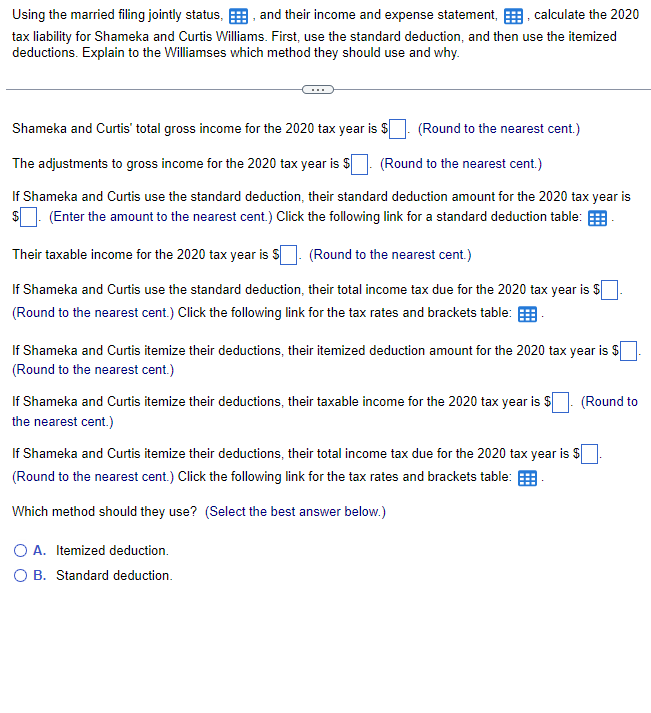

The Lees, a family of two adults and two dependent children under age 16 , had a gross annual income of $70,000.00 for 2020 . Determine their standard deduction and child tax credit amounts, as well as their marginal and average tax rates, assuming their filing status is married filing jointly. Why is their average tax rate lower than their marginal rate? Assuming the Lees' filing status is married filing jointly spouse, their standard deduction for the 2020 tax year is $. (Enter the amount to the nearest cent.) Click the following link for a standard deduction table: Their taxable income for the 2020 tax year is $. (Round to the nearest cent.) Their child tax credit amount for the 2020 tax year is . (Round to the nearest cent.) The Lees' total income tax due for the 2020 tax year is \& . (Round to the nearest cent.) Click the following link for the tax rates and brackets table: Their marginal federal income tax rate for the 2020 tax year is \%. (Round to the nearest whole percent.) Their average federal income tax rate for the 2020 tax year is \%. (Round to two decimal places.) Why is their average tax rate lower than their marginal rate? "The Lees' average tax rate is less than their marginal rate because some of their income is not taxed (the standard deduction of $24,800 ) and some is taxed at a lower rate (the first $19,750 of taxable income is taxed at 10%)." The statement above is (Select from the drop-down menu.) Mrs. Hubbard, a mother of two, has been selected for an audit. Advise her on what to do to prepare for the audit and what to do if the audit does not turn out favorably. To prepare for the audit: (Select all that apply.) A. Mrs. Hubbard should anticipate probable questions and develop responses. B. Mrs. Hubbard should hire an accountant or tax attorney, if necessary. C. Mrs. Hubbard should gather all supporting documents. D. Mrs. Hubbard should reexamine the areas where the IRS raised questions. If the audit does not turn out favorably: (Select all that apply.) A. Mrs. Hubbard can file a formal appeal with the IRS. B. Mrs. Hubbard can file an appeal with the auditor's manager. C. Mrs. Hubbard can file an appeal with the auditor by presenting additional materials. D. Mrs. Hubbard can go to a tax court. Harry and Harriet Potter are in their golden years. Discuss the best tax reduction method for them to use in reducing their estate taxes. "To reduce future estate taxes, the Potters should consider shifting assets to family members in lower tax brackets by establishing trusts and giving gifts." The above statement is (Select from the drop-down menu.) Dong and Chen are a married couple with three dependent children under the age of 17 . Their adjusted gross income is $205,400.00, and they plan to take the standard deduction. Calculate their total tax as well as the child tax credit that they can claim for the 2020 tax year. Assume that their filing status is married filing jointly spouse and that all of their income is taxable and the amount does not include any dividends or capital gains. Dong and Chen's standard deduction for the 2020 tax year is $. (Enter the amount to the nearest cent.) Click the following link for a standard deduction table: Their taxable income for the 2020 tax year is S . (Round to the nearest cent.) Their child tax credit amount for the 2020 tax year is $. (Round to the nearest cent.) Dong and Chen's total income tax due for the 2020 tax year is $ (Round to the nearest cent.) Click the following link for the tax rates and brackets table: Using the married filing jointly status,_, and their income and expense statement, , calculate the 2020 tax liability for Shameka and Curtis Williams. First, use the standard deduction, and then use the itemized deductions. Explain to the Williamses which method they should use and why. Shameka and Curtis' total gross income for the 2020 tax year is $ (Round to the nearest cent.) The adjustments to gross income for the 2020 tax year is $. (Round to the nearest cent.) If Shameka and Curtis use the standard deduction, their standard deduction amount for the 2020 tax year is $ (Enter the amount to the nearest cent.) Click the following link for a standard deduction table: Their taxable income for the 2020 tax year is \$ . (Round to the nearest cent.) If Shameka and Curtis use the standard deduction, their total income tax due for the 2020 tax year is $ (Round to the nearest cent.) Click the following link for the tax rates and brackets table: If Shameka and Curtis itemize their deductions, their itemized deduction amount for the 2020 tax year is $ (Round to the nearest cent.) If Shameka and Curtis itemize their deductions, their taxable income for the 2020 tax year is $. (Round to the nearest cent.) If Shameka and Curtis itemize their deductions, their total income tax due for the 2020 tax year is $ (Round to the nearest cent.) Click the following link for the tax rates and brackets table: Which method should they use? (Select the best answer below.) A. Itemized deduction. B. Standard deduction. The Lees, a family of two adults and two dependent children under age 16 , had a gross annual income of $70,000.00 for 2020 . Determine their standard deduction and child tax credit amounts, as well as their marginal and average tax rates, assuming their filing status is married filing jointly. Why is their average tax rate lower than their marginal rate? Assuming the Lees' filing status is married filing jointly spouse, their standard deduction for the 2020 tax year is $. (Enter the amount to the nearest cent.) Click the following link for a standard deduction table: Their taxable income for the 2020 tax year is $. (Round to the nearest cent.) Their child tax credit amount for the 2020 tax year is . (Round to the nearest cent.) The Lees' total income tax due for the 2020 tax year is \& . (Round to the nearest cent.) Click the following link for the tax rates and brackets table: Their marginal federal income tax rate for the 2020 tax year is \%. (Round to the nearest whole percent.) Their average federal income tax rate for the 2020 tax year is \%. (Round to two decimal places.) Why is their average tax rate lower than their marginal rate? "The Lees' average tax rate is less than their marginal rate because some of their income is not taxed (the standard deduction of $24,800 ) and some is taxed at a lower rate (the first $19,750 of taxable income is taxed at 10%)." The statement above is (Select from the drop-down menu.) Mrs. Hubbard, a mother of two, has been selected for an audit. Advise her on what to do to prepare for the audit and what to do if the audit does not turn out favorably. To prepare for the audit: (Select all that apply.) A. Mrs. Hubbard should anticipate probable questions and develop responses. B. Mrs. Hubbard should hire an accountant or tax attorney, if necessary. C. Mrs. Hubbard should gather all supporting documents. D. Mrs. Hubbard should reexamine the areas where the IRS raised questions. If the audit does not turn out favorably: (Select all that apply.) A. Mrs. Hubbard can file a formal appeal with the IRS. B. Mrs. Hubbard can file an appeal with the auditor's manager. C. Mrs. Hubbard can file an appeal with the auditor by presenting additional materials. D. Mrs. Hubbard can go to a tax court. Harry and Harriet Potter are in their golden years. Discuss the best tax reduction method for them to use in reducing their estate taxes. "To reduce future estate taxes, the Potters should consider shifting assets to family members in lower tax brackets by establishing trusts and giving gifts." The above statement is (Select from the drop-down menu.) Dong and Chen are a married couple with three dependent children under the age of 17 . Their adjusted gross income is $205,400.00, and they plan to take the standard deduction. Calculate their total tax as well as the child tax credit that they can claim for the 2020 tax year. Assume that their filing status is married filing jointly spouse and that all of their income is taxable and the amount does not include any dividends or capital gains. Dong and Chen's standard deduction for the 2020 tax year is $. (Enter the amount to the nearest cent.) Click the following link for a standard deduction table: Their taxable income for the 2020 tax year is S . (Round to the nearest cent.) Their child tax credit amount for the 2020 tax year is $. (Round to the nearest cent.) Dong and Chen's total income tax due for the 2020 tax year is $ (Round to the nearest cent.) Click the following link for the tax rates and brackets table: Using the married filing jointly status,_, and their income and expense statement, , calculate the 2020 tax liability for Shameka and Curtis Williams. First, use the standard deduction, and then use the itemized deductions. Explain to the Williamses which method they should use and why. Shameka and Curtis' total gross income for the 2020 tax year is $ (Round to the nearest cent.) The adjustments to gross income for the 2020 tax year is $. (Round to the nearest cent.) If Shameka and Curtis use the standard deduction, their standard deduction amount for the 2020 tax year is $ (Enter the amount to the nearest cent.) Click the following link for a standard deduction table: Their taxable income for the 2020 tax year is \$ . (Round to the nearest cent.) If Shameka and Curtis use the standard deduction, their total income tax due for the 2020 tax year is $ (Round to the nearest cent.) Click the following link for the tax rates and brackets table: If Shameka and Curtis itemize their deductions, their itemized deduction amount for the 2020 tax year is $ (Round to the nearest cent.) If Shameka and Curtis itemize their deductions, their taxable income for the 2020 tax year is $. (Round to the nearest cent.) If Shameka and Curtis itemize their deductions, their total income tax due for the 2020 tax year is $ (Round to the nearest cent.) Click the following link for the tax rates and brackets table: Which method should they use? (Select the best answer below.) A. Itemized deduction. B. Standard deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts