Question: answer all please! Your answers are saved automatically Remaining Time: 1 hour, 59 minutes, 35 seconds. Question Completion Status: Moving to another question will save

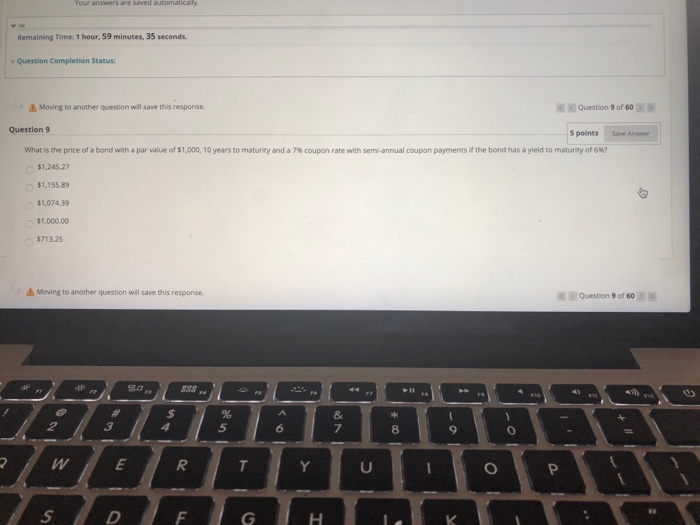

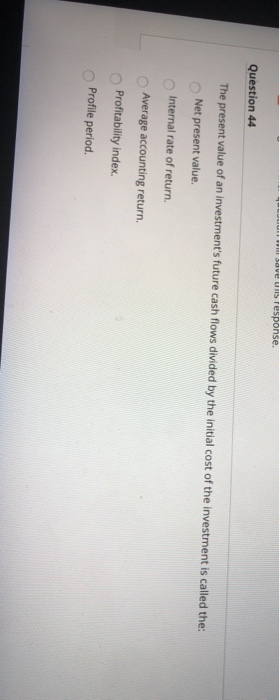

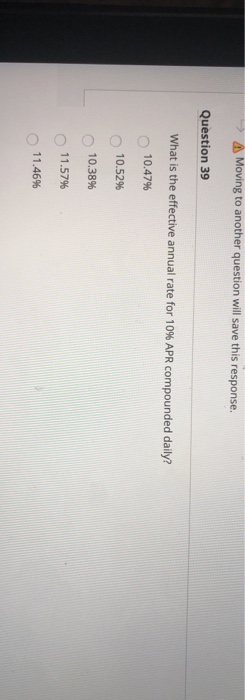

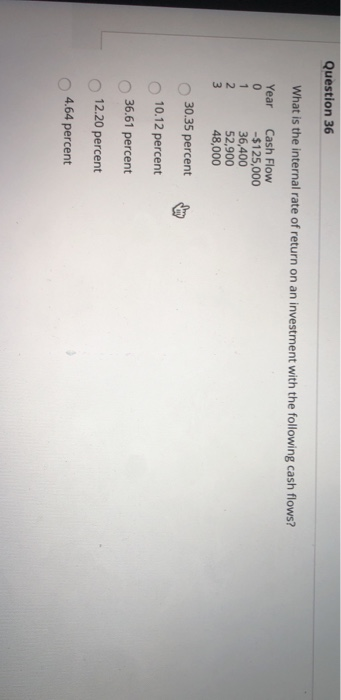

Your answers are saved automatically Remaining Time: 1 hour, 59 minutes, 35 seconds. Question Completion Status: Moving to another question will save this response. Question 9 of 60 Save Answer Question 9 5 points What is the price of a bond with a par value of $1,000, 10 years to maturity and a 7% coupon rate with semi-annual coupon payments if the bond has a yield to maturity of 697 51.245.27 $1.155.89 $1,07439 $1,000.00 $713.25 Moving to another question will save this response. Question 9 of 60 So 11 $ 4 3 % 5 &7 6 8 9 622 W E R T Y U O SEGH K . save uns response. Question 44 The present value of an investment's future cash flows divided by the initial cost of the investment is called the: Net present value. Internal rate of return Average accounting return. Profitability index Profile period Moving to another question will save this response. Question 39 What is the effective annual rate for 10% APR compounded daily? 10.47% 10.5296 10.38% 11.57% 11.46% Question 36 What is the internal rate of return on an investment with the following cash flows? Year 0 Cash Flow -$125,000 36,400 52,900 48,000 2 3 30.35 percent 10.12 percent 36.61 percent 12.20 percent 4.64 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts